Dell reported strong results for its fourth fiscal 2021 quarter and full year, with VMware and its PCs and laptops all doing very well, more core debt paid down, and the company set up nicely for a resurgent economy as the pandemic eases. Although storage declined Y/Y, the PowerStore product is set to drive storage growth.

VMware pulled in $3.3bn for the quarter ended January 29, 2021, and $11.9bn for the full year, up 9 per cent and 7 per cent respectively. Full Dell revenues for the quarter were $26.1bn, up 9 per cent Y/Y, and the full year figure was a record $94.2bn, up 2 per cent.

Dell’s Client Solutions Group reported a record $13.8bn for the quarter, up a stonking 17 per cent on the back of strong consumer and business demand for PCs and notebooks. The Infrastructure Solutions Group recorded $8.8bn sales, flat Y/Y, with servers and networking up three per cent to $4.4bn and storage down two per cent to $4.4bn.

Dell COO Jeff Clarke said in prepared remarks that the company is “in an advantaged position to capitalise on the projected mid-single digits growth in IT spending in 2021.” He anticipates growth in Dell’s “core PC, server, and storage markets.” The company expects next quarter’s and full fiscal 2022 revenues, to both grow Y/Y in the mid-single digit range.

Mid-range storage growth

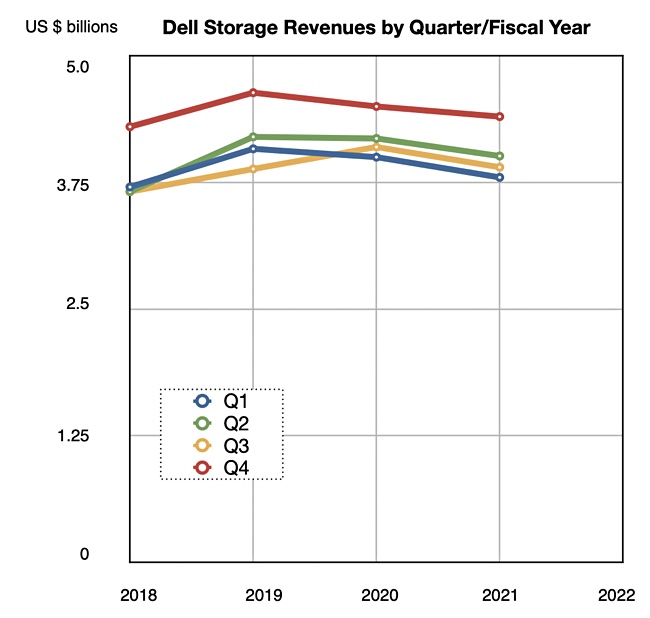

Dell storage revenues have declined for seven out of the past eight quarters.

Some Dell storage products did well in the latest quarter: the earnings report called out PowerMax, HCI (VxRail) and PowerProtect/Data Domain and all-flash arrays for exhibiting order growth. Orders for PowerStore, the mid-range unified file and block array which replaces the prior Unity product, were up fourfold on a Q/Q basis.

On the earnings call, Clarke said the company’s midrange storage business returned to growth in the fourth quarter, “driven by accelerated adoption of PowerStore.”

The company “saw vast improvement in the midrange, the first time we’ve grown the midrange now in storage, I believe, it’s in nine quarters. We grew midrange by 8 per cent on the back of PowerStore.”

He revealed that PowerStore is “ramping faster than XtremIO and VxRail, making it the fastest new architecture we have released. Additionally, approximately 20 per cent of our PowerStore customers are new to our storage business as we tripled the number of wins against key competitors’ quarter-over-quarter.”

He’s optimistic about the mid-range future: “With the momentum we have in the midrange, the opportunity is to grow the sub-$250,000 segment; the mid-range, and that’s what we eye.”

The goal is PowerStore growth and it “is clearly the vehicle that we intend to take share with in fiscal 2022 calendar 2021. … we have a big set of ambitions about taking share in the mid-range.”

There’s more good storage product news to come, according to Itzik Reich, Dell’s VP Technology for PowerStore, PowerFlex and XtremIO, “We’re only getting started [with PowerStore], the roadmap is super solid and I can’t wait share what’s coming next,” he tweeted today.

Financial summary

- Cash flow from operations – $5.9bn, up 68 per cent Y/Y and a record

- Cash and investments – $15.8bn

- Deferred revenue – $30.8bn, up 11 per cent Y/Y

- Core debt paydown – $5.5bn in full year, $2.4bn in the quarter, leaving $29.2bn to pay

Dell reported Q4 recurring revenue of approximately $6bn, up eigh per cent Y/Y, driven by deferred revenue amortisation, data centre utility and as-a-Service models. Its first APEX cloud and as-a-service offerings will arrive in May, with more to follow.