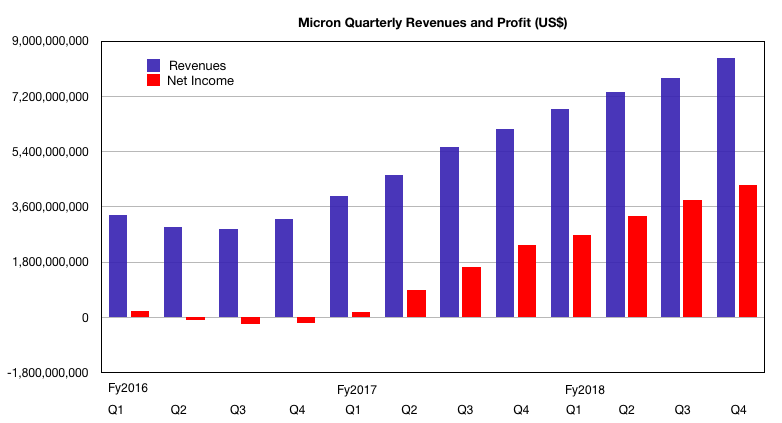

With nine straight quarters of revenue and profits growth under its belt, Micron has become a $30bn revenue company and is on fire.

Fourth fiscal 2108 quarter revenues were $8.44n, up 38 percent on a year ago, Profits were $4.33bn, almost 50 per cent of revenues – talk about a high-demand, benign pricing environment!

Operating cashflow was $5.1bn, compared with $3.2bn a year ago.

Full fy18 revenues were $30.39bn, a rise of 50 per cent annually, generating profits of $14.14bn – almost three times higher than fy17’s $5.9bn. Micron’s annual revenues are now more than three times higher than they were in fiscal years 2010, 2011, 2012 and 2013.

President and CEO Sanjay Mehrotra, CEO of Micron, said the company had grown to become “the second largest semiconductor company in the USA”.

What’s to stop Micron becoming a $50bn company in one fiscal year’s time? Smartphones need more memory and flash. Enterprise servers need more memory and flash as disk arrays are replaced by flash arrays, and AI/ML workloads represent a DRAM/ flash memory market-demand projection wet dream. And there is also storage-class or persistent memory with XPoint DIMM possibilities to consider. Intel’s twinning of Optane XPoint DIMM technology with specific support from Xeon processors gives Micron an open door to look at XPoint DIMM possibilities with ARM and AMD CPUs, as well as IBM’s POWER chips.

Could Micron look to expand its semiconductor product manufacturing product capacity beyond DRAM and NAND, and XPoint? Whisper the acronym CPU and wonder.

We listened to the earnings call for more clues.

Earnings Call

Technology transitions are roadmapped. Mehrotra said of DRAM: “We expect 1Y nanometer sales to commence before the end of calendar 2019 with meaningful production increases beginning in the fiscal third quarter as previously announced new cleanroom space comes on line at our Hiroshima facility.”

We’re also making good progress on our 1Z nanometer technology development.”

With NAND Micron is shipping 64-layer and the company remains on track to “move 96-layer NAND into production this calendar year and we’ll continue to ramp it next year, which should provide us with solid cost reductions in fiscal 2019.”

Plus: “Our first generation NVMe SSD is in the final stages of product development … we are focused on introducing new NVMe SSDs over the course of the next several quarters. Consumer and client NVMe SSDs will come first and then late in calendar 2019 cloud and enterprise NVMe drives. As the market rapidly shifts to NVMe, 2019 will be a year of transition for us following solid SSD share gains in 2018, and we expect to start growing SSD share again in 2020 with a fuller product portfolio.

“The first Micron NVME drives should be introduced later this year.

“We also look forward to leveraging our market advantage with QLC SSDs in 2019 and beyond.”

He added: ” In Q4, we started shipping a new custom persistent memory solution to a large hyperscale company.”

Was that XPoint? Mehrotra didn’t say but we think not, as he disclosed in the call that the company is “also collaborating with customers on 3D XPoint solutions and expect to start sampling products in late calendar 2019”.

CFO Dave Zisner expects revenues net quarter to be in the range of $7.9bn to $8.3bn. It is affected by an assumption of a CPU shortage due to Intel’s manufacturing difficulties.

Mehrotra’s momentum

Micron hired Sanjay Mehrotra as President and CEO in April 2017. Micron results were already on an upward path and have continued their climb with six quarters of revenue and growth since his hiring.

Mehrotra was a co-founder of SanDisk and its CEO when Western Digital bought it for $19bn in October 2015. He left the WD board in February 2017 and joined Micron two months later. Since then has brought in his own execs, many from SanDisk.

SanDisk has a joint-venture with Toshiba to manufacture flash chips at a foundry centre in Yokkaichi, Japan. That gave WD a vertically-integrated chips to SSDs operation. We can only guess Mehrotra’s thoughts on WD CEO Steven Milligan brinkmanship negotiations during Toshiba’s prolonged and ultimately successful attempt to sell off its interest in the JV to a Bain Capital-led consortium.

He’s not been tested by a market downturn at Micron but went through one or two at SanDisk.

Mehrotra has separated from Intel in future 3D NAND development and is setting out independent Micron production and marketing of the XPoint technology it manufactures with Intel. We think the Intel Micron Flash Technologies joint flash chip manufacturing has question marks over its future, with Micron able to fund its foundry capacity expansion needs in-house.

Our assumption is that Micron will take over full ownership of the IMFT foundry at Lehi, with Intel having to look elsewhere to make its XPoint chips.

Micron ended the fourth quarter in a net cash position of $2.72bn with cash, marketable investments, and restricted cash of $7.36bn. Its total carrying value of debt was $4.64bn exiting the fiscal year. That’s a lot of potential foundry-building financial resource right there.