Hyperscalers and enterprise data centres helped Seagate grow revenues in its Q4, despite a pandemic-related drop in demand in several market areas.

Revenues climbed 6.3 per cent year-on-year to $2.52bn and net income was $166m for Q4 ended 3 July. Net income in the same quarter last year was $983m, thanks to a hefty boost from a one-time $702m tax benefit. Full fy20 revenues were $10.51bn, up one per cent on last year’s $10.39bn.

CEO Dave Moseley’s prepared remarks were a bit half and half: “The June quarter was led by robust cloud and data centre demand, which drove record exabyte shipments for our nearline mass capacity drives and strongly contributed to the Company’s overall revenue and solid free cash flow generation.

“However, continued economic uncertainty and COVID-19 related disruptions impacted demand in other key end markets including video and image applications, mission critical and consumer markets and also impacted profitability as we incurred higher logistics and labor costs which together weighed on our fourth quarter results.”

He told analysts on a conference call:

“Economic uncertainty and the extension of restrictive measures began playing out in other markets as the quarter progressed, causing smaller and midsized enterprise customers to scale back their IT budgets, municipalities to delay certain projects and consumers to spend more selectively. These macroeconomic factors ultimately impacted sales of our video and image applications, and led to a steeper than seasonal decline for our legacy products.”

Moseley was more effusive about the full year: “Fiscal 2020 marked a strong year of progress as we grew mass capacity storage revenue by 25 per cent and increased our overall revenue. We executed our technology roadmap, strengthened our balance sheet and delivered on our capital return program.”

Q4 summary

- Operating margin 10.6 per cent

- Cash flow from operations $388m

- Free cash flow $274m

Fy20 summary

- Operating margin 12.4 per cent

- Cash flow from operations $1.7bn

- Free cash flow $1.1bn

- Returned $1.5bn to shareholders through dividends and share repurchases

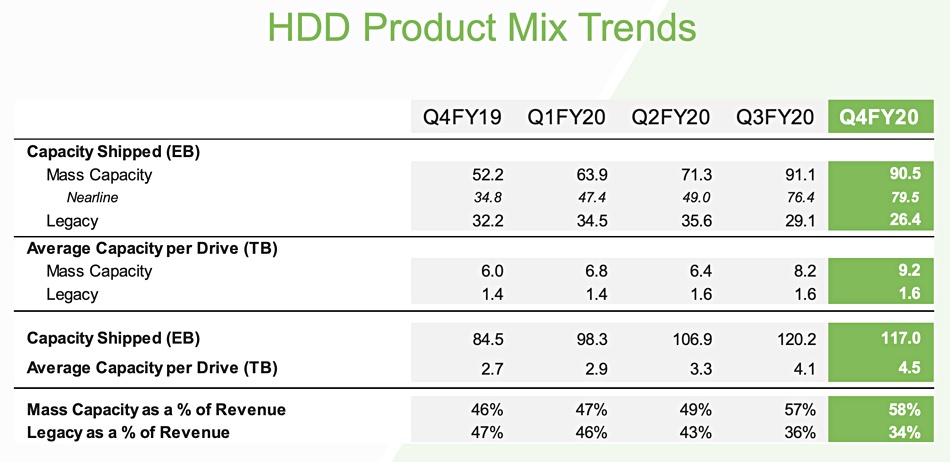

As expected, mass capacity nearline disk drives revenues grew 35 per cent year-on-year and accounted for 63 per cent of total disk drive revenue. Shipments were 79.5EB, up 128 per cent year-on-year.

Full year nearline HDD revenues increased 25 per cent year-over-year and represented 57 per cent of annual HDD revenue.

A Seagate disk drive capacity mix table shows the growth of the nearline disk drive product sector, with EB and average capacity per drive increasing.

Wells Fargo senior analyst Aaron Rakers told subscribers: “Legacy HDDs accounted for 36 per cent of total HDD rev. vs. 38 per cent and 51 per cent in F3Q20 and F4Q19, respectively. The legacy segment experienced weaker than seasonal demand (COVID-19 impacts).“

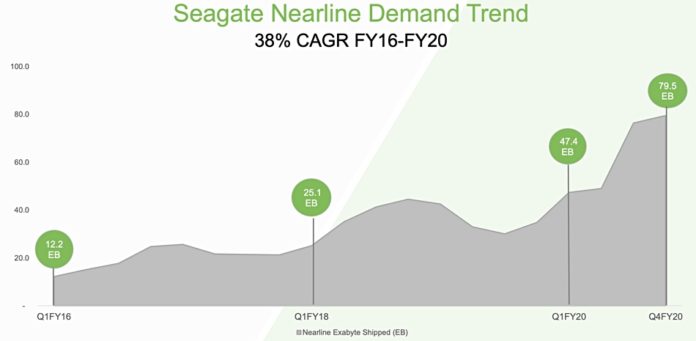

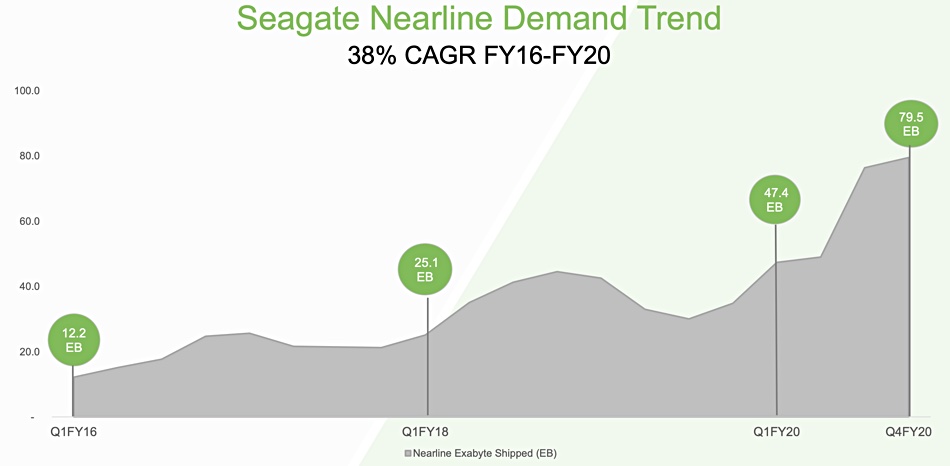

A nearline demand trend chart shows a recent increase;

Seagate is shipping lots of 16TB drives and has begun growing its 18TB drive business, with 20TB heat-assisted magnetic recording (HAMR) drives due by the end of the year.

Small Seagate SSD potatoes

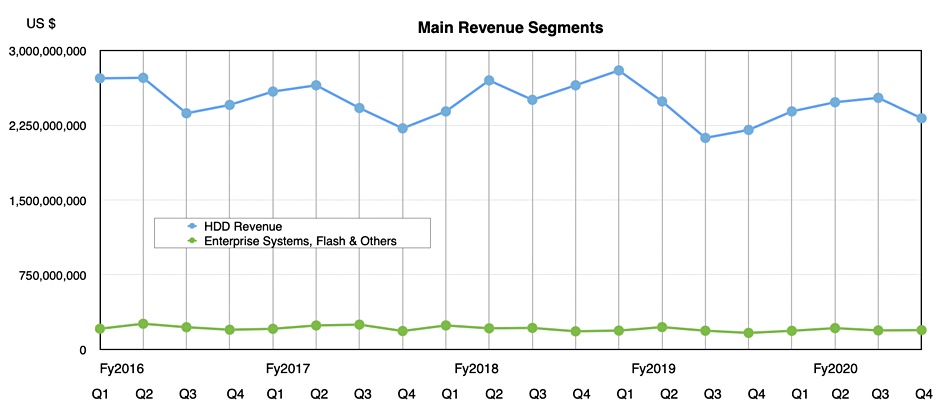

The company made a comparatively small amount of revenue from SSDs and other non-HDD items in the quarter. HDDs accounted for $2.32bn while SSDs, enterprise systems, etc. brought in $195m. That is not to be sneezed at but represents just 8.4 per cent of Q4 revenues.

Seagate anticipates $2.3bn revenues plus or minus $200m for next quarter, down on last year’s $2.6bn. Rakers told subscribers: “Seagate expects demand for its nearline products to moderate during the September quarter. This is driven by COVID-19 related weakness continuing in video and image applications and NAS (SMB enterprise / on-premises), while data centre/hyperscale demand is expected to remain strong.”

Longer term, Seagate sees unabated growth in data at the edge and in the cloud, and this will drive secular demand for mass capacity storage.