Revenues derived from sales IT infrastructure products to public and private cloud environments grew 9.4 per cent Y/Y in the third quarter of 2020, according to IDC number-crunchers. At the same time vendor revenues from in traditional, non-cloud, IT infrastructure fell 8.3 per cent over the period.

IDC tots ups vendor revenues for servers, enterprise storage, and Ethernet switches for this quarterly report. The tech analyst firm said the pandemic has caused a massive global IT adjustment and it has detected massive shifts to online tools. Fast growing use cases include collaboration, virtual business events, entertainment, shopping, telemedicine, and education. Cloud environments, and particularly the public cloud, are a key enabler of this shift, IDC said.

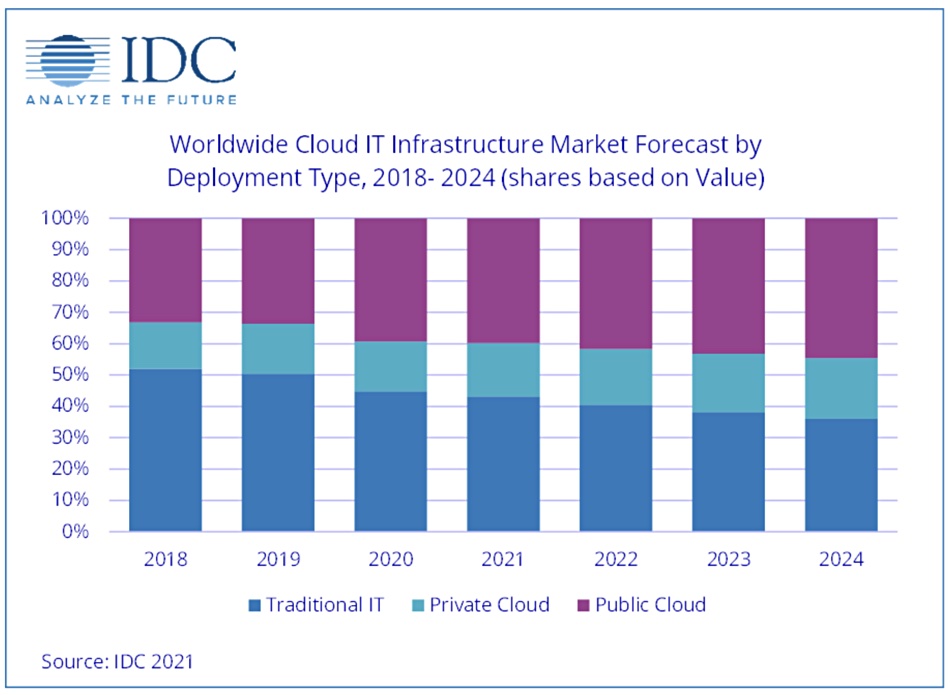

Spending on public cloud IT infrastructure increased 13.1 per cent year over year in 3Q20, reaching $13.3bn. Spending on private cloud infrastructure increased 0.6 per cent Y/Y to $5.0bn with on-premises private clouds accounting for 63.2 per cent of this amount. IDC expects public cloud IT infrastructure spending to expand its lead going forward.

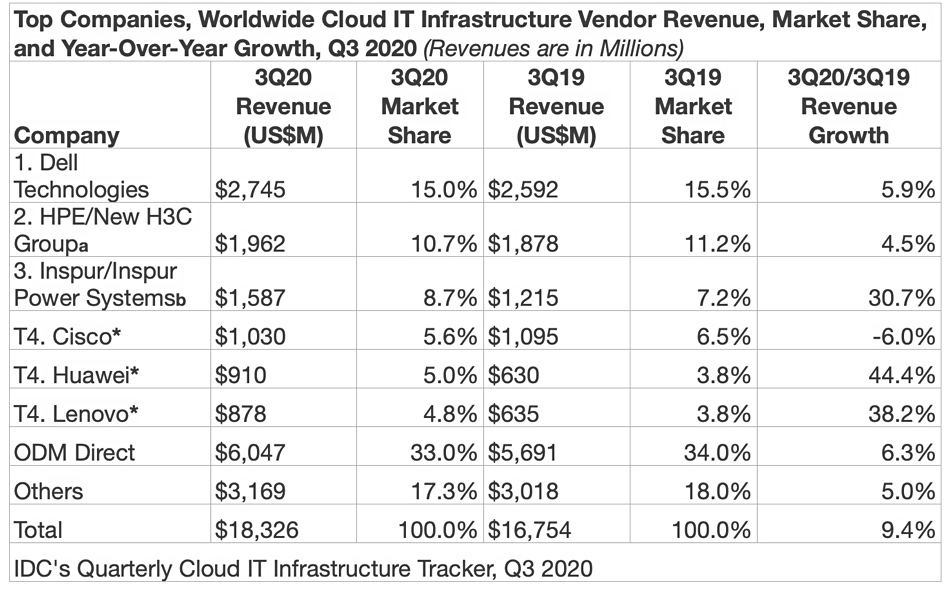

IDC has also provided a table that showsgsupplier revenues and market shares in the quarter. The results were mixed. Inspur, Huawei, and Lenovo had double-digit year-over-year growth while most other major vendors, including the ODM Direct group of vendors, had single-digit growth. Cisco was the only major vendor with a year-over-year decline.