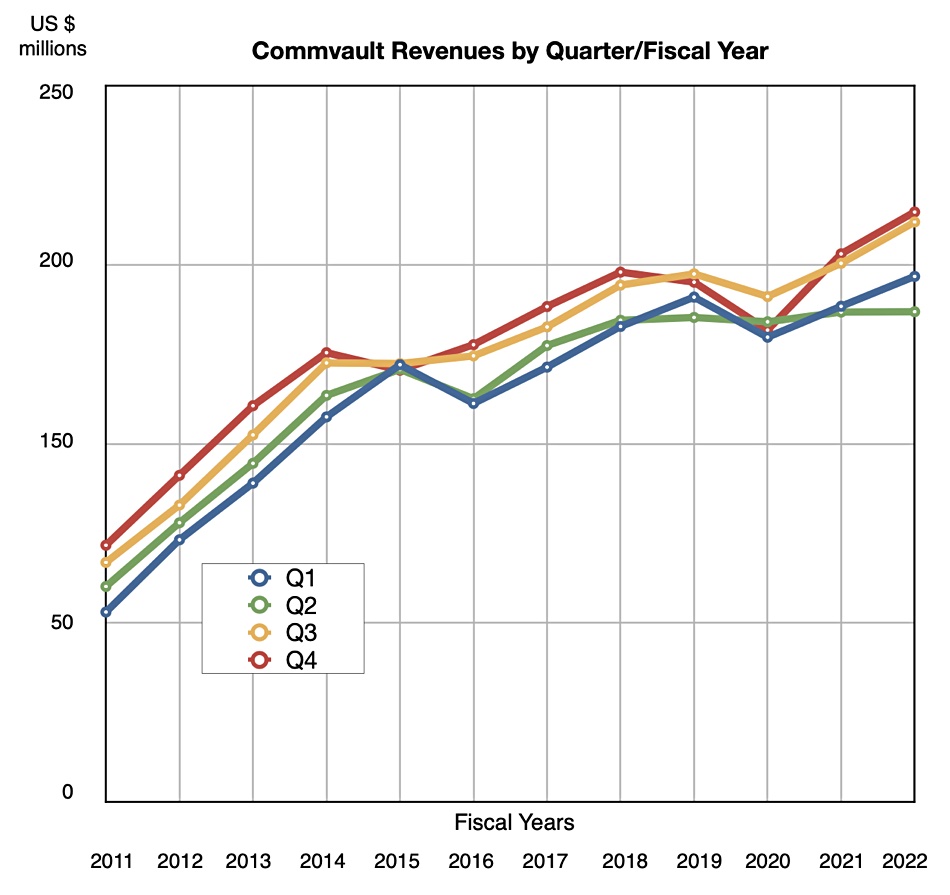

Commvault has exited from a turnaround tunnel into the light, reporting its best-ever quarterly and full year results.

In the fourth fiscal 2022 quarter, ended ended March 31, revenues were $205.9 million – an increase of eight per cent year over year – while full year revenues rose by six per cent to $769.6 million. There was a quarterly profit of $8 million, up 27 per cent from the year-ago $6.3 million, and a full year profit of $33.6 million – a great turnaround from last year’s $31 million loss. CFO Brian Carolan, a 21-year Commvault vet, is leaving for an undisclosed situation, being succeeded by Gary Merrill, current chief of business operations and a 16-year Commvault veteran.

CEO and president Sanjay Mirchandani’s announcement statement was ebullient: “We are pleased to have delivered another record quarter to cap off the best year in our history. Demand is strong for our differentiated portfolio, our team is executing, and we are taking market share. We are excited about our growth prospects in the new fiscal year.”

The growth came from software and SaaS offerings, increased multi-product adoption, and through large deals. Commvault added around 500 new customers in the quarter, with over 60 per cent of that brought in by Metallic, its as-a-service offering. In the earnings call Mirchandani said “in just six quarters of commercial availability, Metallic has exceeded $50 million in ARR. Its growth is extraordinary, customers love it, and we love it.”

The number of larger deal revenue transactions increased 14 per cent year over year to 226 with the average dollar amount approximately $327,000, representing a four per cent increase year-on-year. Larger deal revenue represented 73 per cent of Commvault’s software and products revenue – it is that important.

Michandani said “We continue to believe that the strength of our balance sheet, coupled with the current and long-term outlook for our business, provides an opportunity to create value for our long-term shareholders.”

In the fourth quarter, software and products revenue was up 12 per cent year over year to $356.5 million, with software at $101 million, while recurring revenue was up 19 per cent and annualized recurring revenue (ARR) of $583.3 million rose 13 per cent. Over 80 per cent of Commvault’s revenue is recurring in nature, and growing. It has successfully transferred to a subscription-based business.

Mirchandani said “Q4 software revenue of $101 million was a new milestone for the company, and we crossed $200 million in total revenue for the second consecutive quarter.”

Services revenue, driven by Commvault’s as-a-service offerings, was $105.5 million in the quarter, up three per cent year over year, $413.1 million for the full year, up four per cent. Commvault made no borrowings against its revolving line of credit in the quarter.

Financial analyst Jason Ader from William Blair said the results were solid, but cautioned: “Revenue growth remains below ten per cent, and we worry about competitive dynamics going forward (especially given how crowded the backup space is and the undeniable momentum of well-funded private vendors) and the potential for over-rotation to Metallic to crimp growth in Commvault’s core software business.”

Wells Fargo’s Aaron Rakers was more positive, saying “We applaud Commvault’s strong execution (now ~84 per cent recurring revenue), and remain focused on potential revenue upside.”

Michandani was robustly optimistic about the future in the earnings call, saying “Today’s data protection market, especially data management as a service, is at a tipping point. This is an incredible tailwind for the company, and it is why we firmly believe our time is now. You see, it’s rare to have three critical drivers converging at once.”

The three are Commvault’s heritage in solving very hard and complex data problems, innovative software and SaaS concepts and its “humming” and “razor-sharp” execution engine. He dissed the competition, referring to “Upstarts, point solutions and companies built through piecemeal acquisitions [that] only create more silos.”

Next quarter’s guidance is for total revenue of approximately $195 million, which compares to $183.4 million a year ago – 6.3 per cent growth. Carolan said the guidance was affected by ongoing geopolitical uncertainty, particularly customers’ spending patterns in Europe, and foreign exchange trends. He said Russian operations previously contributed approximately one per cent of total revenue and that is factored into the guidance.