More US enterprises intend to buy object storage than unified file/block, SAN and NAS. Almost half are increasing cloud storage and a quarter are bulking upon-premises storage capacity.

This is according to the May 2019 IHS Markit data center storage strategies survey of North American enterprises.

The researchers found on-premises storage capacity was divided 56:44 between servers and arrays.

IBM was top ranked vendor ,with 48 per cent of respondents rating it among the top three vendors across eight categories. Dell EMC took second place at 43 per cent, followed by HPE (37 per cent), Hitachi (16 per cent), Huawei (15 per cent) and NetApp (14 per cent).

Storage investment focus

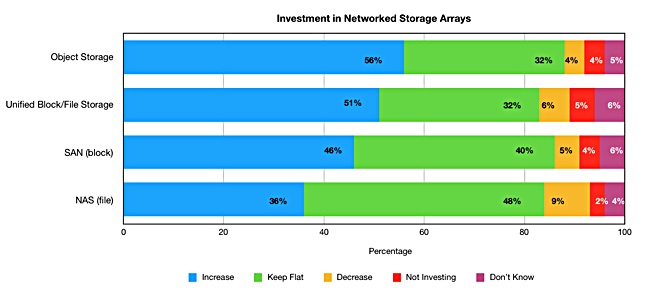

Some 56 per cent of respondents plan to increase investment in object storage. That was followed by unified file and block storage at 51 per cent, storage-area networks at 48 per cent and network-attached storage at 36 per cent – see the chart below:

Dennis Hahn, principal analyst at IHS Markit, said in a canned quote: “As enterprises increase their collection of internet-of-things data, object storage has emerged as the perfect repository for aggregating all this information, allowing ubiquitous access and easy scaling to larger sized data sets. Beyond better scalability and access from any location, object storage offers lower-cost storage management and improved cross-geography data protection.”

Caveats

Blocks & Files notes that the survey results do not show the proportion of existing data centre storage investments split between these categories, in capacity or spending terms. Neither do they show the size of the planned spending.

We don’t know. for example, if enterprises will spend more overall on SAN, unified block and file or NAS storage than object storage. You probably need to buy the full IHS Markit survey results to get those details.

We do get to see some storage capacity data information. The on- and off-premises capacity is apportioned thus;

- Object storage – 35 per cent,

- File – 38 per cent,

- Block – 27 per cent.

This capacity is split between servers, at 56 per cent, and arrays at 44 per cent. No distinction is made between direct-attached storage in servers and hyperconverged infrastructure appliances (aka server SANs.)

Future splits

Respondents expect their storage capacity to grow 33 per cent over the next year or so, with on-premises storage capacity expanding by 24 per cent and off-premises rising by 45 per cent between 2018 and 2019. More capacity is being put in place in the cloud.

Spending intentions by the end of 2019 were split as follows;

- 66 per cent plan to deploy converged infrastructure,

- 56 per cent hyperconverged infrastructure

- 66 per cent hybrid cloud storage,

- 65 per cent software-defined storage,

- 38 per cent NVM Express drives,

- 39 percent NVM Express over fabrics.

Since these numbers add up to more than 100 per cent they are not exclusionary categories. Once again we do not know the size of the spend in each category either. Frustration rules, okay!