Storage is the bright star in Dell’s Infrastructure Solutions Group’s revenues for its third fiscal 2020 quarter, growing while server revenues fall. Both VxRail hyperconverged systems and vSAN license bookings grew strongly.

El Reg covers the overall Dell Technologies results and we delve into the storage side here.

Storage is part of Dell’s Infrastructure Solutions Group (ISG) and ISG revenues fell 6 per cent from $8.94bn to $8.4bn.

Inside ISG:

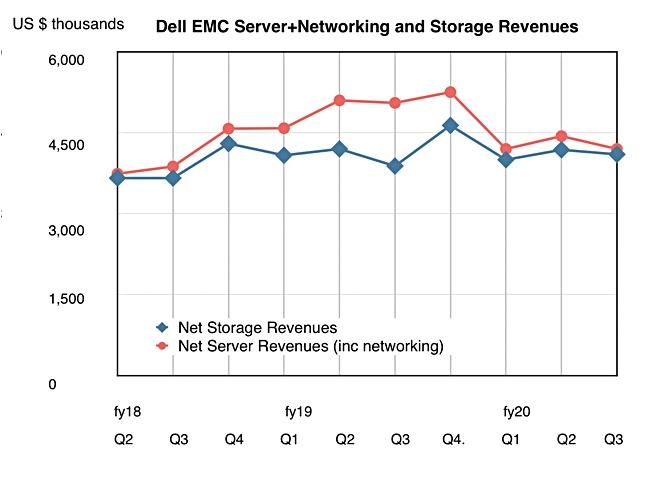

- Net server and networking revenues were $4.2bn, down 16 per cent on the year-ago’s $5.1bn,

- Net storage revenues were $4.1bn, up 7 per cent on the year-ago $3.883bn.

Within storage, VxRail hyperconverged appliance orders were up 82 per cent year-over-year and vSAN license revenues rose 35 per cent year-on-year.

Dell said Server sales were affected by macro-economic uncertainty and difficulties in China. Storage sales were insulated from the macro problems because growing amounts of data have got to be stored. In the earnings call, CFO Tom Sweet said storage sales were not tied to a commodity cost framework and were therefore less price-sensitive.

Dell reckoned its storage sales reflected an updated product portfolio with PowerMax, Unity XT and the recently refreshed Data Domain line, which has been renamed PowerProtect. Jeff Clarke, vice chairman for products and operation, said in the earnings call that PowerMax and Unity XT sales are growing at a double-digit rate.

He’s confident about the future: “We expect to outperform the market and take profitable share.” One aspect of that is the coming unified MidRange.NEXT system; “We will have the product completed by the end of the fiscal year and it will be released.” That means by end-February 2020.

This is against a forecast storage market slowdown. Sweet said: “The storage, external storage [market] forecast is roughly minus one per cent, I think is the aggregate consensus of all of the industry experts and analysts there. But my job is to do better than that; outperform the marketplace and take share. We’re going to do that with the industry’s broadest storage portfolio.”

Dell + EMC + VMware is a storage powerhouse. Dell claims leading share in all-flash arrays, storage software and hyperconverged, and the overall storage market.