Global external storage sales in the second 2020 quarter were flat year on year despite Covid and remained steady on the previous quarter. All-flash array revenues grew four per cent Y/Y to take up 45 per cent of the pot, while disk drive and hybrid HDD/SSD array revenues fell three per cent, according to Gartner number-crunchers.

Cutting the numbers another way, secondary storage revenues climbed 44 per cent Y/Y to account for 16 per cent of the external storage market. Backup and recovery storage array revenues grew one per cent while primary storage declined six per cent.

Gartner estimates storage vendors collectively shipped 11.86 exabytes in Q2, a jump of 33 per cent Y/Y. This includes a 35 per cent increase in HDD and hybrid shipped capacity and a 19 per cent rise in shipped AFA capacity. Shipped primary storage capacity increased 19 per cent.

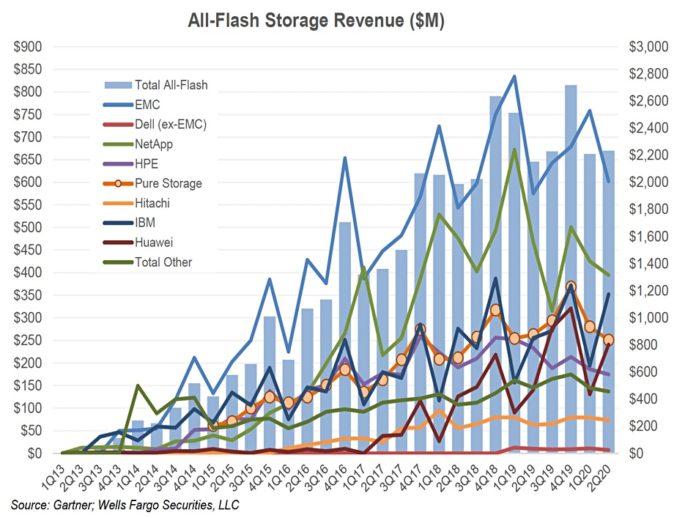

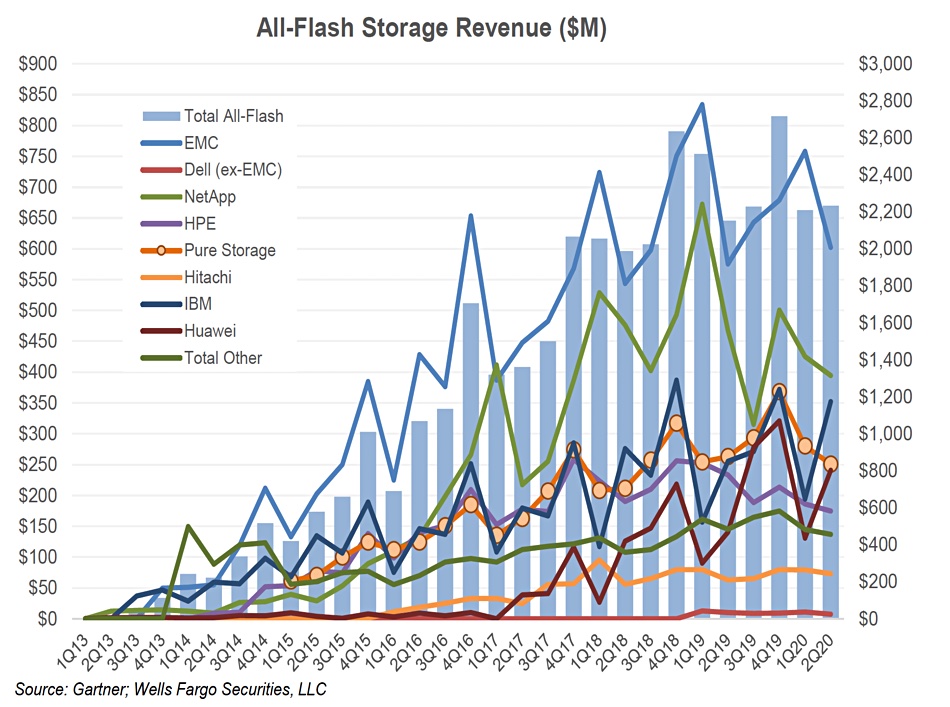

Wells Fargo senior analyst Aaron Rakers provided subscribers with charts based on the Gartner report, and we reproduce a couple here. The first one shows supplier share trends.

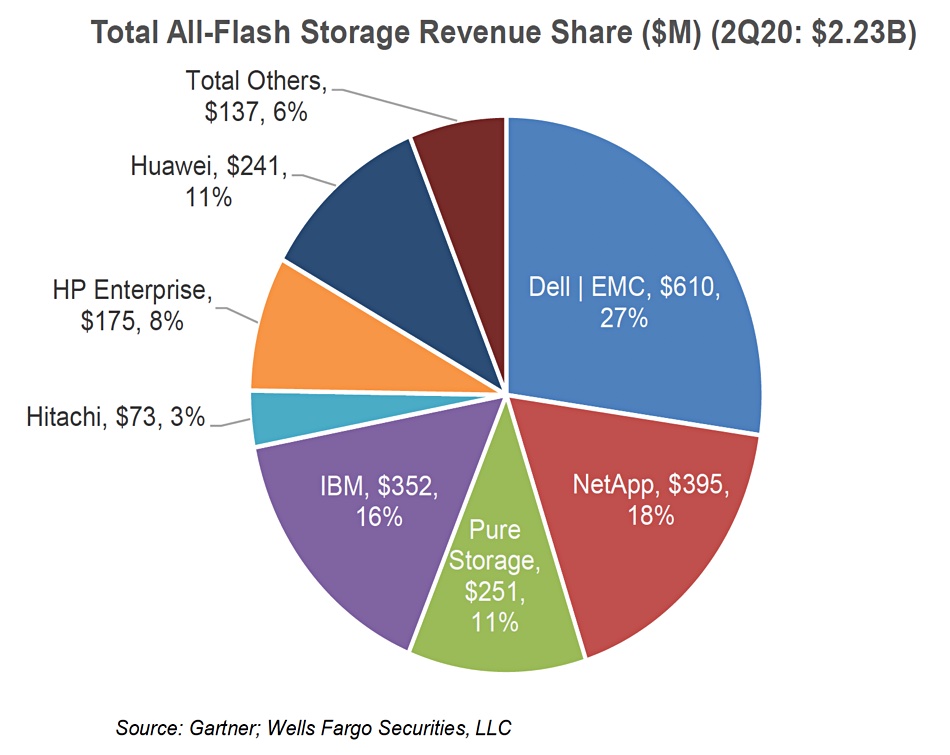

The second chart shows revenue share by vendor.

Three companies grew market share: Huawei, up 72 per cent to 10.8 per cent share; IBM up 30 to 35 per cent (our estimate) to 16 per cent share; and market leader Dell EMC, up four per cent to 27.3 per cent share.

NetApp, HPE, Pure Storage and Hitachi have each suffered two quarters of external storage revenue decline, roughly coinciding with the Covid-19 pandemic. NetApp fell 4.4 per cent to 17.7 per cent share; Pure Storage declined five per cent to 11.2 per cent share, and HPE fell 25 per cent to 7.8 per cent share.