Disk shipments in 2020’s first quarter show nearline drives taking up almost half of all HDD units and the majority of capacity and revenue. Shipments for all other types of hard disk drives declined in the quarter, according to the specialist market research firm Trendfocus.

This confirms the general trend for increased nearline drive unit sales, taking up more capacity and revenue share of the HDD market. Hyperscaler buyers such as the cloud service providers represent the main proportion of nearline disk buyers.

Trendfocus estimates somewhere between 66.5 million and 68.1 million disk drives shipped in the first quarter – 67.3 million at the mid-point, which is a 13 per cent decline year on year. Seagate had 42 per cent unit share, Western Digital took 37 per cent and Toshiba 21 per cent.

The 3.5-inch high-capacity nearline category totalled 15.7 million drives, up 43 per cent. This represents 23.3 per cent of all disk drive shipments.

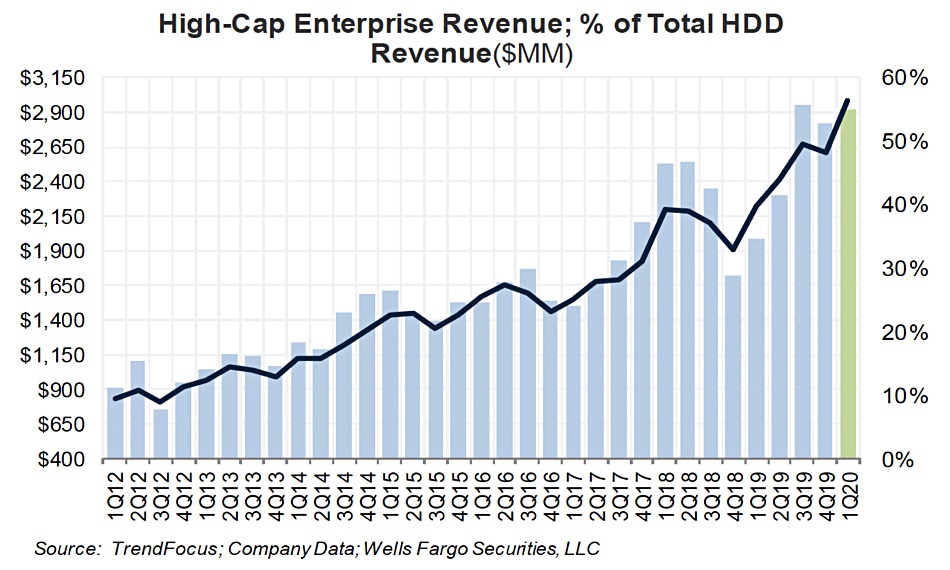

Nearline drives accounted for about 150EB of capacity, up 65 per cent compared with +43 per cent and +89 per cent in Q3 2019 and Q4 2019. According to Wells Fargo analyst Aaron Rakers, nearline drives could account for 55 per cent of total Q1 2020 HDD industry revenue, up two per cent on 2019.

Some 24 million 2.5-inch mobile drives were shipped in Q1, which is down more than 45 per cent y/y, according to Rakers. He thinks some of the decline reflects the “supply chain disruption from covid-19”. Seagate and Western Digital each had about 35 per cent unit share and Toshiba shipped 30 per cent.

About 23 million 3.5-inch desktop drives shipped in the quarter, down 20 per cent on the previous quarter, Rakers noted, citing “seasonal declines, as well as reduced mid-quarter PC and surveillance production due to covid-19”.

The last category is for 2.5-inch enterprise or mission-critical drives and just 4.2 million were shipped, down 12 per cent on the previous quarter. Rakers said: “Shipments continue to face increased SSD replacement.”