VAST Data was cash flow-positive “going out of 2020” and finished the fourth quarter on a $150m run rate. The high-end all-flash array startup’s revenues in FY2021 ended Jan 31 were 3.5 times higher than FY 2020 and it has not spent any of the $100m raised in its April 2020 funding round.

We gleaned these nuggets from a press briefing with co-founder and CMO Jeff Denworth, who re-iterated the company’s intent “to kill the hard drive” (see our Feb 2019 story: VAST Data: The first thing we do, let’s kill all the hard drives).

VAST sold its first products in April 2019 and subsequently claimed that its first year of sales were were significantly higher than any storage vendor in IT history.

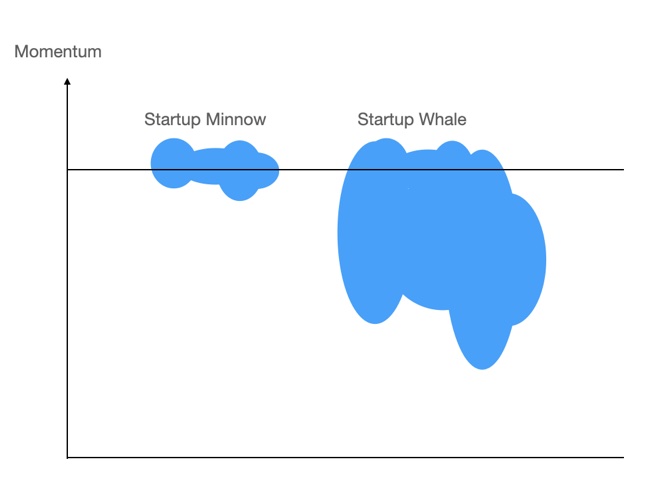

Whale or minnow

Startups use ‘momentum releases’ as a PR tool to encourage new customers to jump aboard a bandwagon without actually revealing the bandwagon size. Blocks & Files pores over these momentum announcements in an attempt to understand the size of the iceberg below the surface but typically they are bereft of useful information. However, VAST has been a bit more forthcoming than most.

In its press briefing, VAST teased some clues about the size of its business underneath the surface. One concerned the size of customer orders.

Denworth said VAST has just achieved its third $10m-spend account – a customer in the defence sector. He said the company has dozens of $1m customers and is “getting first orders of $5m from customers.”

VAST won its first $10m deal from a hedge fund in December 2019. The customer now has 30PB of VAST storage. The second $10m customer is a large US government agency in the bioinformatics and health sector.

A second clue relates to VAST’s headcount. At the end of fy2021 it was 186. VAST said it is averaging a nearly $1m run rate per employee, which is a tad over-enthusiastic with a $150m run rate. The company wants to hire 200 people in 2021, with Peter Gadd, VP International, aiming to hire 30 to 50 outside North America. He is focusing on Europe and Asia.

A third clue is that VAST compares itself to Pure Storage, saying it has fewer employees than Pure and is growing faster. Denworth characterises Pure as selling medium and small enterprise deals that are susceptible to migration to the public cloud. VAST’s on-premises business deals are more sustainable as they involve larger volumes of data that are difficult to move to the cloud, he claimed.

VAST background and direction

VAST markets its Universal Storage Array as a consolidator of all enterprise storage tiers onto its single scale-out, QLC flash-based platform.The system relies on its software, NVMe-over-Fabrics, Optane SSDs, metadata management and data reduction features to provide high-speed and enterprise disk drive array affordability.

Denworth revealed VAST plans a gen 3 hardware refresh later in the year. He said the company has a single data centre product – we press briefing participants detected hints of smaller VAST arrays coming, cross-data centre metro/geo technology, and some kind of future compute/application processing in the arrays.

VAST Data marketing VP Daniel Bounds said on the press call that VAST ”is building the next great independent storage company.” In other words, its ambition is to dress itself for IPO as opposed to a trade sale.