Western Digital execs blamed declining flash prices and demand for a three per cent drop in Q1 2019 revenues.

And they expect it to get much worse, forecasting a 19 per cent fall in next quarter’s revenues.

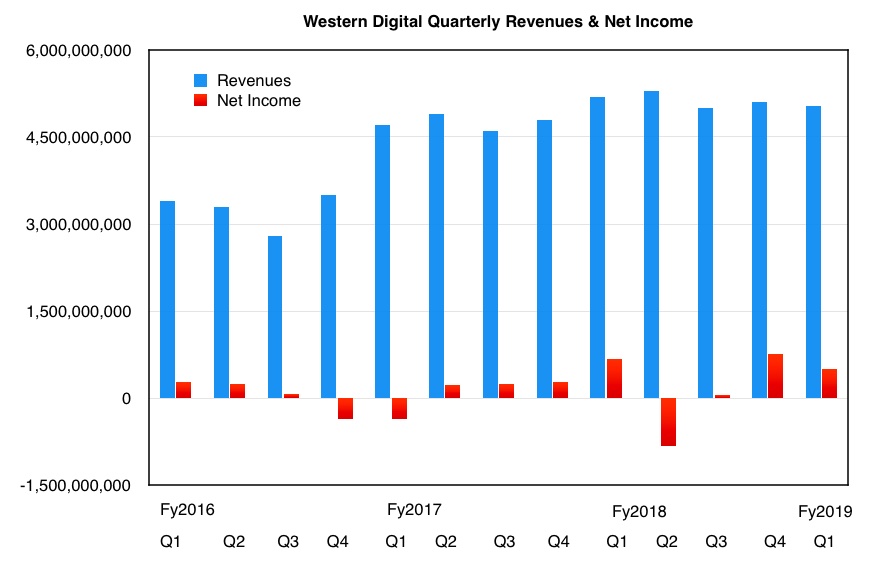

The company pulled in $5bn for Q1 ended September 28, 2018, compared with $5.2bn the same time last year. It anticipates Q2 revenues to fall to a mid-point estimate of $4.3bn, down from $5.3bn in FY2018.

We think Q3 fy2019 revenues are unlikely to be much better.

On the earnings call, CEO Steve Milligan cited trade tensions with China, changes in monetary policy, foreign exchange volatility and the corresponding economic impacts. These are causing a fall in customer demand for SSDs.

In response WD is making an immediate reduction to wafer starts and delaying deployment of capital equipment. These actions will reduce its wafer output beginning in fiscal Q3 2019; ie, mid-calendar 2019.

It also has inventory to burn off. WD aims to get its supply back in balance with demand by mid-2019, but that obviously involves an accurate estimate of likely demand.

And that implies an estimate o overall flash industry supply. If other SSD makers are similarly affected then they could reduce their output or cut prices and go for market share gains. The latter would screw with WD’s plans.

WD says it’s aiming to maintain its market share but it is unclear what Intel, Micron, Samsung, SK Hynix and Toshiba intend to do.

WD thinks the long-term demand for flash is strong and the slowdown will be temporary and relatively short-lived. We’ll see.