Blocks & Files has seen an extract of a soon to be published GigaOm report that assesses unstructured data management suppliers

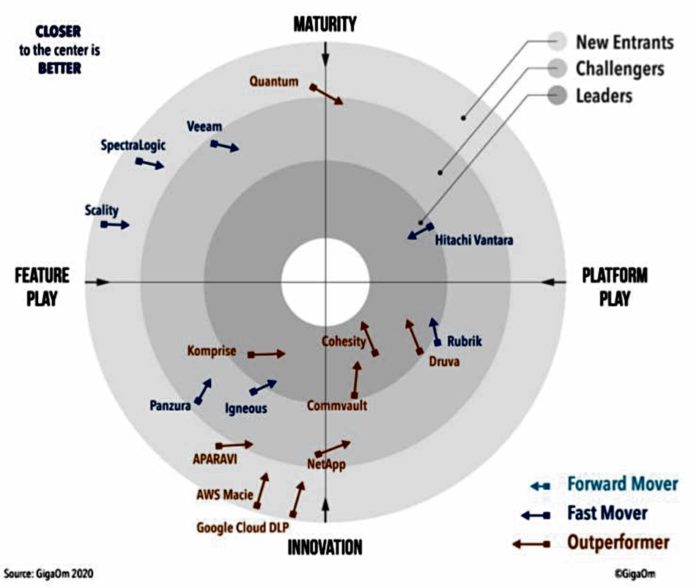

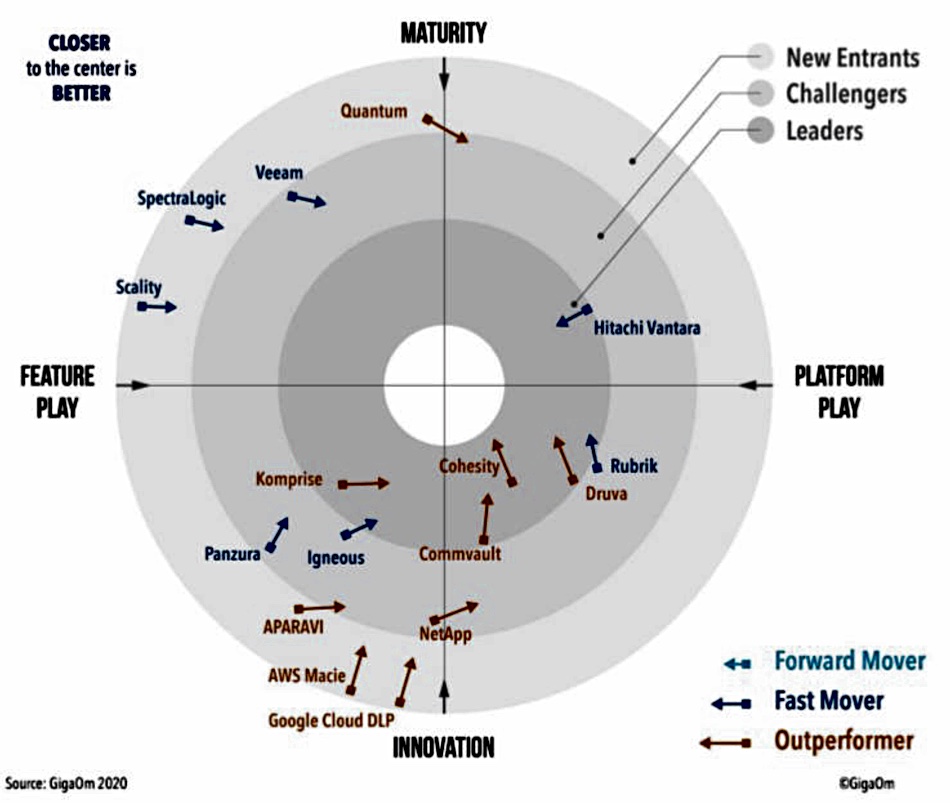

Sixteen vendors are covered by analyst Enrico Signoretti in the GigaOm Radar for Unstructured Data Management. They are Aparavi, AWS Macie, Cohesity, Commvault, Druva, Google Cloud DLP, Hitachi Vantara, Igneous, Komprise, NetApp, Panzura, Rubrik, Quantum, Scality, SpectraLogic and Veeam.

Signoretti confirmed the imminent publication of the report. He told us: “As you know, interest in Unstructured Data Management is skyrocketing. Users want to know what they have in their storage infrastructures and need tools to decide what to do with it. We have identified two categories (infrastructure- and business-focused).

“The first category provides immediate ROI and improves overall infrastructure TCO, while the latter addresses more sophisticated needs, including compliance for example. Vendors are all very active and the roadmaps are exciting.”

In the report, Signoretti writes: “Leading the pack we find Cohesity, Komprise and Commvault.” Hitachi Vantara and faster-moving Druva are moving deeper into the leaders ring. Challengers Igneous and Rubrik are entering the leaders ring. Dell EMC, HPE and IBM are not present in this overall group of suppliers.

GigaOm has already published Key Criteria for Evaluating Unstructured Data Management, which is available to GigaOm subscribers and provides context for the Radar report.

GigaOm Radar details

GigaOm’s Radar Screen is a four-circle, four-axis, four-quadrant diagram. The circles form concentric rings and a supplier’s status – new entrant, challenger, or leader – is indicated by placement in a ring.

The four axes are maturity, horizontal platform play, innovation and feature play.

There is a depiction of supplier progression, with new entrants growing to become challengers and then, if all goes well, leaders. The speed and direction of progression is shown by a shorter or longer arrow, indicating slow, fast and out-performing vendors.

The inner white area is for mature and consolidated markets, with very few vendors remaining and offerings that are mature, comparable, and without much space for further innovation.

The radar screen diagram does not take into account the market share of each vendor.