All storage media technologies saw increased density in 2020 – tape, disk, flash, persistent memory and even DNA. However QLC flash advances meant the nearline disk bastion is now under attack.

Overall there was no single major step forward that turned the storage world on its head last year. DNA storage developers amazed everybody with what they could do but this cuts no ice with storage professionals buying devices to store data now. They want data accessed in microseconds or milliseconds, not days.

Tape

Tape began the year with LTO-8 (12TB raw) and finished with a reduced capacity LTO-9 format – 18TB raw instead of original 24TB. The 2019 interruption in LTO-8 shipments due to the legal spat between manufacturers FujiFilm and Sony, while demand for tape capacity rose, means that LTO-8 capacity is no longer high-enough, so LTO-9 is being brought forward.

Showing tape capacity has a long runway ahead, Fujifilm and IBM demonstrated a 580TB capacity tape. This is 32 times more than current LTO-9 capacity and required a tape that was 1,255m long.

This provides a vivid insight into tape data access speed as streaming three quarters of a mile of tape through a drive will take several minutes. According to Quantum document, streaming time is increasing as tape’s physical speed through a drive is decreasing;

- LTO-6 @ 6.83 m/sec when reading or writing

- LTO-7 @ 5.01 m/sec

- LTO-8 @ 4.731 m/sec.

We don’t have a LTO-9 tape speed number. Quantum said: “Slower tape speed is an enabler for future generations of LTO drives to offer higher data rates.” At 5m/sec it would take 251 seconds to move the full length of an LTO-9 tape through a drive.

Tape search speed is faster, 10m/sec with full height LTO-8 drives. That means it could take 125.5 seconds to stream the tape through the drive when looking for a piece of data – still slow compared to disk.

LTO-9 tape has 12 Gb/in2 areal density. An 18TB disk drive has 1022 Gb/in2. That means LTO-9 tape can achieve the same 18TB capacity with only 1/85th of the areal density than that of an 18TB disk. No wonder tape’s area density has such a large development head room.

Disk

Disk began 2020 with the standard 3.5-inch nearline drive storing 16TB, and ended it with 18TB and 20TB drives from Western Digital and Seagate. Both companies are developing next-generation technology to progress beyond current Perpendicular Magnetic Recording (PMR). This technology is reaching a dead end beyond which capacity can increase no further, due to the bit areas becoming too small to hold data values in a stable manner.

Western Digital intends to use microwaves to write data to a more stable recording medium called MAMR technology, while Seagate is overcoming its new medium’s resistance to change by using temporary bursts of heat (HAMR). Seagate has started shipping HAMR drives but Western Digital is only shipping partial MAMR tech drive drives using so-called ePMR technology.

We anticipate WD to ship MAMR drives this year, and Toshiba, the third disk drive manufacturer, to follow suit.

Dual or multi-actuator tech appeared in 2020, with Seagate adopting the technology. There are two read/write heads and they divide a disk drive into two logical halves that perform read/write operations concurrently to increase overall IO bandwidth.

But, even so, the time to access data on a disk depends mostly upon the seek time. This is the time needed to move a read/write head to the right track, and then for the track to spin under the head until the right data block is accessed. This can take between 5 and 10 milliseconds (5,000µs and 10,000µs). The data access latency for a QLC (4bits/cell) SSD is in the 100µs or less area – up to 1,000 times faster. That opened the door for QLC SSDs to go after the nearline capacity storage business.

Flash

The big stories with flash and SSDs have been the increasing 3D NAND layer count and the rise of QLC (4bits/cell) NAND.

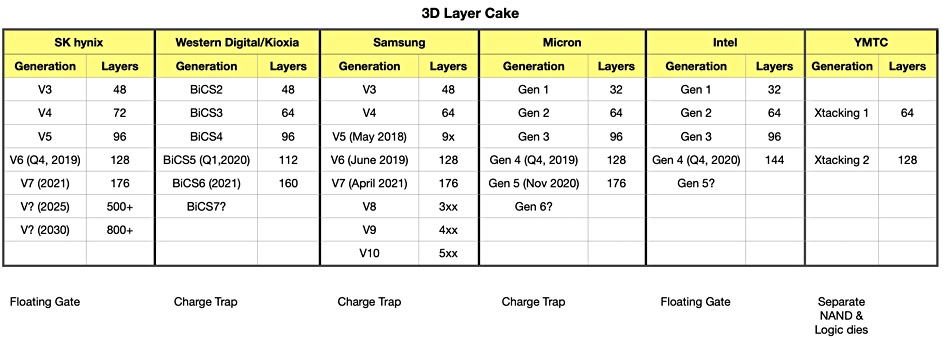

A table illustrates the layer count increase clearly.

Western Digital and Kioxia started 2020 with 96-layer 3D NAND in production and 112 layer in development. The pair now have 160-layers in development. Samsung and SK hynix are moving from 128-layer to 176-layer. Intel moved from 96 layer to 144 layer. (It also sold its NAND business to SK hynix late last year but that sale won’t complete until 2025.)

In general, adding 48 or so layers to a 3D NAND die increases manufacturing cost but assuming similar or better manufacturing yields, there is an overall decrease in cost/TB.

Adding a fourth bit to each cell increases capacity by a third. QLC flash doesn’t last as long as current TLC (3bits/cell) flash so extra over-provisioning cells are needed to compensate for worn-out cells. Even so, 150-layer-plus 3D NAND with QLC cell formatting, provides a flash SSD that is cheaper to make than a sub-100-layer TC flash SSD.

In April, Micron aimed its 5210 ION QLC NAND SSD at the nearline disk drive replacement market.

We now have many flash array suppliers adding QLC flash to their product lines; Pure Storage, NetApp, Nexsan, StorONE and VAST Data.

Tech developments suggest that the SSD threat to disk will intensify. Intel suggests that coming PLC (5bits/cell) NAND will enable the total cost of SSD ownership to drip below that of disk in 2022.

Persistent Memory

There is one main persistent memory game in town, and that’s Intel’s Optane. But let’s give a nod to Samsung’s Z-SSD.

The Z-SSD had a big win in 2020, with IBM adopting it for the FlashSystem arrays, with up to 12 x 1.6TB Z-SSDs supported.

Optane SSDs, which are not persistent memory products, but faster SSDs, were used by StorONE in its S1 Optane Flash Array, and also by VAST Data.

Intel started shipping second generation 3D XPoint technology in 2020, meaning 4-layers, double that of the gen 1 products. The company announced three products using gen 2 XPoint: PMem 200 Optane Persistent Memory DIMMs, server-focused P5800X Optane SSDs, and an H20 client SSD combining a gen 2 Optane cache with 144-layer QLC 3D NAND.

Intel put in a sustained and concerted effort throughout 2020 to increase its support by applications. The hope is that, as customers take up these applications they will buy Optane persistent memory to send their performance to a higher level.

To date, adoption of Optane persistent memory – Optane DIMMs used as quasi-DRAM to expand a server’s memory pool – has been muted. But the adoption of the PCIe Gen 4 bus, twice the speed of PCIe 3.0, could deliver a bigger bangs-per-buck bump than Optane for less cash.

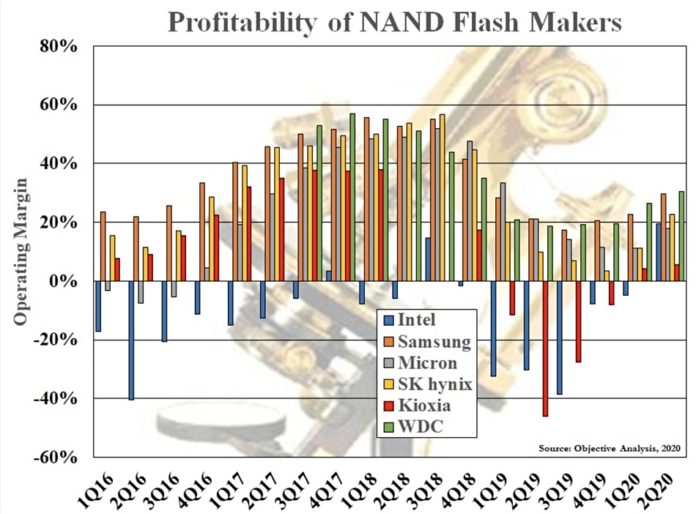

Intel in December outlined two coming Optane technology generations, with no performance details. All-in-all, Intel is making slow progress although it may have turned the corner on Optane profitability, according to tech analyst Jim Handy, in a blog in August. He included a chart in the blog;

This shows the operating margin of NAND manufacturers from 1Q 2016 to 2Q 2020, with Intel’s Non-volatile Solutions Group represented by a blue bar that’s mostly in negative territory. Handy thinks this is due to Optane losses. However, in 2020 the picture changes. NSG made a 19 per cent positive margin in 2020’s second quarter.

Handy comments: ”Intel has lost well over one billion dollars per year in 2017-2019 to bring 3D XPoint to the break-even point.”

He says: “The economies of scale have allowed Intel to finally reach the break-even point, and from now on Optane is likely to either continue to break even or to make a profit. This is enormously important if the company ever wants to spin off the Optane business. A spin-off seems very likely since Intel has exited nearly every memory business it has participated in since its founding: SRAM, DRAM, EPROM, EEPROM, NOR flash, Bubble Memories, and PCM. The only two left are NAND flash and 3D XPoint.”

Intel is now selling its NAND memory business to SK hynix, which would make Handy’s Optane spin-off suggestion even more likely.

DNA

DNA storage came into prominence a couple of times last year, with its fantastic promise of extraordinary capacity in a small space. But that extraordinary capacity; one gram of DNA being able to store almost a zettabyte of digital data, one trillion gigabytes, comes at a cost.

A lot of mechanical movement, chemical reactions, complicated lab machinery and time is needed. A Microsoft and University of Washington demo system had a write-to-read latency of approximately 21 hours for a 5-byte data payload.

But, again, scientist-led startups like Twist BioSciences and Catalog are pushing the DNA storage envelope forward and we might hear more about it in 2021. Indeed, Catalog now has a $10 million war chest to fund its development.