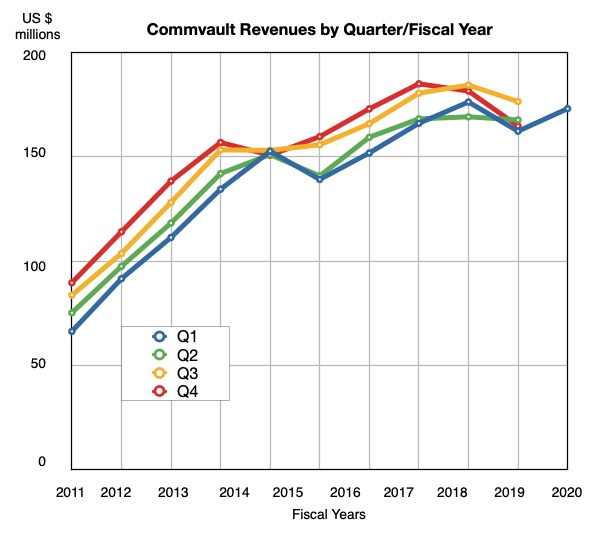

Commvault has grown its revenues after five quarters of decline as changes to its products, sales organisation and channel program start delivering results during the Covid-19 pandemic.

First quarter revenues for fiscal 2021 ended 30 June were $173m, a 7 per cent year-on-year rise, easily surpassing the $155m to $250m revenue guidance Commvault provided three months ago.

President and CEO, Sanjay Mirchandani, was effusive in his prepared remarks: “I could not be prouder of the team. Our first quarter results are validation that our streamlined operations and reinvigorated go-to-market engine are starting to execute well. Together with our new product portfolio and robust partner program, our customers are starting to embrace our intelligent data management vision.”

Profit came in at $2.28m, a turnaround from the $6.8m loss reported a year ago. William Blair analyst Jason Ader said this was helped by: “Changes to its expense structure – particularly related to rationalising sales-and-marketing costs – as well as temporary savings associated with Covid-19 (e.g., less sales-related travel and a shift to virtual conferences).”

He added: “Outperformance in the first quarter was due to several non-repeatable factors – i.e. reduced OPEX resulting from Covid-19-related expense reductions and large deal closures.”

- Annualised recurring revenue (ARR) was $471.6m, up 9 per cent year-on-year.

- Subscriptions represented 69 per cent of total software revenue in the quarter.

- Software and products revenue was $76.6m, up 20 per cent year-on-year, driven by a record 41 per cent increase in larger deals in the Americas – greater than $100k in software and products revenue.

- Average large deal size was $402k compared to $298k a year ago.

- Services revenue was $96.4m, a decrease of 2 per cent year-on-year

- Operating cash flow totalled $15.3m compared to $31.1m a year ago.

- Total cash and short-term investments were $356.3m compared to $339.7m in the corresponding quarter of fiscal ’19.

Wells Fargo analyst Aaron Rakers looked at the geographic breakdown of the results : “Commvault reported a 62 per cent year-on-year increase in Americas software revenue, a 36 per cent year-on-year decrease in APAC software revenue, and a 12 per cent year-on-year decrease in EMEA software revenue.

“Total revenue in the Americas returned to growth and was up 17 per cent year-on-year while EMEA and APAC declined 2 per cent and 19 per cent year-on-year respectively.” Clearmyl there’s still work to be done in Commvault’s APAC and EMEA regions.

Commvault estimated that Q2 fy21 revenues will be $164m, slightly down on the year-ago’s $167.6m.

Ader said he remained “wary that one quarter of strong performance does not a trend make,” – he is now modelling 2 per cent revenue growth for Commvault’s fiscal 2021, up from his previous forecast of a 6 per cent revenue decline. That’s quite some turnaround.