The WSJ is reporting Korean DRAM, NAND and SSD maker SK hynix could buy some all of Intel’s NAND business operation for around $10bn.

Details are few but a deal could be announced next Monday.

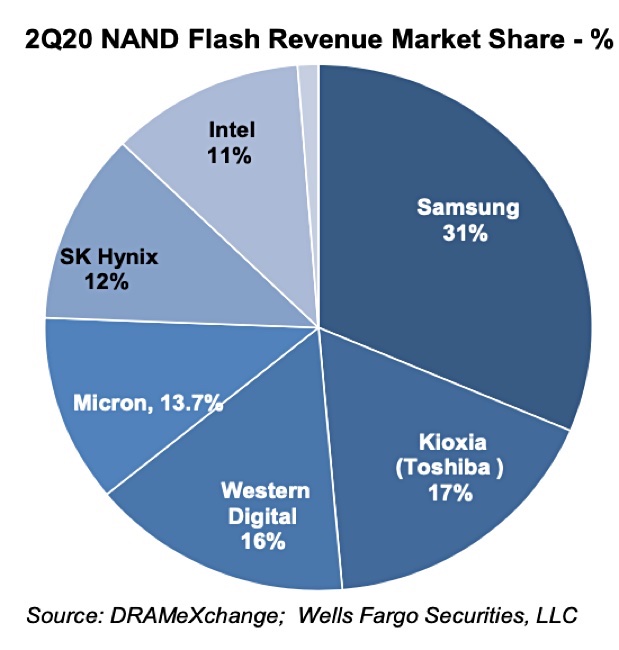

Intel is the sixth and smallest NAND maker in terms of revenue market share, having 11 per cent of the market, behind leader Samsung with 31 per cent, Kioxia with 17 per cent, Western Digital with 16 per cent. Micron with 13.7 per cent and SK hynix itself with 12 per cent.

A seventh supplier, China’s YMTC, has negligible market share.

In March, Intel CFO George Davis said Intel was unable to sell enough SSDs to make a profit from the 3D NAND chips it made in its Dalian, China, foundry.

Wells Fargo senior analyst Aaron Rakers told subscribers that Intel NAND operating income was -$340m for the trailing 12 months ending 2Q20, according to DRAMeXchange.

Intel was, Davis said, exploring options such as closing its foundry and buying in chips, or selling chips to third parties or buying in SSDs from a third party.

A Chinese media report posted in July last year said: “Hynix plans to acquire Intel’s Fab 68 factory in Dalian, China.” The paper quoted a person familiar with the matter as saying: “According to the current progress, Hynix is negotiating with Intel. Hynix wants to acquire the entire Intel Dalian factory and 3D NAND business. Intel only retains XPoint-related technologies.”

A Reuters report said Intel would sell both its foundry and its NAND SSD business to SK hynix but keep its Optane 3D XPoint business. That would shrink its entire Non-Volatile Solutions group business unit drastically.

It appears likely that SK hynix is negotiating to buy Intel’s Dalian fab. Intel could then buy in chips from SK hynix if it wants to continue selling SSDs. It is conceivable that Intel is considering selling its entire NAND business to SK Hynix but that would be a drastic step.

Rakers suggested a consolidation from seven to six NAND manufacturers would be a good thing in terms of overall industry profitability. He thinks a supplier consolidation move, like SK hynix buying Intel’s fab, would also provide opportunities for competitors to attack Intel’s SSD customer base.

Intel reports its 3Q20 earnings on Thursday and we may hear more then.