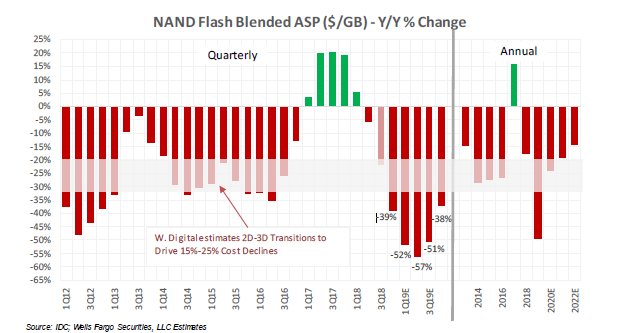

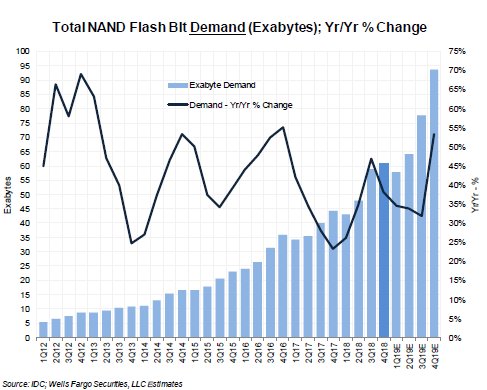

IDC has tweaked its NAND flash supply vs demand forecast, estimating that 2019 and 2020 bit volumes will now grow at 39 per cent and 38 per cent year on year. The analyst firm also expects that reduction in flash prices is likely to slow.

According to IDC, the average selling price of flash NAND in $/GB will fall 45 per cent year on year in the second half of 2019 compared with -54 per cent in the first half of the year.

Supply and demand are the two factors affecting the price that customers pay for their flash storage, with increased demand pushing prices up, prompting the vendors to increase production. This is turn can lead to a glut and falling prices if they overestimate demand.

IDC’s estimates reflect the expectation for 2019 and 2020 bit demand to grow at 39 per cent and 38 per cent, with average selling prices down 50 per cent in 2019 and another 24 per cent in 2020.

In terms of revenue, IDC now estimates the total NAND flash industry worth $54.6bn for 2018 – four per cent less than its earlier estimate. In 2017 total revenue was $48.6bn.

On a quarterly basis, revenue for 4Q18 fell 19 per cent, compared with an earlier five per cent estimate. Total NAND flash bit demand for the same quarter grew 3.7 per cent, against previous estimates of 15 per cent growth.

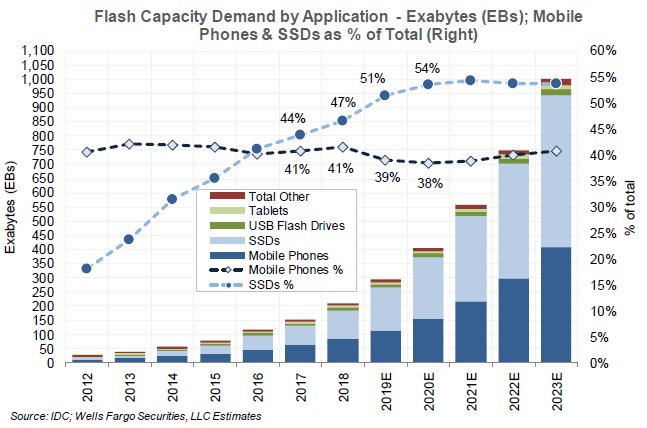

SSDs are a significant part of the flash market and are now starting to plateau at 54 per cent of total NAND flash bit demand, according to IDC. Smartphones are now expected to gradually increase from 39-41 per cent of the total bit demand from 2020 onwards, following a slight slowdown in 2019 and 2020.