Kioxia aims to raise $3.6bn via an IPO that values the flash memory chip maker at $20.1bn.

Kioxia will list on the Tokyo Stock Exchange on October 6, and this will make it the biggest Japanese IPO of the year.

Major shareholders Toshiba and Bain Capital will sell part of their Kioxia holdings, and Kioxia will also issue new shares.

Kioxia used to be called Toshiba Memory Corporation. It was spun off from Toshiba in 2018, after the parent company ran up huge losses in its nuclear power station division.

The deal with a consortium led by Bain Capital saw Toshiba retain 40.2 per cent of the TMC business, with the Bain consortium holding 56.2%. The transaction was complicated by the joint foundry venture with Western Digital and this led to court cases. TMC renamed itself Kioxia in July 2019.

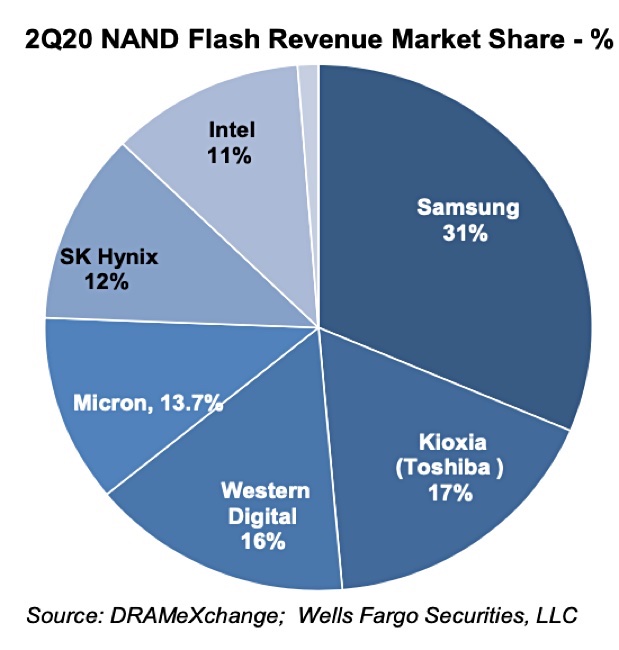

Since then Kioxia has progressed through a NAND glut and currently has a 17 per cent share of the NAND Flash market, second to market leader Samsung which has 31 per cent.

Following the IPO, Toshiba’s stake will reduce to 32 per cent and the company said it will return a majority of the cash to shareholders., Reuters reports. The Bain consortium will cut its stake to 47.8 per cent.