Seagate met Wall Street’s anaemic expectations in the first quarter. But the company expects a revenue uptick for the rest of the fiscal year, with 16TB enterprise disk drive shipments leading the way.

Revenues were $2.58bn in the first 2020 quarter ended October 4, 13.8 per cent down on a year ago but a little above the company’s $2.55bn guidance. Net income was $200m, compared with $450m last year.

During the quarter Seagate repurchased 9.2 million shares for $450m. Cash and cash equivalents was $1.8bn at quarter end.

The mid-point revenue outlook for the December quarter is $2.72bn. Seagate expects revenues to continue rising as fiscal 2020 progresses.

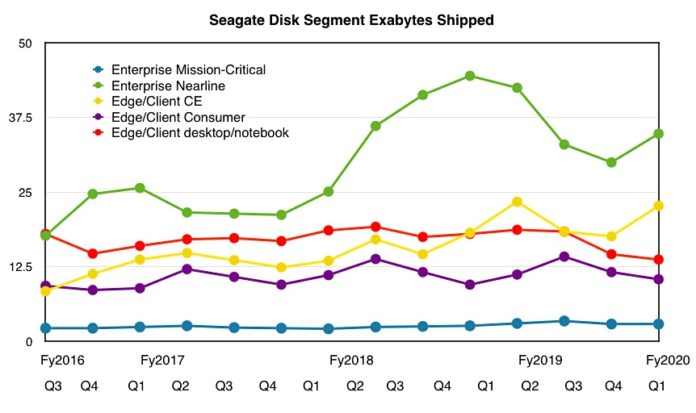

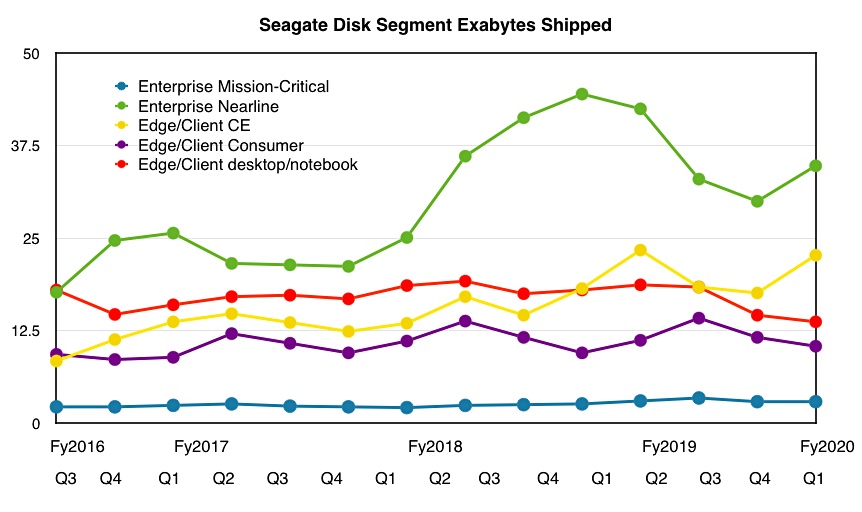

CEO Dave Mosley said in a statement: “Seagate had a solid start to the fiscal year… Exabyte levels were near record levels in the first quarter driven by improving demand conditions for mass capacity storage.”

Seagate is ramping up 16TB drives production to meet this demand.

Earnings call

In the earnings call Mosley said that the 16TB drive was the “fastest nearline product ramp in Seagate’s history”.

CFO Gianluca Romano said the company expects “16-terabyte to be our highest enterprise revenue product in fiscal Q2 and our largest company revenue contributor in fiscal Q3… We have a huge expectation for volume increase demand in the next two or three quarters.”

Seagate forecasts the mass capacity storage revenue total addressable market to more than double from current levels by 2025.

The company aims to ship 18-terabyte drives in the first half of calendar year 2020, Mosley said. The company is “on-track to ship 20-terabyte HAMR drives in late calendar year 2020. We expect to see demand for dual actuator technology to increase as customers transition to drive capacities above 20 terabytes.”

Net:net

Seagate continues to focus on generating cash from the enterprise capacity disk drive business. It has a minor presence in the SSD market and gives little impression of wanting to invest significantly to grow that business.