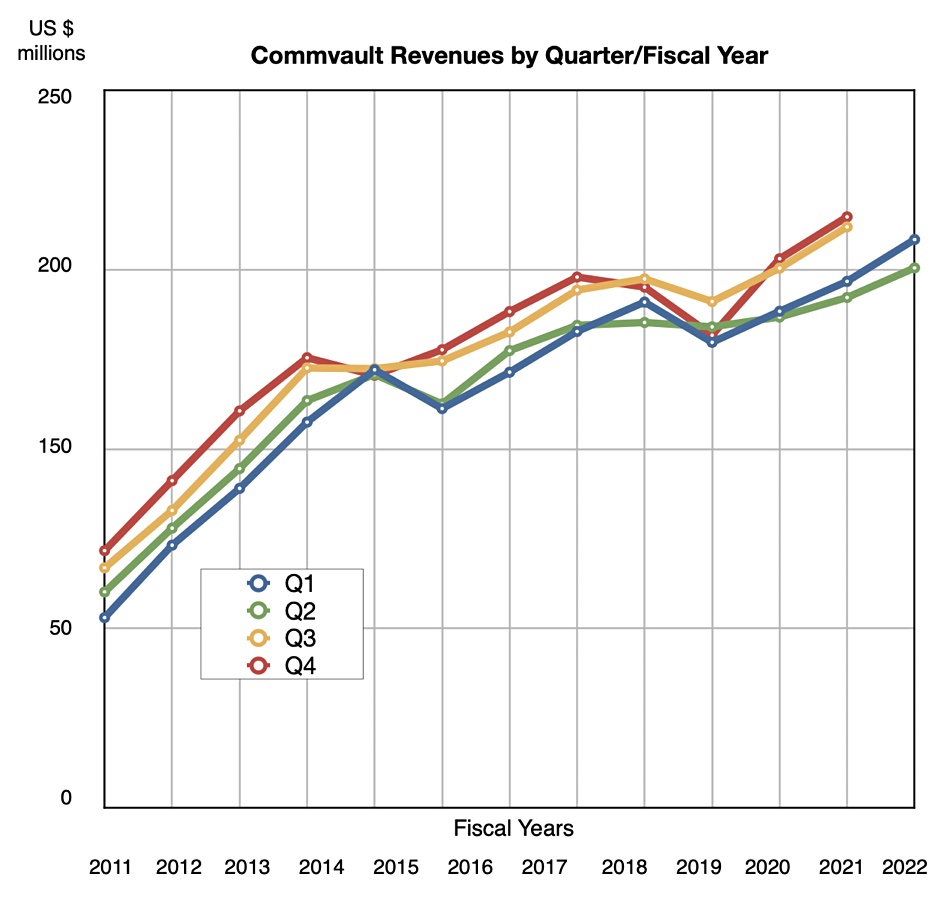

Against a background of storage media suppliers announcing downturns, Commvault reported its tenth growth quarter in a row, beating analysts’ earnings and profits estimates.

Revenues were up 5.8 percent year-on-year to $188.1 million in its second quarter of fiscal 2023 ended September 30, and profits rose to $4.5 million from $1.73 million.

Businesses may be buying fewer disk and solid state drives, but they need to protect the data they have. CEO and president Sanjay Mirchandani said: “Our fiscal Q2 record results and double-digit constant currency growth reinforce that customers see the value of Commvault’s software and SaaS solutions. We believe our comprehensive data protection portfolio has never been more important in today’s increasingly difficult world.”

Annual recurring revenue (ARR) represented 84 percent of Commvault’s earnings. It was 79 percent a year ago Q2 and 75 percent a year before that.

Revenue segments:

- Software and products revenue: $82.8 million, up 10 percent

- Service revenues: $105.2 million, up 3 percent

- Total recurring revenue: $158.2 million, up 12 per cent year-on-year

- Annualized recurring revenue: $604.4 million, up 11 percent

There were 173 large deal transactions compared to 163 a year ago. The average dollar amount of these was approximately $346,000, an 11 percent increase from the prior year. Large deals accounted for 72 percent of Commvault’s software and products revenues, $59.6 million, and 32 percent of Commvault’s revenues for the quarter.

Commvault reported $49.8 million in operating cash flow, up 90.8 percent annually. Total cash at quarter end was $262.5 million compared to $267.5 million as of March 31, and it has no debt. It said earnings per share were $0.57 compared to $0.48 a year ago.

Customers stored 3EB of data in the cloud, a 2.5x increase since Q2 of fiscal 2022.

Mirchandani said in an earnings call that the exec team had returned Commvault to responsible growth. Customers, he said, wanted both software and SaaS approaches to data protection and Commvault supplies both via it’s Metallic SaaS. There were more than 2,500 Metallic customers at quarter end, 72 percent of them new to Commvault. There were fewer than 2,000 at the end of fiscal 2021.

Metallic surpassed $75 million in ARR this quarter, up 50 percent since the start of the fiscal year, and half of the Metallic customers had also bought another Commvault product. It is a land-and-expand strategy and Commvault wants to accelerate this. Mirchandani said he expects every customer over time to need both Metallic and Commvault’s Complete Data Protection software product: “That’s our playbook. That’s how we go to market.”

The outlook for the next quarter is $203.5 million plus/minus $1.5 million, up just 0.54 percent year-on-year. CFO Gary Merrill said it was taking longer to close new business, and Mirchandani agreed, adding that closing got harder across the quarter, particularly in Europe. Merrill said this longer time to close was factored into the outlook.