The Covid-19 pandemic sent enterprise storage revenues down in 2020’s first quarter but Huawei, Pure Storage and IBM went against trend and grew revenues.

The latest edition of IDC’s Worldwide Quarterly Enterprise Storage Systems Tracker reveals total storage capacity shipped in the quarter slipped 18.1 per cent Y/Y to 92.7EB.

Sebastian Lagana, research manager at IDC, issued a quote: “The external OEM market faced stiff headwinds during the first quarter as enterprises across the world had operations impacted by the global pandemic. ODMs once again generated growth, taking advantage of increasing spend from hyperscalers – demand that we anticipate will remain solid through the first half of 2020.”

The 92.7EB of total storage capacity comprises server SANs, ODM (Original Design Manufacturers) sales to hyperscalers like Amazon and Facebook, and sales by OEMs to the enterprise external storage market.

ODM capacity shipped went down 20.2 per cent to 54.8EB, but revenues rose 6.9 per cent to $4.9bn. Enterprise external storage did the opposite; capacity rose 3 per cent but revenues fell 8.2 per cent to $6.5bn.

The total all-flash array (AFA) market generated $2.8bn in revenue, up 0.4 per cent. The hybrid flash array (HFA -disk + SSD) market generated $2.5bn, down 11.5 per cent. An industry source tells us the disk array portion of the enterprise external storage market declined 18 per cent.

Vendor numbers

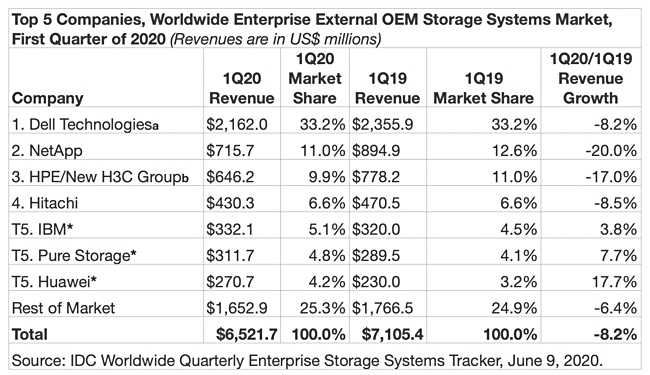

There was a wide divergence in the fortunes of individual suppliers, as an IDC table comparing the first quarters of 2020 and 2019 shows:

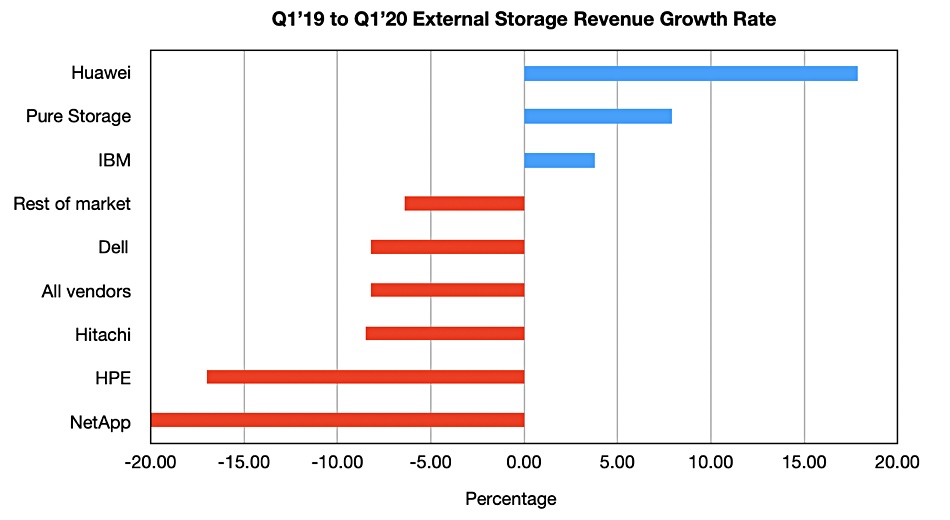

Dell continues to dominate in revenue and market share, but revenues fell 8.2 per cent in line with the market. We have charted vendor revenue growth rate changes to bring out the differences:

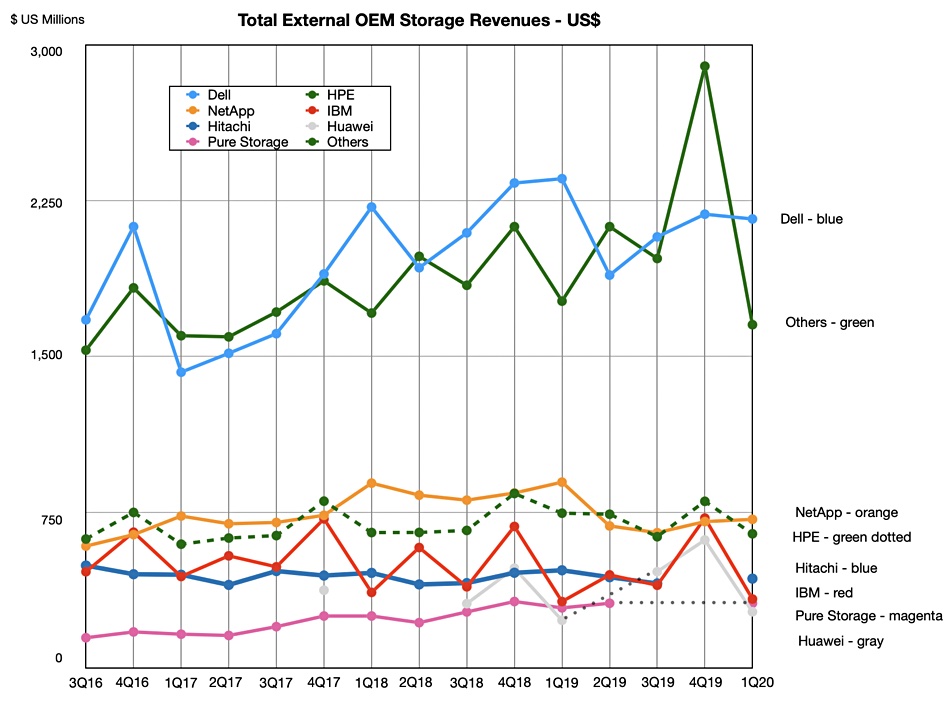

Are these changes significant? After all there has been minor revenue growth differences for years with little substantive effects over time as a chart of IDC Storage Tracker enterprise storage vendor revenues for the past 15 quarters makes clear.

Supplier positions

Dell is still top of the tree by a wide margin. Covid-19 has sent the market down but IBM experienced saw 3.8 per cent growth, driven by a mainframe refresh cycle drawing high-end DS8800 sales in its wake.

Huawei grew revenues at the fastest rate, up 17.7 per cent. It has dipped in and out of IDC’s top five vendor list and has shown a more jumpy curve than Pure.

HPE and NetApp have swapped positions regularly as have Hitachi and IBM. That implies the latest figures do not indicate substantive changes in these vendors’ positions.

Nor did it affect Pure Storage – that much, with growth at 7.7 per cent. We see its comparatively long term growth trend relaxing a little in this latest Storage Tracker edition. Fewer customers stopped buying kit and services and the total AFA segment, Pure’s sole market, grew 0.4 per cent, while Pure grew 7.7 per cent.

Pure told us the market in Japan shrank 4.3 per cent while Pure grew 37.5 per cent. In LATAM the market grew 19.9 per cent and Pure grew 99.9 per cent. The North America market shrank 9.2 per cent and Pure grew 11.8 per cent.