Will SSDs kill the enterprise disk drive business? Hyperscalers will continue to use disks out to 2035, if Seagate’s revenue forecasts are accurate, but enterprises will switch en masse to SSDs.

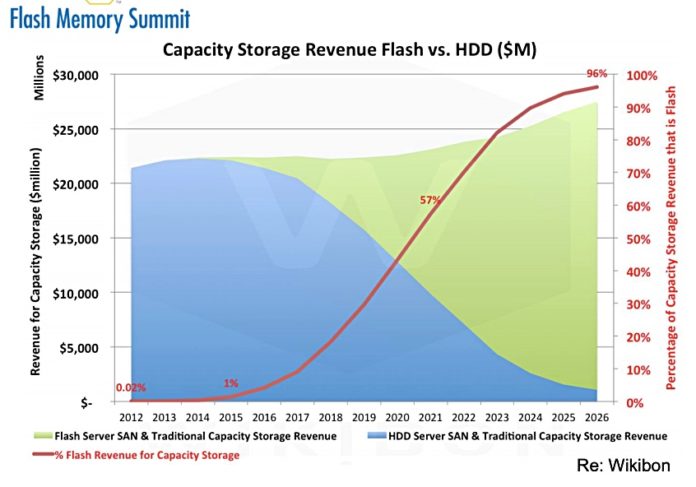

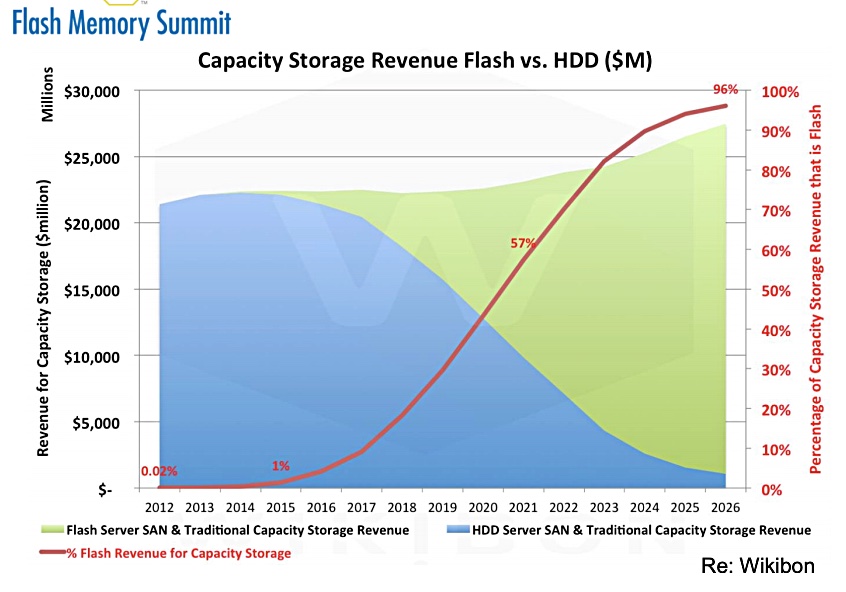

In his presentation at the Flash Memory Summit 2019 in Santa Clara, consultant David McIntyre cited Wikibon research showing enterprise disk drive use tailing off by 2026.

Most enterprise disk drive capacity usage is in data centres with nearline 7,200rpm 3.5-inch capacity drive -8TB, 10TB and so forth. Wikibon forecasts this falling to less than five per cent of the revenue for capacity storage by 2026. SSDs will then take slightly more than 85 per cent of capacity storage revenues, effectively killing off disk drive use in enterprise data centres.

From the consulting room

Blocks & Files asked three consultants how they thought enterprise data disk drive use would change with the advent of SSDs.

GigamOM consultant Enrico Signoretti told us: “My opinion is that, if there isn’t something really big that we don’t know of yet, HDDs will remain for a long time but will become more of a niche product, only for very big infrastructures that can manage them… more or less like tapes now.

Hyperscaler data centres are an example of such big infrastructures.

“Simply put, HDD-based infrastructures will have a TCO that is not really compatible with enterprise operations (Cattle vs Pets kind of reasoning). In the research I’m doing right now on object storage, half of the vendors have (or are planning to release) all-flash object stores for enterprise use cases…”

That’s pretty supportive of the idea that SSD growth will drive down enterprise disk drive use to tape drive level.

Storage architect Chris Evans said: “I think [the scenario] makes sense as a simple cost level.”

He sees more than simple cost affecting the issue: “There’s a “slot cost” in using SSDs or HDDs that includes power, space, cooling, maintenance etc… For example, a 16TB Seagate NL drive will consume 5W idle, and up to 10 watts max. Compare this to a 2TB QLC Intel 660p M.2 drive with 0.1W active and 0.04W idle. Even if you multiply the SSD by a factor of 8, it is still much more power efficient.”

More peripheral componentry is needed for disk drives and disk drives are slower to access than SSDs. “The only ways to solve HDD performance are to either go multi-actuator or add more cache… Both of these solutions will drive up HDD $/GB cost and so make SSDs more attractive earlier than we think. This pushes HDDs towards a really low-use status.”

Evans suggests that if SSDs get more traction at the protocol level to make them usable by hyperscalers, this again may tip the scales towards SSDs

Like Signoretti, Evans is comfortable with the idea that SSDs will eventually diminish enterprise disk drive use to a low level.

Hypo or Hyper?

Rob Peglar of Advanced Computation and Storage told us: “Eventually, SSDs will ‘takeover’ all but a trivial part of consumption and usage in enterprise.”

But not so with the hyperscalers; he cites Amazon, Apple, Facebook, Google, Microsoft, Baidu, Alibaba, and Tencent, which currently buy around half of all disk drives. This is amounts to 400EB of capacity per year – and several million disk drives each quarter.

They will carry on buying. Hyperscalers need an acceptable time to the first byte and good streaming speed for user-requested video, image and photo files. Disk is good enough and cheap. Tape is cheaper but too slow. SSD is too fast for the need and too expensive.

Peglar concludes: “SSD will, in our collective lifetimes, not replace HDD entirely. It will in enterprise, to a great extent, but not in hyperscale, which is where the majority of the business lies today and onward (perhaps increasingly so) into the future.”

So the consensus is that SSDs will kill the enterprise disk drive business but not the huge hyperscale HDD business. The hyperscalers also buy tape drives and libraries by the truck-load. Their capacity requirements are huge and they need to maximise price/performance for different storage use cases.