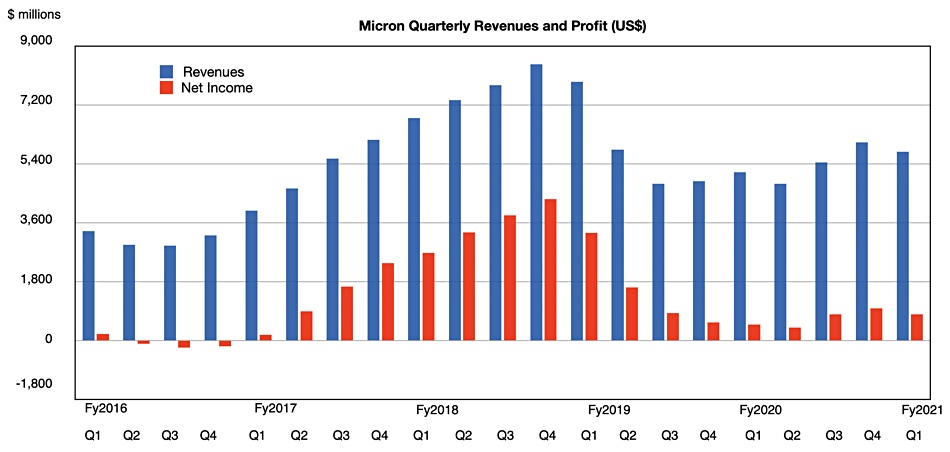

Micron has posted first fiscal 2021 quarter’s revenues of $5.77bn, up 12 per cent Y/Y. The US semiconductor maker chalked up net income of $803m for the quarter ended December 3, up 63.5 per cent Y/Y, and the company thinks it has reached the trough of a DRAM price depression.

The company expects next quarter’s revenues to be $5.8n at the mid-point up 21 per cent Y/Y but notes that a power outage in Taiwan on December 3 and an earthquake in the country on December 10 has affected DRAM production. The effects have been factored into the expectations for the next quarter.

President and CEO Sanjay Mehrotra noted in prepared remarks: “Memory and storage industry revenues have grown faster than the broader semiconductor industry, from approximately 10 per cent of semiconductor industry revenues in the early 2000s to now approaching 30 per cent.”

He said: “We are excited about the strengthening DRAM industry fundamentals. For the first time in our history, Micron is simultaneously leading on DRAM and NAND technologies, and we are in an excellent position to benefit from accelerating digital transformation of the global economy fueled by AI, 5G, cloud, and the intelligent edge.”

DRAM accounted for 70 per cent revenues ($4.056bn) and increased 17 per cent Y/Y. NAND represent 27 per cent its revenues $1.574bn), and rose 11 per cent Y/Y.

In business unit terms:

- Compute and Networking – $2.5bn, up 29 per cent Y/Y,

- Mobile – $1.5bn, up 3 per cent Y/Y

- Storage – $911m , down 6 per cent Y/Y,

- Embedded – $809m, up 10 per cent.

3D XPoint

CFO Dave Zinsner noted: “3D XPoint revenues are now reported in the Compute and Networking Business Unit. Excluding 3D XPoint from the prior year’s quarter, SBU revenues would be up 14 per cent year-over-year.”

We think that means $169m of the SBU’s $968m revenues for Q1 fy20 were due to 3D XPoint – in other words, that’s what Intel paid Micron for XPoint chips for its Optane products in the quarter.

Micron said NVMe represented over 90 per cent of client SSD bits, with QLC flash accounting for almost half of the total. Mehrotra claimed: “We are leading the industry with the broadest portfolio of QLC SSDs across client, consumer and data centre markets. QLC helps to make SSDs more cost-effective and accelerates the replacement of HDDs with SSDs. QLC SSD adoption continues to grow, and our bit mix of QLC SSDs increased further in FQ1.”

He also talked about memory: “Cloud and enterprise DRAM revenue declined sequentially … We began revenue shipments for our ultra-bandwidth HBM2E memory, which is used for data centre AI training and inference. We are making progress on the DDR5 transition, which will double bandwidth and reduce power consumption, and we plan to start that transition in the second half of fiscal 2021.”

New server CPUs, like Intel’s Ice Lake, shoulddrive DRAM demand higher as they support more memory channels.

The embedded market looks good too, according to Mehrotra “We had a record auto revenue quarter, resulting from the resumption of auto manufacturing around the globe and the continued growth of memory and storage content per vehicle.“