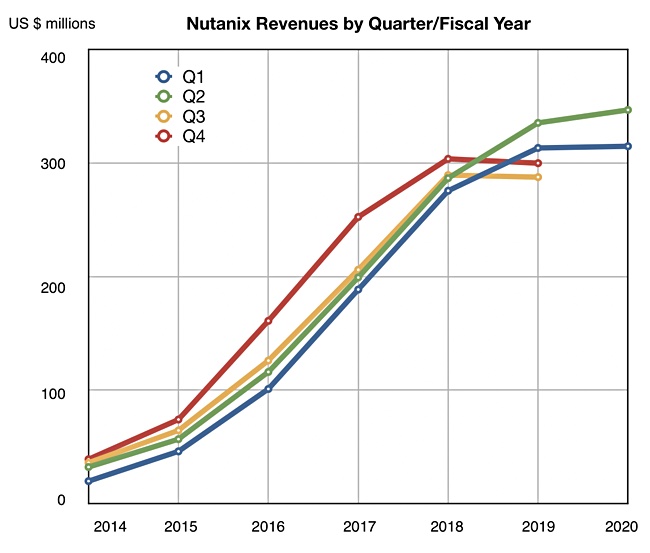

Nutanix shares dropped 20 per cent in after market trading yesterday in response to worse than expected losses for Q2 fy2020 and a disappointing outlook for the next quarter.

On the bright side, the hyperconverged infrastructure (HCI) software reported revenue growth, including accelerated growth in subscription revenue and a decent net gain in customers. It also met Total Contract Value (TCV) billings guidance and beat TCV revenue, gross margin and also EPS guidance. This follows three declining or flattish revenue quarters. CFO Duston Wiliams said in the earnings call: “It is nice to see … that finally the year-over-year growth rate has now started to reaccelerate once again.”

The company reported loss of $217.6m, compared with -$122.8m last year. It may be prioritising growth over profit but the market appears to be losing patience.

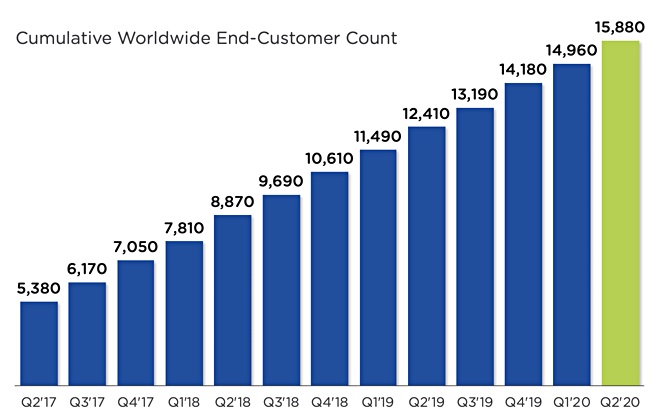

Revenues of $346.8m were up 3.4 per cent annually, reflecting increased product sales and 920 new customers, an uplift on the previous quarter’s 780 customer acquisitions. An HPE reselling deal delivered 117 new accounts, up from 25 in the previous quarter.

CEO Dheeraj Pandey said: “I think HPE is becoming a pretty substantial portion of our both enterprise and commercial go-to-market.” There’s “More things to come with subscription of our software in their hand with GreenLake and, especially some things around how we can … go to market together and sell together, including their existing products.”

Nutanix finished the quarter with 880 cumulative Global 2000 customers, a 119 per cent y/y increase, with a target of 1,100 by the end of its fiscal 2020. The total customer count is now 15,880 and more customers are buying more than one Nutanix product.

Numbers summary:

- Gross margin – 81 per cent, up from 77 per cent a year ago,

- Free cash flow – negative $73.7m compared to negative $4.1m last year,

- Total deferred revenue – $1.01bn, up from last year’s $779.9m,

- Cash and short term investments – $819m, down from $965.9m last year.

Pandey said in the earnings call: “Our TCV (Total Contract Value) billings came in on the high end of our guidance range and our TCV revenue gross margin and EPS all exceeded our guidance despite a softer US federal business. Further our deferred revenue surpassed a $1 billion for the first time this quarter growing 35 per cent year-over-year. … Business is robust.”

Wells Fargo analyst Aaron Rakers told subscribers that Nutanix reported annual contract value in the quarter of $130m, which was up 18 per cent y/y but “below the company’s $135m guidance due to weaker performance in the Fed vertical as well as the impact from a faster-than-expected subscription transition.”

Pandey said: “The federal miss was related to large deals that we believe were not lost, but rather pushed out to future quarters … the time to close these deals is uncertain.”

What next?

Subscriptions accounted for 79 per cent of billings, compared with an expected 75 per cent proportion. This translated to $267.6m subscription revenue, up 77 per cent year on year.

This faster-than expected subscription growth at the expense of one-hit perpetual license sales, has tempered Nutanix’ guidance for the next quarter and the full year. Pandey also referred to need for caution due to uncertainty over the impact of the coronavirus.

Nutanix is pencilling software and support revenue at $300m – $320m versus Wall St expectations of $339m – $340m. Total contract value billings are expected to be $365m – $385m versus Rakers’ prior estimate of $403m.

They were $420m in the latest quarter. Rakers estimates the lower forecast means $35-$40m billings guide reduction.

As is its practice, Nutanix did not issue a straightforward revenue guide for the next quarter. Instead Williams said: “We anticipate that the year-over-year [revenue] growth rate will further accelerate to approximately 10 per cent in Q3, and 25 per cent in Q4.”

That implies next quarter’s revenue will be around $316.4m and the fourth quarter will see $374.9m. These two estimates help provide an estimated full fy2020 revenue total of $1.353bn, up 9.1 per cent on last year.