Semiconductor consultant Mark Webb thinks XPoint will dominate the memory-flash performance gap and could be a $2.7bn business for Intel and Micron in 2023, with DIMM sales driving most revenue.

Webb is a credible analyst – his CV includes 23 years with Intel in NAND production and with IMTF, the joint Intel-Micron manufacturing venture.

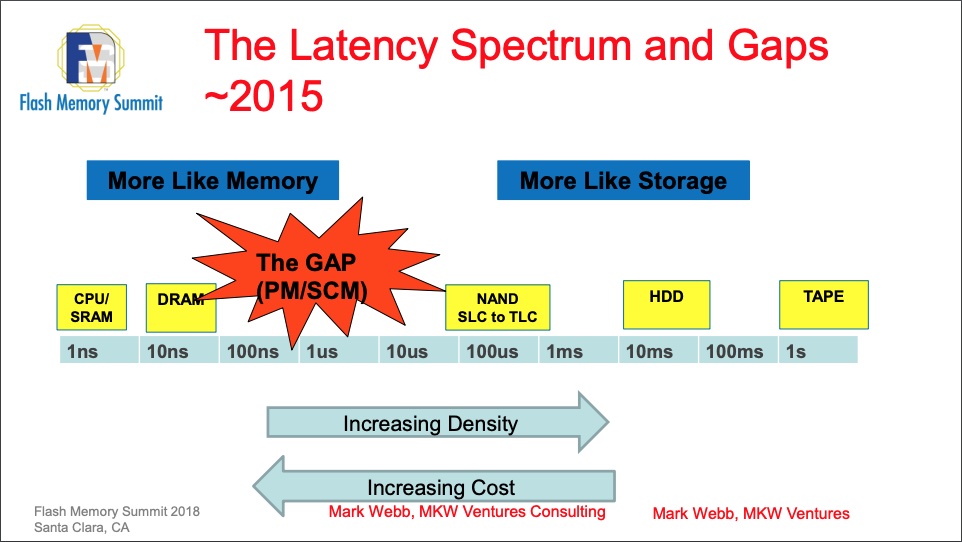

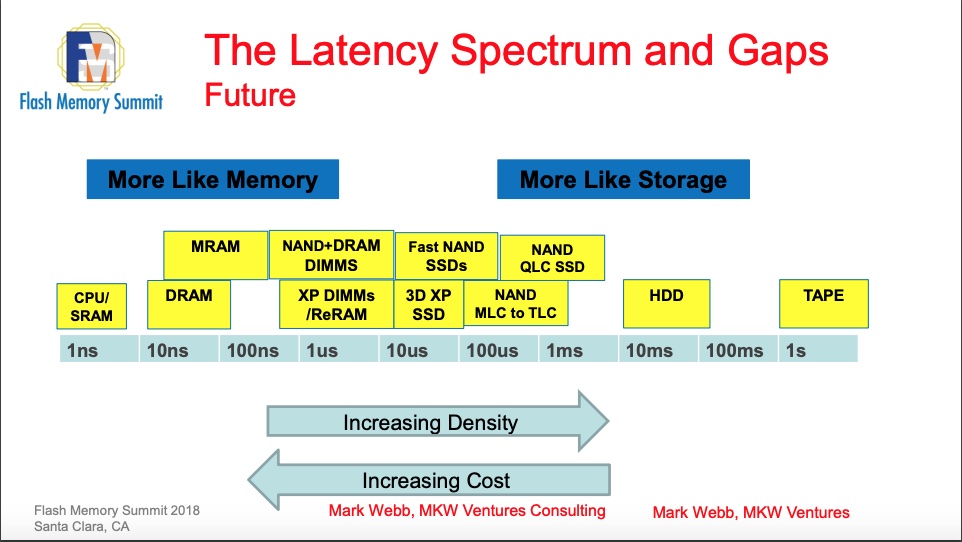

His chart, presented at the 2018 Flash Memory Summit, details the memory (DRAM) and NAND performance gap in terms of latency.

The latency gap exists between 10ns DRAM and 100μs (100,000ns) NAND and is being filled by persistent or storage-class memory technology products.

Intel’s Optane drives are built from 3D XPoint media produced at a Lehi, UT, foundry, operated by its IMFT joint venture with Micron.

Optane is available in SSD form, with a NVMe interface using the PCIe bus, and in DIMM form, plugging into a host’s faster CPU-memory bus.

But there are other candidate technologies and Webb positions them on a chart based on the latency time spectrum.

The other gap-filler candidates are MRAM, NAND-DRAM DIMms and alternative ReRAMS (Resistance RAMs such as ones using pure Phase Change Memory).

They are less mature than 3D XPoint and lack an industry giant like Intel to push them. As a result Intel’s Optane brand has advantages from a technological and product marketing perspecitve.

The technology’s advantages will soon become greater as Micron is set to enter the 3D XPoint market towards the end of this year.

3D XPoint revenues

Webb has modelled 3D XPoint revenue out to 2024, and he thinks more than two-thirds will be attributable to DIMM products.

He notes that the DIMM forecasts contain assumptions for Cascade Lake share (Cascade Lake AP CPUs are needed to support Optane DIMMs(, server DIMM attach rates and average Optane density.

In a blog he notes Intel is off to a slow start in 2019. The Optane DIMM-supporting Cascade Lake CPU has arrived later than Intel planned and that has pushed volume ship back. He also reckons Cascade Lake take-up is below Intel’s expectations.

The attach rate for Optane DIMMs has been disappointing. And demand for Optane on desktop PCS has yet to materialise. Intel has announced notebook Optane drives in which the Optane functions as a cache for a slug of QLC (4bits/cell) flash. That makes for a cost-effective performance SSD.

Optane DIMMS are not wholly persistent – DRAM cache contents are lost when power is switched off. This is a sales drawback.

To enable persistent Optane memory, says Webb, the application must explicitly write data to Optane, deciding where to write it in the Optane address space. This is called Application Direct Mode.

Existing application software has to be modified and this will impede take-up for Optane DIMMs.

Webb tells us; “I have all the details on what happens next on 3D XPoint with increased density and cost reduction.”

We aim to find out more.