Nutanix grew faster than other HCI startups because it employed a core of ’10 eXer’ engineers and surrounded them with good people.

This was the central point made by Sunil Potti, Nutanix chief product and development officer, in an interview at the company’s .NEXT conference in Anaheim in May.

The other HCI startups were Atlantis, Maxta, Pivot3, Scale Computing, SimpliVity, and Springpath, with LeftHand Networks, acquired by HP in 2008, pioneering a virtual SAN idea. SimpliVity was bought by HPE and Cisco bought Springpath after initially OEMing its software in the HyperFlex offering. Atlantis and Maxta withdrew from the market.

VC-funded Pivot3 and Scale Computing are both continuing and growing, selling their HCI software through OEMS such as Lenovo and their own channel reselling partners.

Only Nutanx has made it to IPO status and it is the most successful HCI startup by far. Why is this?

In the beginning

Nutanix was started in 2009 by CEO and chairman Dheeraj Pandey, Chief Product Officer Ajeet Singh who left in 2012 to start up another business, and CTO Mohit Aron. Aron resigned in 2013 and subsequently started up Cohesity. Potti, the former head of Citrix’s netscaler business, joined Nutanix in early 2015.

He said Nutanix stood out from the pack because it had better engineering talent, with four or five core engineers who were far and away better than any other engineers in Silicon Valley.

Potti: “We call good engineers 10 eXers.” He said NetApp had similar class engineers when it was founded and Cisco too, in its router business.

Ultimately, he said, Nutanix executed better with 10X better people. The core design was very elegant and allowed mistakes to be made.

These engineers were bold. They built their own hypervisor, giving Nutanix more control over its foundation software. None of the other HCI startups did that. Dell, with VMware, has that level of hypervisor control as well.

The other HCI startups had engineers “maybe 50 per cent better than the average” but this was not good enough.

Potti, of course, spoke with the benefit of hindsight. Nutanix has succeeded, going to and beyond an IPO. So its engineers must have been good, have been 10 eXers, by definition. QED.

In Potti’s view such engineers can’t develop a stand-out product that leaves others behind. He thinks that the foundational product is like the basement of a building. You have to get the right core engineering talent to build it, because “it has to be strong. It can’t be brittle.”

Nutanix has carried on basing development on great engineers. According to Potti, “in every good service we build we base it around very good people and then surround them with other good people.” He makes it sound easy.

Part of the reason Nutanix has been able to do that because it has been a single product set company, with a mushrooming set of services expanding out from its core HCI foundation. Potti said incumbents such as Cisco, Dell EMC, HPE and NetApp, are multi-product set operations, “with internal competition for resources.”

“To do HCI well, you have to shed the old ways,” he argues. “Otherwise you get stuck in the messy middle…In big companies most of the competition is inside, not outside.”

There are resources invested in existing products which product line management s unwilling to give up.

Funding

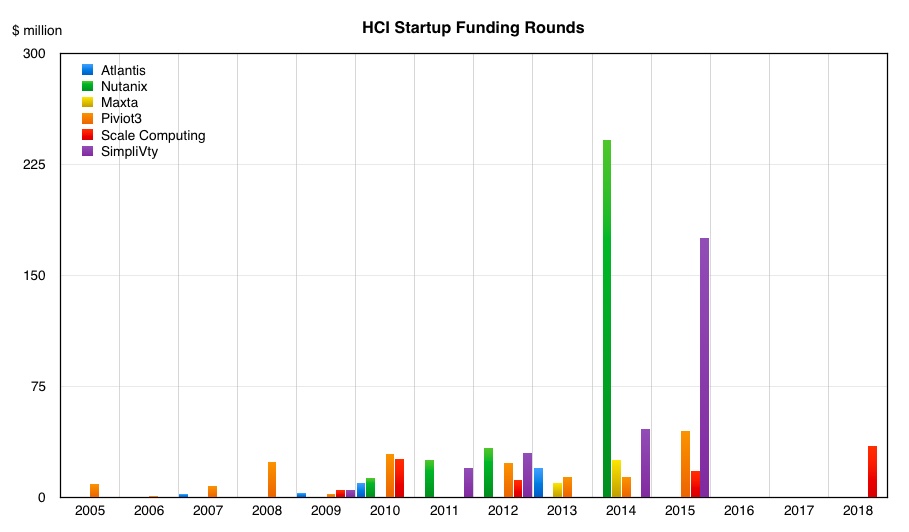

Nutanix was also better funded than its HCI startup competitors, as a chart of funding rounds for HCI startups shows:

It accumulated $312.6m before its IPO in 2016. SimpliVity was in second place in funding terms, with $276m invested. It was bought by HPE for $630m in 2017.

Pivot3 is in third place in the total funding stakes, with $247m, followed by Scale Computing with $104m, and then Atlantis and Maxta with $35m each.

There is no guarantee that the more funding a startup gets the more likely it is to be successful. It wasn’t until 2014, five years after it was founded, that Nutanix’ funding soared. Ditto SimpliVity with its 2015 funding hike following six years of graft after it was started up.

Nutanix competitor tiers

Potti said the competitor Nutanix meets most in the field – its tier 1 competitor – is Dell EMC. Tier 2 embraces HPE and Cisco, fairly well-established HCI vendors. Tier 3 is NetApp.

We were interested in exploring Nutanix’s view of NetApp’s competitive status because NetApp has been a latecomer to HCI, tailing Cisco and HPE.

Can it get as established as Cisco and HPE?

Its HCI product includes a separate storage element, being a hybrid HCI product and therefore located in Potti’s messy middle ground.

Potti said NetApp’s customer base overlaps with Nutanix, so it’s not that defensible by NetApp in terms of keeping Nutanix out. Blocks & Files thinks it could get as established as Cisco and HPE but find it challenging to grow beyond that.

All-in-all, while expressing respect for the resources and talent in Cisco, HOE and NetApp, we came away convinced Nutanix is primarily focused on Dell Technologies now and AWS in the future as its main competitors.