Micron thinks it has reached the bottom of the trough of over-supply affecting the industry and revenues will grow in coming quarters.

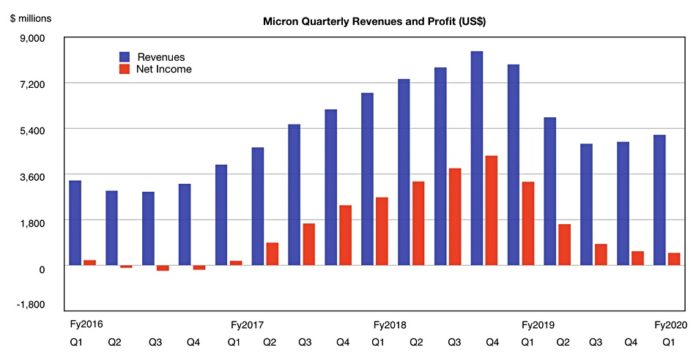

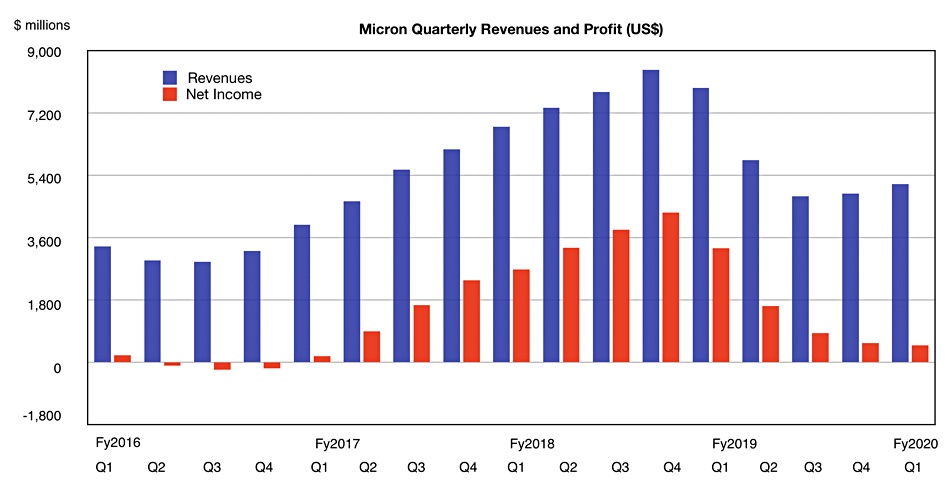

The memory and flash chip maker’s Q1 fy2020 earnings show a 35 per cent decline in revenue from last year’s $7.93bn to $5.14bn and a thumping 85 per cent fall in net income to $491m.

CEO Sanjay Mehrotra said in a statement: “With our strong execution and improving industry conditions, we are optimistic that Micron’s fiscal second quarter will be the cyclical bottom for our financial performance.”

Micron makes DRAM, flash chips and SSDs and is starting to supply its own 3D XPoint memory after decoupling from Intel. Its main markets are mobile telephony, data centres, PCs, graphics processing and the automotive industry.

DRAM comprised 67 per cent of total revenues in the quarter and NAND accounted for 28 per cent. Compute and Networking business unit revenues fell 45 per cent to $1.98bn. Mobile revenues fell 34 per cent to $1.46bn; storage decline 15 per cent to $968m and embedded systems shrank 21 per cent to $734m.

The current quarter’s revenues are expected to be $4.65bn at the mid-point and down 21 per cent from the $5.85bn recorded a year ago and less than the 35 per cent fall this quarter. This is Micron’s seasonally weakest quarter and market demand is rising due to 5G phones, autonomous systems, AI, and machine learning.

In the earnings call Mehrotra said: “5G phones are driving a step-level function increase in the average content of both DRAM as well as NAND.” Micron is introducing its own deep learning accelerating hardware for AI to capitalise on that area’s increased demand.

Micron doesn’t see any macroeconomic environment or trade-related issues affecting its markets. Things are looking up as it anticipates making, shipping and selling more and smaller DRAM and NAND bits with better pricing.

Micron forecasts DRAM and NAND bit supply growth will lag behind demand growth and this should help pricing. The company has gained permission from the US government to qualify new products with Huawei, Micron’s biggest customer until the US Government imposed restrictions on US companies working with the Chinese giant. Micron does not anticipate significant revenues from Huawei for at least a couple of quarters.

Higher value and smaller cells

In response to the supply glut, Micron has changed its NAND product mix to include more high-value, high-margin products and so improve profitability. These are expected to grow from 50 per cent of NAND bits in fy2019 to over 66 per cent this fiscal year and up to 80 per cent in fy2021.

The DRAM and NAND industries are on a permanent quest to build denser chips with smaller cells and, in the case of NAND, higher layer and bit counts. Micron is progressing through a DRAM node transition to smaller cells with 1Z production ramping up and it says cleanroom expansion in Taiwan is on track. The next, smaller still, 1 alpha, beta, and gamma nodes can be made with current advanced immersion and multi-patterning technology. The Taiwan cleanroom is EUV-capable – for if and when this more advanced and costly technology is needed.

Micron is ramping production of 96-layer 3D NAND, using floating gate technology, and developing 128-layer chips with denser replacement gate (RG) technology. Gen 1 RG technology will start production in the second half of 2020, with slightly lower-cost chips. A gen 2 will appear in fy2021 bringing in more layers, more cost-reduction and a strong focus on QLC (4bits/cell) technology.