Actifio, the venture-backed data management startup, has used a reverse stock split to torch the shares of up to 1,000 staff and former employees.

The company last week implemented a reverse stock split ratio of 100,000-to-one, which “decreases the aggregate number of shares of Common Stock issuable thereunder to 9,728,360 shares of Common Stock,” priced at 24c “fair value” each.

That $0.24 “fair value” means Actifio’s 9,728,360 shares of Common Stock are valued at $2.335m. Yet the company was classed as a unicorn in August 2018, worth more than $1bn by VCs, and has taken in $311.5m of VC investment since it was founded in 2009. The reverse stock split ratio indicates that an incredible 972 billion shares were previously issued.

What’s going on here? Peter Godman, the co-founder and former CEO of startup Qumulo, has a plausible explanation. “If I were guessing I’d say they took new investment at near-zero valuation,” he writes on Twitter. “The level of outstanding stock imputed a very low per-share valuation. So, they printed a trillion shares, awarded it to new investors and loyal employees, and then reverse split to fix it all. … Whatever the reason, a sad day for early employees particularly.”

Let’s see how this affects Actifio’s small stockholders.

Something to nothing

Jeff Greene was a Professional Services Engineer at Actifio from July 2012 to December 2014. “I joined in July 2012 and was employee number 90,” he told us. “I was offered 5,000 shares and when I left in 2014 I purchase 2,333 vested shares for approximately $5k. I viewed it as Vegas money and rolled the dice.” He is now receiving a payout of $0.005599, a five thousandth of a dollar. Yes, you read that correctly.

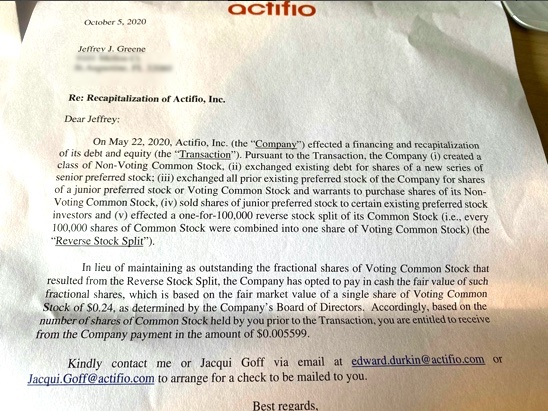

Greene received the news via a letter from Actifio’s CFO Ed Durkin, dated October 5, 2020.

Two manoeuvres by Actifio turned Greene’s shares priced at $5,202.59 to dust. First was the recapitalisation and 100,000:1 reverse stock split. That converted 2,333 shares of old Actifio Common Stock into a fractional share, comprising 0.02333 of of the new Voting Common Stock.

The second event is detailed in the letter, which states; “In lieu of maintaining as outstanding the fractional shares of Voting Common Stock that resulted from the Reverse Stock Split, the company has opted to pay in cash the fair value of such fractional shares, which is based on the fair market value of a single share of Voting Common Stock of $0.24, as determined by the Company’s Board of Directors.”

Jason Axne was a Professional Services Engineer and then Principal Systems Architect at Actifio from August 2012 to March 2018. He said on LinkedIn: “If you are a minority stockholder, a reverse split could extinguish your position and force you out. Unfortunately, there is not much you can do as long as the reverse split follows legal procedures and you receive the correct number of new shares.

“Your chance of prevailing in a lawsuit brought against the board of directors is slim. The courts have held that, absent fraud, misrepresentation or misconduct, a corporation has the right to eliminate minority stockholders through a reverse split.

“Incredible. So many of us poured our heart and souls into that company only for them to squash us like cockroaches… so disappointing.”

Actifio declined to comment.