HPE’s latest quarterlies show storage revenues down while hyperconverged and composable systems revenues rose.

The overall results for Q4 of HPE’s fiscal 2019 are covered by El Reg. Here are some highlights.

- Hybrid IT revenue, which includes storage, was $5.7bn, up 2.5 per cent year over year

- Compute segment revenues of $3.3bn were down 13.4 per cent on last year’s $3.7bn

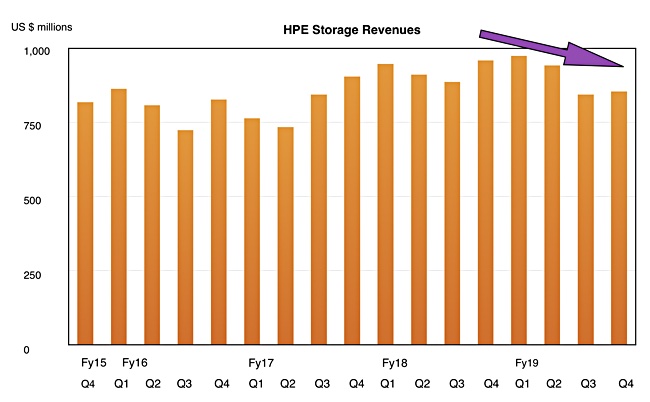

- Storage revenues of $855m were 10.8 per cent less than the year-ago $959m

- Hyperconverged infrastructure (SimpliVity) revenues rose 14 per cent to an undisclosed number

- Composable cloud (Systems) grew 21 per cent, to $1bn in annual revenues.

The chart of HPE’s quarterly storage revenues shows a recent downturn.

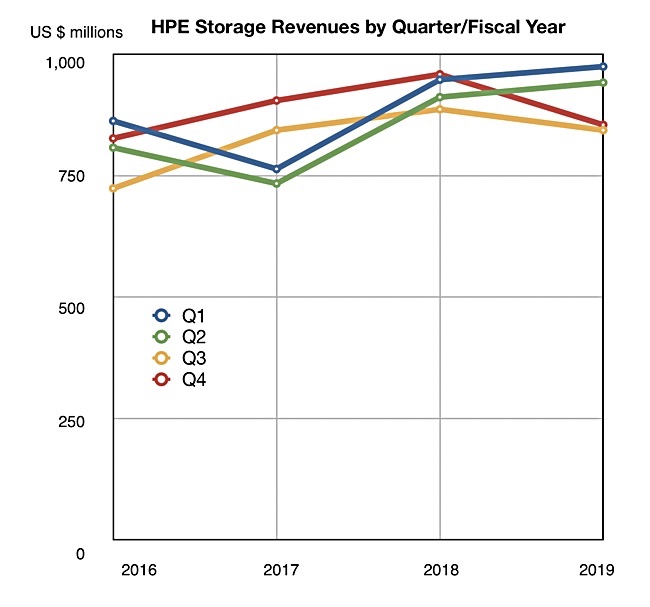

If we look at the storage revenues differently, charting them by quarter and by fiscal year we see the recent two quarter downturn more clearly;

HPE storage revenue was $3.7bn in FY 2018 and dropped 2.7 per cent to $3.6bn in 2019. However, in the earnings call, CEO Antonio Neri said HPE had gained one per cent of storage market share in the quarter. He also said storage prices were stable.

Nimble array storage revenue in Q4 was up two per cent when adjusted for currency. Nimble revenues grew 21 per cent in the prior quarter and 45 per cent in the quarter before that.

There was no mention of a sales ramp for its latest Primera array; that’s expected in the next few quarters, nor of an all-flash array run rate. The implication is that all-flash array technology is no longer driving HPE storage sales upward.

HPE said hyperconverged infrastructure revenues will be included with storage revenues from the next quarter onwards.

There were no significant revenues in the quarter from its recently acquired Cray supercomputer business, which includes ClusterStor arrays.

Comment

Basically, HPE’s storage product revenues look like they have run out of growth. But Neri said storage “is a key strategic area for us,” and HPE is investing in storage R&D.

In general, HPE says it has become a stable, consistent company, with three successive quarters of revenues around $7.2bn. It claims it is resilient to macro-economic softness, able to generate substantial amounts of free cash flow, and anticipates sustainable profitable growth and shareholder returns for the long term.

It does not say it’s looking ahead to substantial revenue growth though (beyond the incorporation of Cray into its earnings). And the revenue outlook for the next quarter is flat, meaning about $7.1bn. Four flat quarters in a row; HPE is level-pegging, and storage is level-pegging, at best, inside HPE.