HPE storage revenues fell in Q12020, but the company was pleased even to maintain “flat sequential revenues [because of the] competitive backdrop”, CFO Tarek Robbiati said.

The Register noted in its report of the firm’s overall Q1 fy2020 earnings: “HPE endured a rough few months thanks to a hardware crunch and manufacturing headaches caused in part by the outbreak of the Wuhan coronavirus.”

HPE management tried to offset these disappointing results by pointing to underlying positive indicators. The company also claimed its shift to as-a-service subscriptions was working.

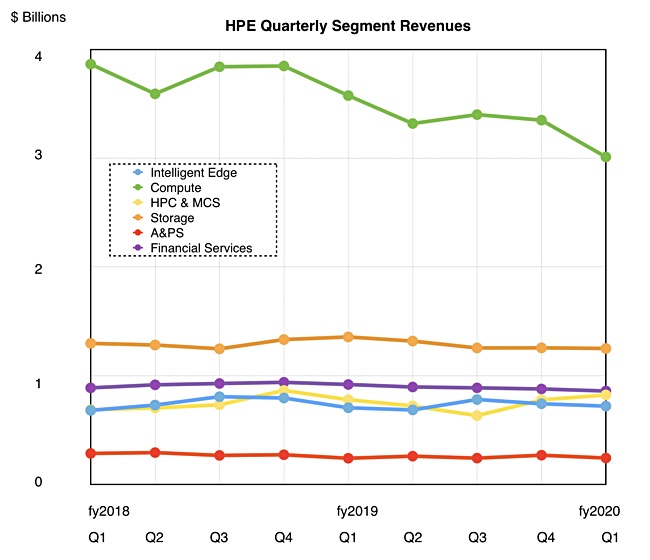

We focus in solely on the storage results here, and find that HPE has reformulated its reporting, following the Cray acquisition – supposedly to “align with peers”. SimpliVity hyperconverged (HCI) revenues are now included with storage, for example. HPE has altered its historical numbers so we can still do a compare:

We can see storage revenues, now bulked up with Simplivity HCI sales, have been flattish for two years. This contrasts with the picture we drew last quarter when they looked much more up and down.

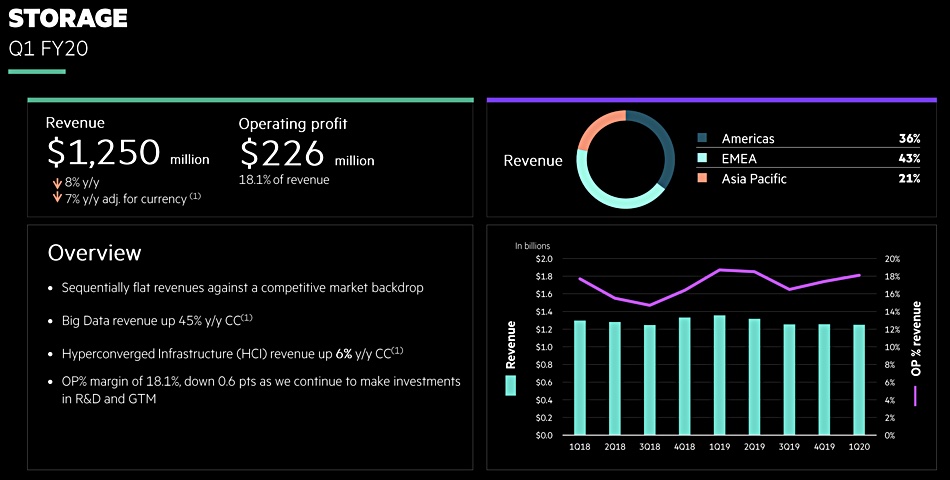

In the latest quarter, storage revenues of $1.25bn were down eight per cent annually, as a results presentation slide shows:

Surprisingly, EMEA storage sales, at 43 per cent of the total, were greater than those in the USA (36 per cent).

We note HPE’s HCI sales rose six per cent in the year, having grown 14 per cent in the previous quarter. This contrasts with market leader Dell EMC which saw VxRail sales rise 60 per cent.

The storage sales summary above mentions a tough market overall, yet Pure Storage saw storage revenues rise 17 per cent in the same market.

We note as well that this was HPE’s first full quarter of its high-end Primera array sales and there was no visible sales uplift from that system

Earnings call

We dived into the earnings call, where execs made little mention, for example, of Primera.

CEO Antonio Neri stated: “We gained momentum in key [storage] areas during the quarter and expect to gain share in external disk.”

The slide above calls out Big Data storage growing at 45 per cent in constant currency, but with no actual revenue number, so it is probably from a small base. Big Data storage means Apollo server-based systems and MapR software.

Investors and analysts on the call were told HPE InfoSight, HPE’s cloud-based AI operations platform, gained momentum in storage and in the compute segment, but no growth percentage or revenue numbers were provided.

Analyst Aaron Rakers at Wells Fargo told subscribers HPE management noted that it does not find it likely that revenue will grow in Fy2020. It sees uncertainties around the the general economy, trade disputes and the coronavirus outbreak.

HPE is not providing revenue expectations for the next quarter, with Neri saying there are “too many unknowns at this point to provide second quarter guidance”.

Comment

Blocks & Files sees HPE focusing mainly on cloud-to-edge and pivot-to-service strategies. There is a strong focus on the edge and its local networking and compute, where the company sees continued momentu.

In the earnings call, Neri said: “As we think about these storage platforms, particularly what I call intelligent data platform, the data growth requires that the data gets stored and gets managed and ultimately insights are extracted from it. So, that’s positive as well.”

That’s looking ahead and, despite this we do not see much general focus on storage. It seems almost a second tier area for HPE.

HPE storage is under-performing compared to Pure Storage. The strategy of selling storage through partnering with software suppliers such as Cloudian, Datera, Qumulo, Scality and WekaIO isn’t delivering storage growth.

As we see it the HPE storage business needs an injection of growth juice and historically HPE has reached for its acquisition wallet when in this situation. We wouldn’t be surprised if this happened once more.

CFO Tarek Robbiati said in the earnings call that HPE could borrow up to $5bn for acquisitions and still maintain its investment grade credit rating.