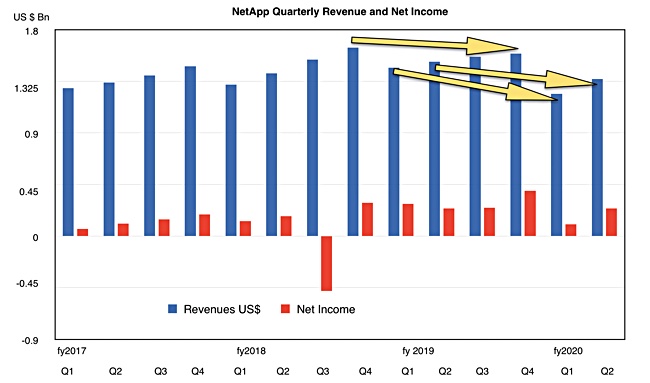

NetApp’s ongoing revenue decline continues with its latest set of results.

Second fiscal 2020 quarter revenues of $1.37bn were almost 10 per cent down on the year-ago $1.52bn. But its $243m net incom was slightly higher than the $241m recorded a year ago, reflecting its greater ability to extract profits from revenues.

This the NetApp’s third successive quarter of revenue decline and it was attributed by CEO George Kurian to “ongoing macroeconomic uncertainty and the potential for continuing unpredictability in enterprise purchasing behaviour”.

Product revenues of $771m were down 18 per cent from last year’s $913m while software maintenance brought in $254m, up from last year’s $236m. Hardware maintenance revenues declined to $346m from last year’s $368m.

CEO George Kurian’s release quote said: “We delivered gross margin, operating margin, and EPS all solidly ahead of our guidance ranges.”

- Cash and cash equivalents at quarter end were $3bn.

- Gross margin of 67.5 per cent.

- Cash flow from operations was negative $53m.

- Free cash flow was negative $89m

- $611m spent (returned to shareholders) on dividends and share repurchases

- All-flash array run rate is $2.2bn, up 29 per cent sequentially, with 22 per cent of the installed base now being on AFA.

The negative cash flow numbers were attributed primarily to accounts receivable timing issues and larger cash tax payments; both temporary.

Bright spots included its Cloud Data Services annualised recurring revenue of approximately $72m, an increase of 167 per cent year-over-year. But Kurian admitted: “We’ve taken longer than we originally expected to get to general availability given the technical sophistication of what we are offering to customers.”

The majority of the growth in Cloud Data Services was from Microsoft Azure NetApp Files.

Weakness to continue

Kurian was downbeat about future trading: “Both macroeconomic and enterprise spending indicators show continued weakness. While we cannot predict when conditions will improve, we are planning our business, assuming no change in these external factors for the foreseeable future.”

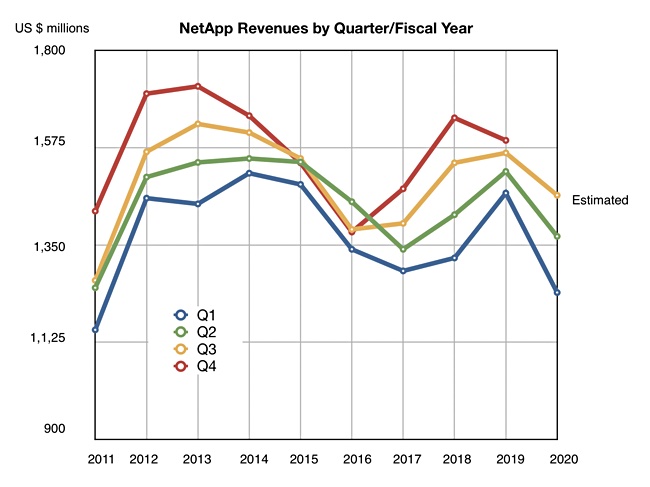

The outlook for the third quarter is for revenue between $1.39bn to $1,54bn, $1.47bn at the mid-point which would be 6.0 per cent down annually; the revenue dip continues for a fourth successive quarter in other words; as a chart shows;

The full fy2020 outlook is for an approximate 8 per cent revenue decline, which we calculate to mean to $5.65bn, implying fourth fy2020 quarter revenues of $1.57bn, 1.4 per cent down annually. That would make a fifth successive quarterly drop, though thankfully with a lower decline rate than in the other quarters of the fiscal year.

It will get better

Kurian is optimistic about returning to growth. He is convinced the business model and product strategies are okay. An increased sales head count, mostly in the Americas, should be fully productive and bringing in more sales, both from new accounts and existing accounts, in NetApp’s fiscal 2021.

He doesn’t see Dell EMC’s coming Midrange.NEXT product as a threat, being confident in NetApp’s product portfolio. Nor does he see a move to subscriptions (Keystone) as a threat: “We don’t believe that Keystone subscription services will replace CAPEX purchasing.”

Comment

The main growth prospects for NetApp seem to be increasing its small/medium enterprise business, dependent on the news sales heads and better channel business, and boosting its Cloud Data Services revenues. But the Keystone subscription business needs to be additive and not affect customer’s CAPEX purchasing. That will need good positioning to have customers not perceive subscriptions as a way of transferring existing CAPEX spend to OPEX.