The pricing of Optane memory, also called 3D XPoint, will cannibalise some DRAM sales and this could give Micron a big headache.

“The revenues of 3D XPoint memory are likely to be matched by similar-sized sales declines in the server DRAM market,” writes Objective Analysis’s Jim Handy in a July 2019 update to his 3D XPoint Report.

On the other hand, the “SSD market for 3D XPoint will remain relatively small, with the new memory serving more to displace DRAM memory rather than NAND flash SSDs or HDDs,” he adds.

Since Optane DIMMs only work with newer and more expensive Xeon SP processors they will help Intel sell more of them to the extent that customers buy into this scenario.

Intel will care a lot about this as processors are its main source of income. Intel does not make DRAM and so will not care if DRAM sales are affected by Optane DIMMs.

Why Optane is cheaper than DRAM

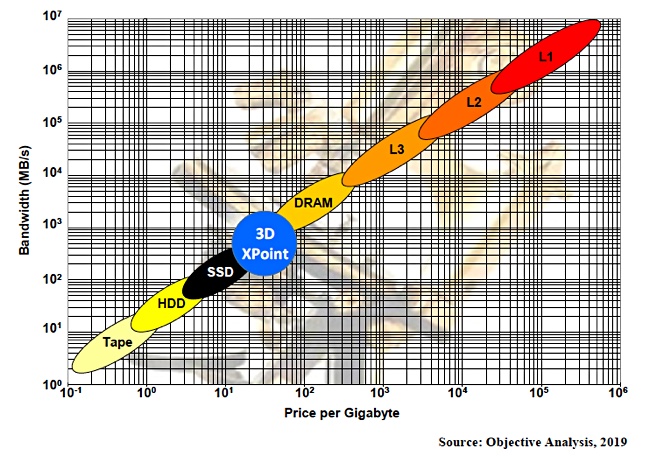

Intel positions Optane as less expensive and slower to access than DRAM but more expensive and faster to access than NAND SSDs. An Objective Analysis chart, plotting storage, memory and cache types against bandwidth and price per GB, shows this positioning:

Handy writes: “3D XPoint Memory won’t fit into the memory/storage hierarchy… unless it is sold for a lower price than DRAM. If its price is higher than DRAM’s price it will not be adopted.” It has, in effect a price ceiling.

Optane shoehorns its way into a memory hierarchy gap with SSDs below it and DRAM above it. Where will it gain most market share? Handy believes “that the 3D XPoint memory’s biggest impact will be to the server DRAM market.”

Customers get the highest application performance increase for their Optane cost that way.

Using Optane, servers can have a larger memory space as Optane DIMMs have four times the density of DRAM DIMMS. So servers can have more memory space. They can accommodate more or larger applications, which then run faster.

That’s because the apps avoid storage IO and therefore delays from IO requests passing through the storage software stack.

When Optane SSDs are used instead of NAND SSDs performance increase is limited to 5x to7x the SSD access speed because the storage software stack still has to be traversed by IOs. “For most applications the price premium is too high for the performance improvement,” Handy writes.

In other words Optane SSD prices have a lot further to go to cannibalise standard SSD sales.

DRAM DIMM and Optane DIMM price relationship

Handy notes that Optane DIMM prices are held to a constant relationship to DRAM DIMM prices.

Optane DIMMs are priced at slightly more than half the cost of half the DRAM capacity. High-density DRAM DIMMs cost more than lower density versions. and the same is true for Optane DIMMs. The logic is that Optane DIMMs are priced to replace DRAM.

When Optane is used instead of DRAM, applications (a) run a little more slowly because they have less DRAM, but (b) then run a heck of a lot faster because they have far less storage IO. Overall, the apps run much faster because (b) more than cancels out (a). That’s the theory.

Systems with Optane DIMMs must have some DRAM as well. Handy calculates that “At 6TB the memory in a DRAM plus Optane DIMM system costs 30 per cent less than a DRAM-only system.” With a 2X or more application speed up, depending on the Optane DIMM mode, that’s a worthwhile cost saving.

Why this is a problem for Micron

Micron makes and sells DRAM. Why should it displace a 256GB DRAM DIMM with a 256GB Optane DIMM when the DRAM DIMM brings in more revenue, and is likely profitable whereas Optane, being produced in relatively low volumes, is not?

We might expect Micron to focus on ways to sell Optane that don’t affect DRAM sales. For example, it may seek to displace Samsung or SK Hynix DRAM with its 3D XPoint DIMMs – branded Quantx.

Or, in the extreme case, abandon the Optane market altogether. Handy speculates this may be the case, with Micron having “desire to extricate itself from the 3D XPoint business while still satisfying alternate-sourcing agreements made by the company prior to XPoint’s 2015 introduction”.