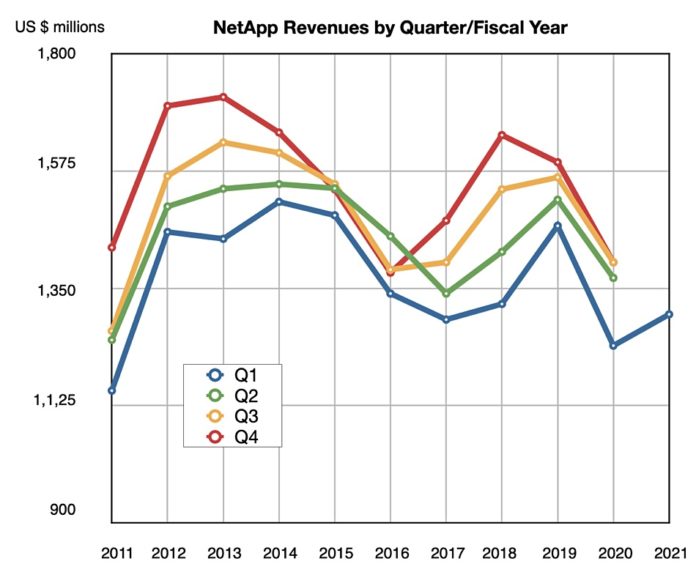

NetApp has pulled off a strong first quarter, posting revenues up five per cent y/y to $1.3bn and net income of $77m.

CEO George Kurian said yesterday: “In the face of an uncertain environment, NetApp performed well in the quarter with revenue, operating margin and EPS all exceeding our guidance… The improvements we made to sales coverage in FY ’20 and the tighter focus on execution are starting to pay off.”

We’ll return to the numbers later, but let’s take a look first at the NetApp re-org, announced yesterday.

NetApp has confirmed the company is laying off 5.5 per cent of the workforce – approximately 700 employees (see our report: NetApp layoffs hit SolidFire hard).

The company told us via an email statement: “In the realignment of our resources at NetApp, we are changing our approach to advanced technology and our industry standards body participation.We’re tightly aligning those functions to the business so that we can be more responsive to the rapidly changing demands of the market and customers.

“As a result, many Advanced Technology Group (ATG) and Standards and Industry Associations Group (SIAG) team members will be integrated into the business and engineering teams, while some will be leaving NetApp.”

NetApp’s Solidfire operation is shrinking to focus on core enterprise usage. “We are narrowing our focus with a SolidFire and HCI portfolio to the high-margin parts of the market,” Kurian said in yesterday’s earnings call.

Solidfire AFAs will get investment to increase operational simplicity and security plus additional software features. NetApp told us: “We are investing in NetApp HCI as a simplified and automated infrastructure solution for on-premises Kubernetes environments and are closely aligning NetApp HCI to Project Astra.”

The company is winding down efforts on MAX Data technology, which links host server Optane drives to ONTAP arrays – at least for the present. NetApp said: “Our launch of Memory Accelerated Data (MAX Data) was far ahead of the market. To give the market time to catch up with our innovation, we are focusing our resources to explore new ways we can use the core technology and underlying IP across our core storage and cloud portfolio.“

The numbers

OK, so what’s new?

NetApp has two strategic initiatives: to regain growth in its storage business and to push ahead with public cloud services. Kurian said in the earnings call: “Enterprises are prioritising transformational and hybrid cloud projects which drove our momentum as customers turn to NetApp to help them accelerate these plans.”

The Q1 results show flash storage sales are picking up, and cloud is promising – albeit from a small base compared with some competitors. In the earnings call yesterday, Berry said: “Public cloud services delivered an impressive $178m in ARR (Annual Recurring Revenue), growing 192 per cent year over year.” Three recent acquisitions, Spot, CloudJumper and Talon, accounted for $44m of the revenue growth.

Product revenues were $627m, down three per cent y/y. Hardware revenues were $316m, down seven per cent due to lower disk sales. Software product revenues were $311m, up two per cent as all-flash ONTAP revenues rose.

Berry said: “Our all-flash revenue of $567m was up 34 per cent year over year, nicely positioning us for share gains in the quarter.” The percentage of the installed base that has converted to all-flash was 22 per cent in Q1’19, 24 per cent in Q4’20 and 25 per cent in the latest quarter.

Kurian said in the earnings call: “Our installed base continues to grow. And the fact that with strong growth rates in all-flash array, we move the penetration one per cent at a time is just the dimension of the magnitude of our growing installed base. These are very, very big installed base numbers … One flash array replaces a few disk-based systems.”

Maintenance revenues climbed 14 per cent to $608m, accounting for 47 per cent of total revenue in the quarter. Berry said: “When combined, software revenue and recurring maintenance revenue totalled $919m in Q1, representing 71 per cent of total revenue.” The gross margin for these two areas is 83.4 per cent.

Revenue outlook for next quarter is $1.225bn – $1.375bn which at the midpoint implies a five per cent decline. Kurian said: “Enterprises are prioritising transformational and hybrid cloud projects which drove our momentum as customers turn to NetApp to help them accelerate these plans. … Uncertainty remains high, but we are moving into a new normal and adjusting to operate in a virtual environment.”

The company has plenty of wiggle room. Cash, cash equivalents and investments were $3.77bn at the end of the quarter.