Dell Technologies storage revenues slid four per cent in Q2 2020, as Pure and NetApp posted revenue rises for the same period.

Dell’s overall revenues were $22.7bn, compared to $23.37bn a year ago.But net income fell to $1.1bn, compared with $4.5bn last time around. VMware posted $2.9bn revenues for the quarter, up 10 per cent and helped by subscription and SaaS revenues rising 44 per cent. There was triple-digit revenue growth for VMware Cloud on AWS.

It was Covid-19 wot did it. Jeff Clarke, Dell’s COO and vice chair, gave his take on this in the earnings call : “We have continued to see customers slow down their investments, in some cases, sweat their current infrastructure through the first half of the year to navigate through the pandemic.”

Enterprises were more resilient than SMB customers: “We saw healthy demand in the largest companies around the world continuing to buy servers and continuing to buy storage class products.” He said there was “a dramatic deceleration in US GDP during the second calendar quarter of the year [but] Overall, we had a solid quarter relative to the macro environment.”

Dell saw “saw strength in the government sector and in education, with orders up 16 and 24 per cent, respectively, as parents, teachers and school districts prepare for a new frontier in virtual learning.”

Generally, revenues were driven by work and learn from home demand with outperformance from its consumer business with strong double-digit growth for its consumer notebooks and gaming systems.

Some $3.3bn was recorded in cash flow from operations; up 2 per cent Y/Y. There was a 14 per cent rise in deferred revenue to $28.8b, with $6.0bn in recurring revenue, up 15 per cent.

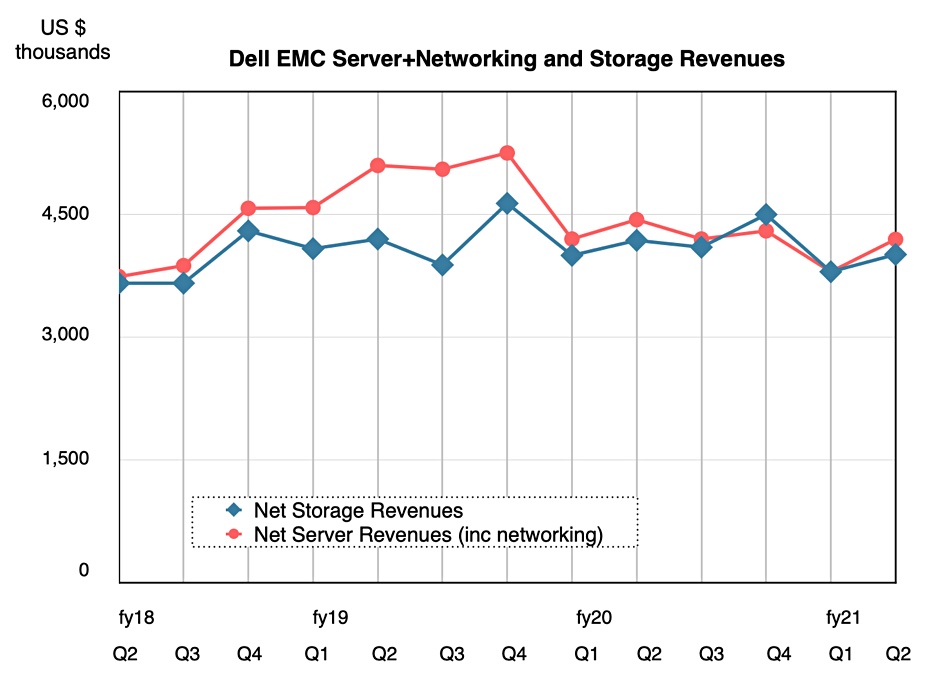

Drilling down within Dell, the Infrastructure Solutions Group (ISG) accounted for $8.2bn revenue, 5 per cent down on the year. CFO Tom Sweet said: “Given the dynamics in the macro environment, the ISG results have been softer than we expected coming into this year.”

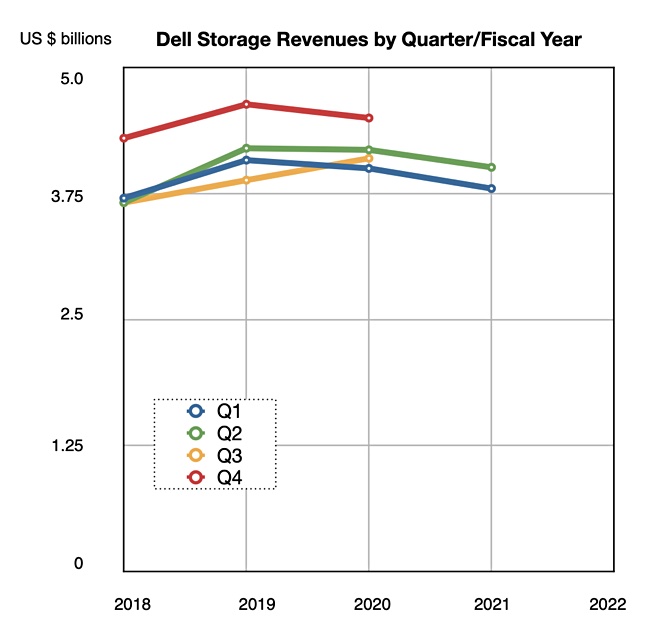

Servers and networking accounted for $4.2bn, down 5 per cent Y/Y, with storage down as well, by 4 per cent to $4bn. This the fourth quarter in a row of Y/Y storage revenue decline for Dell.

There was a Q/Q rise in both servers and networking revenues and also in storage, a bright spot in this Covid-19 era, but the annual compare for storage and also servers and networking is down.

Dell reported continued strong demand for VxRail hyper-converged appliances, with double-digit orders growth for the second quarter in a row. ITHe company maintained its #1 position with a 33.6 per cent market share. High-end PowerMax array revenues grew by a mid-single digit percentage according to Clarke.

Sweet mentioned “triple-digit orders growth in our high-end PowerMax solution and double-digit orders growth in Data Protection.”

Mid-range storage and PowerStore

So there was no storage surge as yet from the new PowerStore systems, introduced in May. CFO Tom Sweet said: “ We saw softness in other areas of core storage, including midrange. We continue to build pipeline for PowerStore and are pleased with customer receptivity. We expect it to ramp through the second half of this year and heading into FY22.”

Clarke said: “it’s a little early to comment on PowerStore performance, we continue to hear positive feedback and feel confident that the pipeline will drive profitable share gains, specifically in the midrange segment this year.”

In yesterday’s NetApp earnings call, CEO George Kurian said: “The PowerStore product that they have brought to market is not being well received by customers, and we are displacing them in several accounts.”

Clarke expressed an opposing view in the earnings call: “ I would tell you, we’re very happy with the early traction we’ve had with PowerStore.

“At less than a quarter of shipping, we have already acquired hundreds of new customers, 20 per cent of them are new to Dell. … What’s probably the more compelling from my point of view is we’re seeing a strong correlation with our competitive swaps that are up 32 per cent quarter-over-quarter. And we’ve seen 2x the level of competitive displacement revenue than the previous quarter since the launch of PowerStore. … We absolutely believe we have a winner here.”

Guiding down

For the next quarter, Sweet said Q3 revenue would be “seasonally lower than prior years, which has typically been flat to down 2 per cent sequentially.”

Clarke said: “IDC has shown the external storage market and the mainstream server market under pressure in the second half of the year, specifically changing their forecast by roughly 600 basis points more negative. And we think we can weather the storm throughout the rest of the year. And as we look into next year, we see growth in the server market and the external storage market.”