It takes Snowflake Computing six months or more from signing up a big enterprise customer for the revenues to start rolling in. Onboarding migration delays are to blame. This was one of the key takeaways from this week’s Q4 earnings call, in which the cloud data warehouse firm revealed why it is losing so much money.

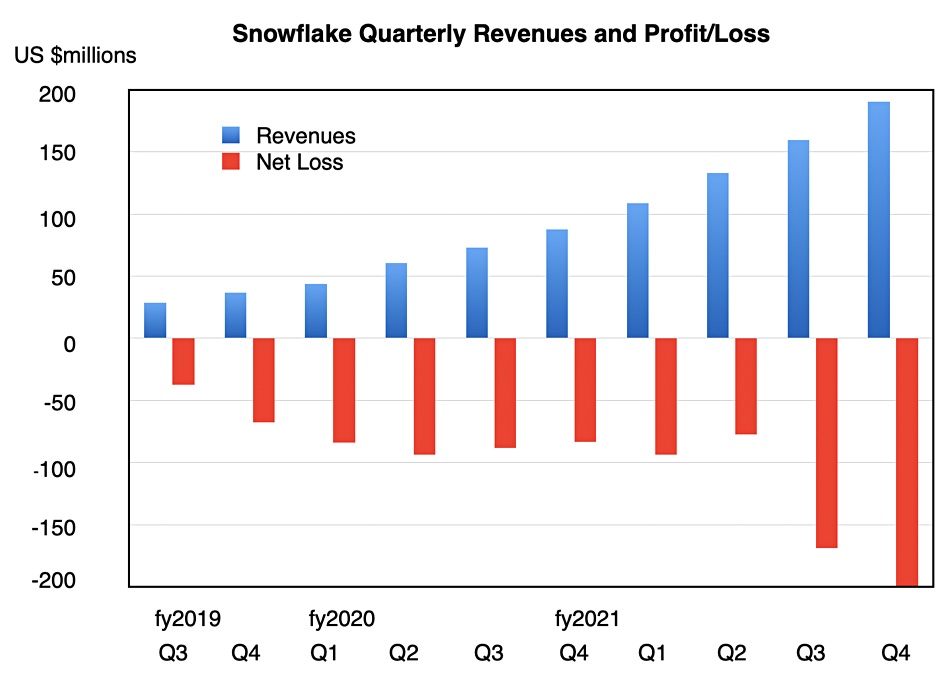

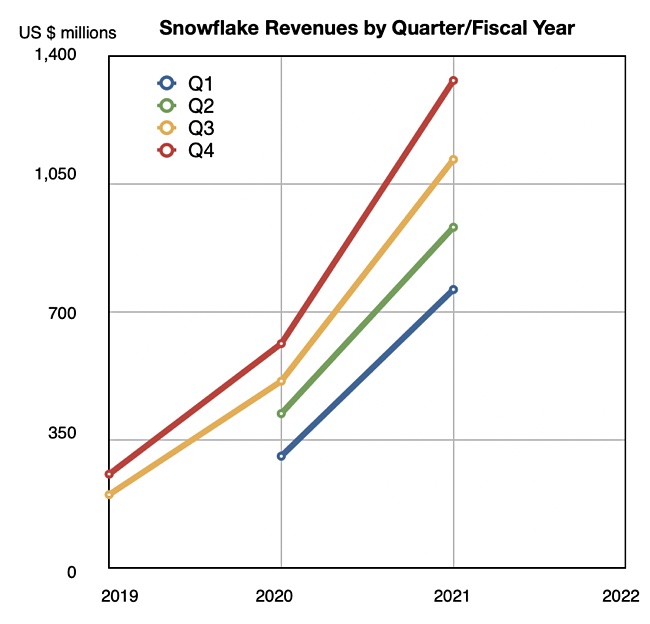

Revenue in the quarter was $190.5m, up 117 per cent Y/Y and beating forecasts. However, the net loss was $198.9m, 139 per cent worse Y/Y. Full year revenue was $592m, up 124 per cent, and the company posted a loss of $539.1m – 54.7 per cent worse Y/Y. (Read The Register‘s report for more details.)

Earnings call

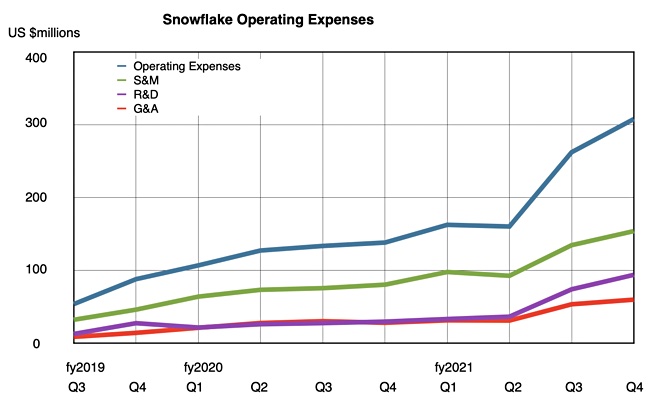

So what gives? The company is spending big in a dash for growth and operating expenses are outstripping revenues. Snowflake is on a hiring spree and doesn’t intend to slow down. It hired 800 people in fiscal 2021 and aims to hire even more in fiscal 2022.

CEO Frank Slootman said this in the earnings call: “We’re going to add 1,200 people next year. Actually, Q1 is a very, very big onboarding quarter. It will be probably the largest quarter of the year because we’re onboarding a lot of people in the sales and marketing organisation in advance of our sales kickoff that we just had. We are investing as quickly while being efficient in our business as we can.”

The revenue problem here is that Snowflake has focused on winning enterprise customers and they take many months to migrate their existing on-premises data warehouses to Snowflake’s cloud.

Migration drag

CFO Mike Scarpelli said: “I want to stress, it takes customers, especially if you’re doing a legacy migration, it can take customers six months-plus before we start to recognise any consumption revenue from those customers because they’re doing the data migration. And what we find is – so they consume very little in the first six months and then in the remaining six months, they’ve consumed their entire contract they have.”

Scarpelli said: “We are landing more Fortune 500 customers. We talked about we landed 19 in the quarter, but those 19 we landed, just to reiterate, we’ve recognised virtually no revenue on those customers. That’s all in the RPO that will be in the next 12 months.”

RPO (remaining performance obligation) represents an amount of future revenue that has been contracted with customers, but is not yet recognised as revenue.

Engineering spend

Slootman revealed that Snowflake engineering is developing the product to work faster: “Historically, we have shared data through APIs and through file transfer processes, copying, and replicating. It’s been an enormous struggle. The opportunity with Snowflake as to make this zero latency, zero friction, completely seamless.”

The need is to reduce what Snowflake calls data latency. Slootman explained: “One of the areas that we are investing in where we have extraordinary talent that we have attracted [to] the company is where our event-driven architectures. Today, our event latency is sort of seconds and minutes, right? But you want to drive that down to sub-second and dramatically sub-second.”

He said: “That obviously, that requires tremendous optimisation on our part and we are working on that because we see that as a very, very critical part of the ongoing evolution of digital transformations. … we have to become much, much faster than what we’ve done so far. … this is going to expand the marketplace in places where these technologies historically have not been.”

By the numbers

A chart shows the dramatic increase in losses over the last two quarters;

Snowflake’s revenue growth is accelerating, as a second chart shows, with its steepening quarterly revenue lines.

Snowflake’s operating expenses have shot up faster still in the two most recent quarters;

Snowflake watchers have to wait and see if its plans deliver increased growth in the next few quarters. Slootman is betting on it.