In an end-of-the-week news blizzard, Nutanix delivered Covid-19-defying revenue growth, said its co-founder and CEO plans to retire, and bagged a $750m investment from Bain Capital. The news pleased the market with Nutanix shares rising nearly 20 per cent after the close of business on August 27.

Let’s start with the retirement. CEO and chairman Dheeraj Pandey co-founded the hyperconverged infrastructure powerhouse in 2009 and has steered the company to $1.3bn in annual revenues. He will stay on until the board hires a new CEO.

He said he strong quarterly results and the Bain Capital investment put Nutanix in good shape for the future: “I am confident there is no better time for me to make this transition to a new leader who can guide Nutanix through its next decade of growth and success.”

Pandey added: “While I will miss being in the trenches with our team every day, working from home alongside my family over the last several months has been a fulfilling experience. I look forward to spending more time with our children and allowing myself the space and flexibility to read and write, and learn new domains, which simply hasn’t been possible as a full-time CEO.”

The results

Nutanix posted fourth FY20 quarter revenues of $327.9m, up on the year-ago $299.9m, but losing $185.3m in the process. The year ago net loss was $194.4m. The company gained 780 new customers in the quarter and the total customer count stands at 17,360.

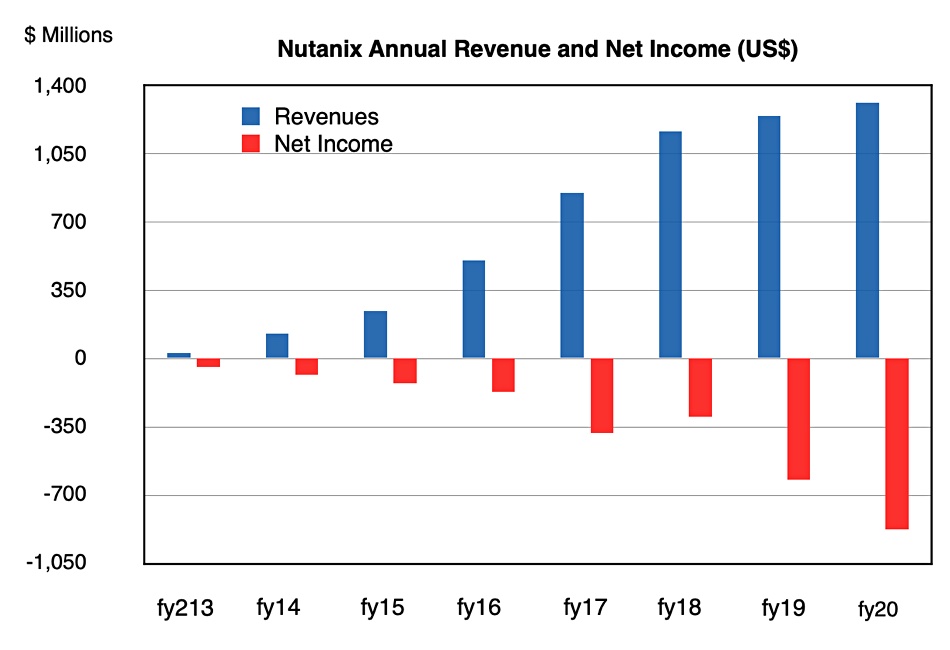

Full FY’20 revenues were $1.31bn, 5.7 per cent up on the previous year, and the net loss was $872m, compared with -$621m in FY’19. To date Nutanix has prioritised growing business far more than making a profit. It has also been transitioning from product sales to subscriptions. This has a knock-on effect on revenues in the short term as there is less upfront revenue when customers make an order. However, the transition is nearly complete, with Nutanix reporting 88 per cent of Q4 total billings were subscription-based, up from the prior quarter’s 84 per cent.

- Gross Margin: 79.6 per cent, up from 77.0 per cent a year ago

- Free Cash Flow: $13.8m compared $33.3m a year ago

- Cash and Short-term Investments: $719.8m, down from $908.8m a year ago.

Bain Capital

Bain Capital is purchasing $750m in senior convertible notes, initially convertible at $27.75 per share to Nutanix’ Class A Common Stock. The notes will mature on September 15, 2026 and bear 2.5 per cent interest per year. The transaction should close in late September this year. Bain gets two seats on the Nutanix board, which increases from 9 to 11 members

Pandey said the investment “validates the market opportunity in front of us and positions us well with enhanced financial flexibility and resources to further scale, gain share and remain at the forefront of innovation in our industry.”

William Blair analyst Jason Ader told subscribers that Nutanix will use the money for “growth initiatives and to fund its shift to an ACV (Annual Contract Value) model …We think investors will breathe a big sigh of relief from both the solid quarterly results and the influx of cash that should assuage liquidity concerns.

“While we salute Pandey on the job he has done in building and evolving Nutanix into a market leader and billion-dollar-plus company, we think the time feels right for a leadership change, especially as the company enters its second decade and embarks on a new direction as a hybrid-cloud software vendor with an ACV subscription model.”

It is changing from a Total Contract Value (TCV) to the ACV model, which has annual contracts instead of the TCV’s 3.8-year contract periods. Ader says this should ultimately drive “greater predictability and operating leverage in the business as the company farms a greater portion of its business from low-cost, low-risk renewals.”

Bain’s capital will help fund the TCV-to-ACV transition.