HPE CEO Antonio Neri yesterday hailed the company’s “strong Q1 performance…Our revenue exceeded our outlook and we significantly expanded our gross and operating margins to drive strong profitability across most of our businesses.”

Revenues for the quarter ended Jan 31 were almost back to pre-pandemic levels, down 1.7 per cent Y/Y to 6.8bn. Net income fell 33 per cent to $223m.

Neri summed HPE’s position up like this: “As a result of our cost optimisation and resource allocation program, we are emerging from an unprecedented crisis as a different company, one that is much leaner, better resourced and positioned to capitalise on the gradual economic recovery currently at play.”

Free cash flow in Q1 was a record and the company’s ongoing transition to a subscription-based business saw a 27 per cent increase in ARR (annualised revenue run rate) to $649m.

However, all of its business segments, with the exception of the Intelligent Edge, were flat or reported decreased revenues in Q1.

- Intelligent Edge (mostly Aruba) – $806m – up 12 per cent Y/Y,

- Compute (Servers) – $2.98bn – down 1 per cent,

- High Performance Compute & Mission-Critical Solutions – $762m – down 9 per cent

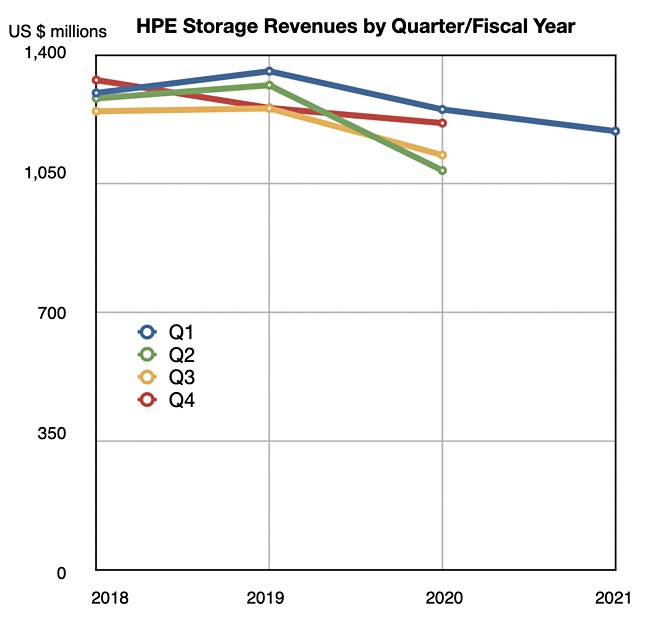

- Storage – $1.19bn – down 5 per cent,

- Corporate Investments, etc. – $321m – down 4 per cent,

- Financial Services – $860m – flat Y/Y.

The High Performance Compute business head, Peter Ungaro, ex-CEO of acquired Cray, is leaving in April, and consulting with HPE for six months. HPE said this business suffers from lumpy or uneven revenues and it remains confident in both the near-term and long-term outlook. The backlog of awarded but not yet recognised business exceeds $2bn of exascale business, and many multi-million dollar deals.

Storage

In storage, HPE continues to “see strong revenue growth in our own IP software-defined portfolio where we have been investing.” Specifically, the Primera array business grew triple digits Y/Y and is expected to exceed 3PAR revenues – possibly next quarter. Neri said this is the fastest revenue ramp in HPE’s storage portfolio. Primera launched June 2019.

The overall HPE all-flash array business grew five per cent Y/Y, with Nimble and Primera arrays identified as driving this. The overall Nimble business was up 31 per cent Y/Y.

Neri said HPE’s hyperconverged strategy “continued to gain traction” but didn’t provide any numbers. He also said more storage operational services are being sold with the arrays, again without revealing numbers.

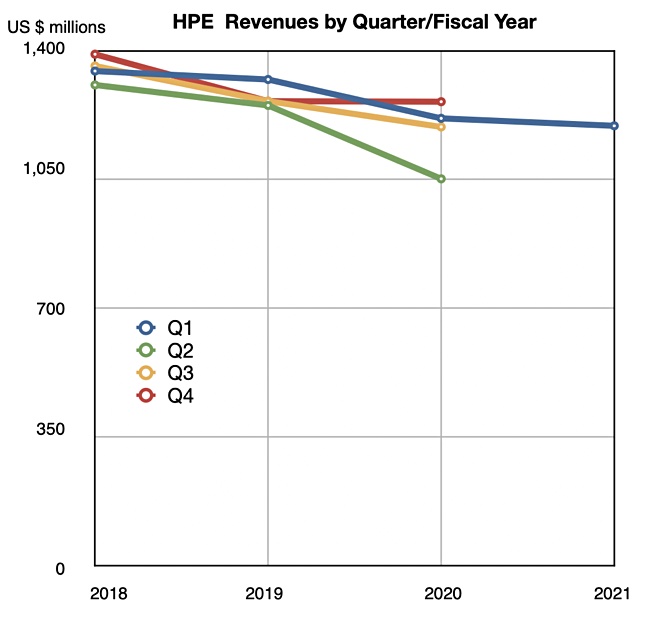

HPE has recorded storage revenue declines for five successive quarters, and Nero didn’t predict when storage growth might occur.

Outlook

HPE expects “to see gradual improvement in customer spending as we progress through fiscal year ’21 giving us the confidence in our ability to deliver on our long-term revenue growth guidance.“ HPE is guiding 30-40 per cent CAGR from fy19 to fy22 and is raising its free cash flow outlook for fy2021.

Neri said: “In the core businesses of Compute and Storage, our strategy to grow in profitable segments and pivot to more as-a-service solutions is paying off.”

The outlook for the next quarter is for double-digit percentage revenue growth Y/Y from last year’s $6bn and mid single-digit decline from the current quarter’s $6.8bn. We calculate that to mean a rough range of $6.6bn to $6.7bn.

Financial Summary

- Gross margin – 33.7 per cent, up 0.3 per cent Y/Y,

- Compute operating margin – 11.5 per cent, up 0.8 per cent Y/Y.

- Free cash flow – $563m; a record for HPE,

- Cash flow from operations – $1bn,

- Cash on hand at quarter-end – $4.2bn.