VAST Data has completed a $100m funding round during the covid-19 pandemic which values the all-flash array storage startup at $1.2bn.

The company will spend the new money on building sales teams and on research and development. This includes work on the next-generation product line, which is expected to launch in 2022 or 2023.

VAST Data publicly launched its first high-end array in February 2019. Deduplicated data is stored in QLC SSDs, referenced using metadata stored on Intel Optane drives, with NVMe-over-Fabrics access to the flash SSDs.

VAST sums of money

VAST claims first year sales were significantly higher than any storage vendor in IT history but did not reveal numbers. Pure Storage reported $6m revenues in its first fiscal year – so that provides a base comparison. VAST’s average selling price is more than $1m.

VAST told us the sales momentum had prompted unsolicited funding approaches from new VCs. Due to covid-19 there were no face-to-face meetings with the investors, CEO Renen Hallak said. “It was all done through videoconferencing.”

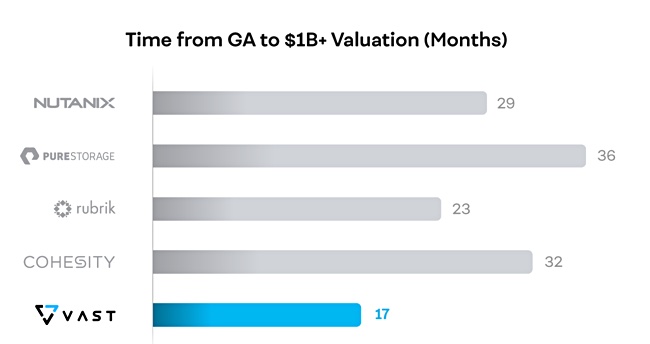

VAST Data notes it has achieved $1bn unicorn status faster than any IT infrastructure startup to date, and has made a little graph to show this.

Total funding is now $180 million and the latest round includes cash from new investors Next47, Commonfund Capital and Mellanox Capital plus existing investors 83 North, Dell Technologies Capital, Goldman Sachs, Greenfield Partners and Norwest Venture Partners.

Hallak wants the world to know that the company is well-funded: “Considering that VAST has not even tapped into its $40m Series B financing, the company now has a $140m war chest to satisfy global customer demand for next-gen infrastructure, and to enable data driven applications through continued innovation.”

The pandemic has encouraged some customers, especially in the hedge fund and health sectors, to buy because they can converge other systems onto VAST and save money. Also they can run and analyse more historic data than before, according to Hallek.

He anticipates VAST’s support of Intel Optane and container storage will fuel sales growth as both technologies are gaining traction.

File and object workloads

Hallak told Blocks & Files that the VAST array is used mostly by large enterprises for file and object workloads.

They like being able to store primary data on the array because of its speed, as well as secondary and tertiary data because of its cost-effectiveness.

This is valued by data-intensive customers such as hedge funds, which can run real-time analyses on more old data than with other arrays, according to Hallak.

He said the Dell EMC and NetApp scale-out file systems are typical competitors, adding that the company has also won AI deals against Dell.

VAST will make a major Universal Storage v3.0 software release in coming weeks. This may include support for SMB and S3, along with military grade encryption and cloud-based replication.

Data storage simplification

VAST Data claims that the data storage market has reached a tipping point and that simplified storage is the way forward. Certainly, the trend in the storage array business is for product line simplification.

For example, IBM has converged its midrange Storwize and FlashSystem lines into a single FlashSystem product. And Dell is preparing the imminent launch of MidRange.Next, which unifies the Unity, XtremIO and SC arrays.

Hitachi Vantara, like Pure Storage, has several hardware arrays running the same operating system.

Infinidat’s single-tier high end Infinibox system uses nearline disk drives for bulk data storage and DRAM caching for performance. Unlike VAST Data, the Infinibox is primarily used for block storage and the companies do not compete for business, Hallek told us.

NetApp focuses on AFF ONTAP but still sells E-Series and Solidfire all-flash arrays.

HPE has yet to simplify its array line-up, which features the XP8, Primera, 3PAR and Nimble products. Increasingly this seems like a matter of ‘when’, rather than ‘if’.