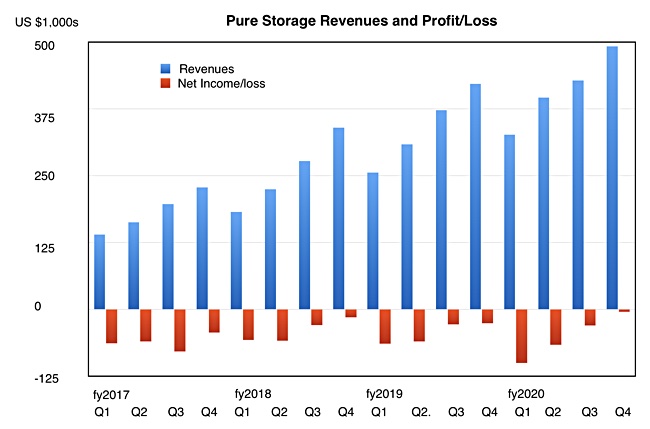

Pure Storage has reported record fourth quarter fy2020 revenues, the lowest net loss in five years, record customer acquisitions and a new FlashArray. The results beat analyst expectations but lower next quarter revenue guidance left shares relatively unchanged.

Quarterly revenues of $492m were up 17 per cent with a net loss of $4.65m compared to a $25.8m loss a year ago.

In the earnings call CEO Charlie Giancarlo said: “I am pleased with our Q4 performance, resulting in record revenue and the largest bookings quarter in Pure’s history… Pure finished the year with the strongest growth and margin profile in the industry.”

Full year revenues climbed 21 per cent to $1.64bn, and net loss was $201m (2010: -$178.4m).

Moor Insights and Strategy analyst Steve McDowell told us by email: “In a year that was disrupted by both unusual pricing pressure from a global NAND oversupply, as well as global economic factors ranging from trade issues to the Corona Virus, nearly every enterprise infrastructure provider has shown stalled growth.

“Pure’s performance stands in stark contrast to its closest competitors in the enterprise storage market for the same periods, who have delivered relatively flat to negative growth, and are predicting the same for the coming year.”

By the numbers

- Q4 GAAP gross margin – 70.8 per cent,

- Q4 operating cash flow – $69.9m, down -14 per cent,

- Q4 free cash flow – $56.2m, up 9 per cent y/y,

- Full-year GAAP gross margin- 69.0 per cent,

- Full-year operating cash flow – $189.6m, up 15 per cent,

- Full-year free cash flow – $101.7m, up 59 per cent,

- Total cash and cash investments at year- end -$1.3bn compared to $1.2n a year ago,

Pure added more than 500 customers in the quarter, a record, and the cumulative total now stands at 7,500. The company said this includes 44 per cent of the Fortune 500.

CFO Kevan Krysler, saw no large US enterprise buying slowdown as reported by Dell Technologies this week: “I’m especially pleased with the growth that we saw in enterprise customers; a lot of them quite new and therefore opening up new potential for the future.” Pure also has little Chinese business, another bugbear of Dell, and is not affected by any market upset there.

Sales were helped by the recently-announced FlashArray//C which uses QLC (4bits/cell) NAND to provide secondary storage. Giancarlo said: “We are seeing phenomenal adoption of FlashArray//C and in its first two quarters has already become Pure’s fastest-growth product ever.”

VP for Strategy Max Kixmoeller said Pure’s competitors had not responded to the product: “I think one of the biggest surprises around FlashArray//C is it’s largely been completely unanswered by the competition.”

Pricing

Giancarlo said the year had seen “an unparalleled industry pricing decline”. The “early parts of the year just saw breathtaking price declines in the market that were created through by a free fall of NAND pricing earlier in the year.”

Despite this, Pure has maintained pricing above its competitors: “It’s the software value that we provide that is having our customers paying [a] 10 per cent to 20 per cent premium for our product versus our competition. And we don’t really believe that we ever lose a deal based on price.”

However a normalised pricing environment is coming though: “We know that the commodity prices have been stabilised for some time [and] are projected to go up next year.“

The company is pleased with its progress in moving to Pure-as-a-Service subscription pricing. Giancarlo said it “achieved the largest-ever bookings of Pure as-a-Service in Q4, including wins at three major international banks.”

Coronavirus

Giancarlo said Pure is not factoring any coronavirus-caused downturn yet: “Based on what we know today, we do not anticipate a significant impact to this quarter’s supply and operations, although the situation remains quite fluid.”

“We’re not yet seeing it in any of our Q1 business. And I think it’s far too early to start predicting Q2 and beyond given the uncertainty of the virus whether it’s contained or not contained how much of the quarantines may affect customers’ orders and so forth.“

Purity pledge

Giancarlo said Pure is developing the Purity operating environment to cover on-premises Pure arrays, with respect to FlashArray multi-tier and multi-protocol (block, file), as well as Cloud Block Store on AWS and Azure.

“We think this is a real big differentiator. Most of our competitors have multiple products to deal with different workloads and environments. We’re going to be able to satisfy it with one software base all managed by a single management system in Pure One.”

Outlook

The guidance for the next quarter, Q1 fy20, is for revenues of $365m, up 12 per cent y/y but lower than a Wall St consensus of $381.2m.

Full fy21 revenues are being guided at $1.9bn, up 6 per cent y/y; Wall St had expected $1.93bn.