Dell and Nutanix together account of nearly three quarters of hyperconverged (HCI) systems revenues. HCI revenues have surpassed converged systems and the integrated platform is in decline.

This is revealed by IDC’s Q1 2019 Worldwide Quarterly Converged Systems Tracker. The tech analyst firm organises the market into three categories;

- Certified reference systems and integrated infrastructure – pre-integrated, vendor-certified systems containing server, storage, networking, and basic element/systems management software.

- Integrated platforms – integrated systems sold with pre-integrated packaged software and customised system engineering; think Oracle ExaData

- Hyperconverged systems – collapse core storage and compute functionality into a single, highly virtualized system with a scale-out architecture and all compute and storage functions coming from the same x86 server resources.

The category revenue numbers for the quarter are:

- CRS & IS – $1.4bn (9% y-o-y) – 36.6% of market

- IP – $556m (-13.3% y-o-y) – 14.8% of market

- HCI – $1.8bn (46.7% y-o-y) – 48.6% of market

- TOTAL – $3.75bn – growth y-o-y not revealed

In the CI category Dell said its revenue share was 55.3 per cent, comprised of Dell EMC VxBlock Systems, Ready Solutions and Ready Stack.

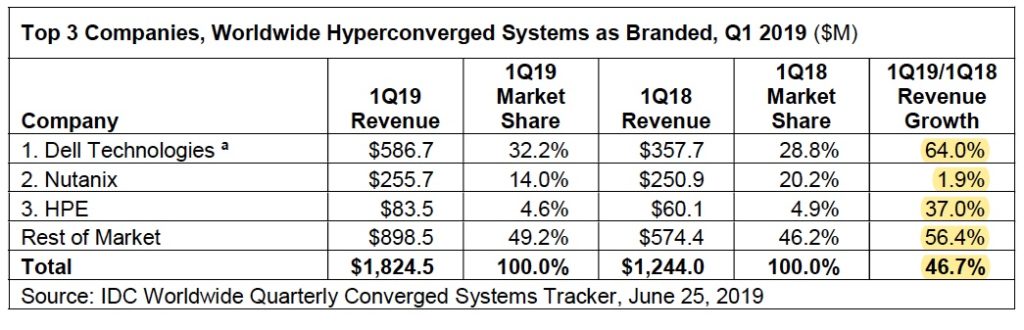

IDC publishes top supplier revenue numbers for the HCI market, showing branded systems. It also divvies up the revenues by software supplier.

Dell has more than twice the revenue of second-placed Nutanix; and both dwarf HPE. The market grew 46.7 per cent, with Nutanix and HPE increasing revenues at less than that rate. But Nutanix has been moving to a subscription, software-only business model. It also supplies software to run on other vendors’ hardware. So like VMware, it gains more market share when the numbers are cut by HCI software supplier.

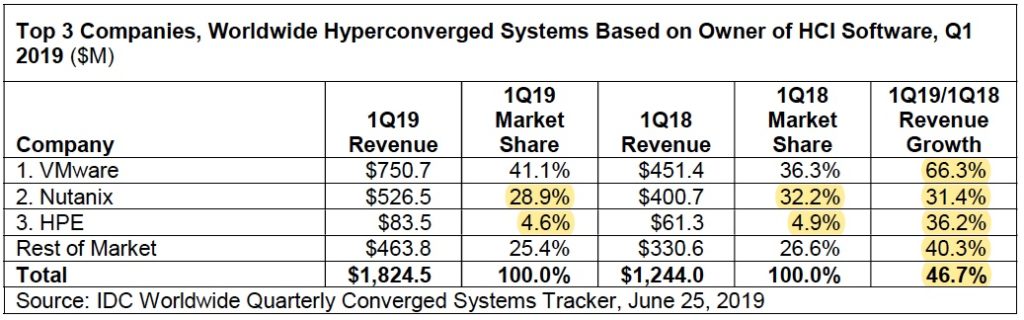

VMware and Nutanix dominate the software market, with 70 per cent combined share. VMware revenues grew 36.3 per cent year on year, the market as a whole at 46.7 per cent, Nutanix and HPE and the rest-of-market category growing at less than trend. Also-rans in IDC’s Rest of Market category include Cisco, Datrium, Maxta, NetApp, Pivot3 and Scale Computing.

Wells Fargo senior analyst Aaron Rakers provided data for NetApp and Cisco:

- Cisco’s HyperFlex revenue was ~$82m, just a shade behind HPE, and up 37 per cent – again similar to HPE’s 36.2 per cent growth rate.

- NetApp’s Elements HCI revenue was estimated at ~$46M, up 128.4 per cent, making NetApp the fastest-growing supplier in this group.

VMware’s dominance increased over the year while Nutanix market share eased from 32.2 per cent to 28.9 per cent. Nevertheless Nutanix revenues are more than six times higher than third-placed HPE.

IDC has split out a separate HCI category, calling it Disaggregated HCI; systems designed from the ground up to only support separate compute and storage nodes. It doesn’t publicly reveal any numbers in this segment but says an example supplier is NetApp, with its Elements HCI.

Blocks & Files would add Datrium and HPE’s latest dHCI Nimble array to this category. IDC doesn’t publicly reveal the overall size of this niche, its growth rate or the supplier shares.