Commvault reported eight per cent year-on-year revenue growth in its third fiscal 2022 quarter, recovering strongly after a flat second quarter.

Revenues in the quarter ended December 31 2021 were $202.4 million compared to $188 million a year ago. There was a profit of $10 million, much improved from the $1.67 million in seen in Q3 FY2021. Total recurring revenue was $164.4 million, representing 81 per cent of total revenue. Annualised recurring revenue (ARR) was $561.2 million, up 11 per cent year-over-year.

President and CEO Sanjay Mirchandani said “Increasingly, customers are turning to us because we provide one platform for software and SaaS offerings to address a multitude of data management needs. This is fueling our growth and accelerating our journey to a cloud-first recurring revenue model.”

Software and products revenue was $98.6 million, an increase of 11 per cent year over year, a 24 per cent increase in larger deals (ones greater than $0.1 million). Larger deal revenue represented 76 per cent of its software and products revenue and the average large deal size was $332,000. There were 225 large deals in the quarter, up 20 per cent year-over-year.

Services revenue in the quarter was $103.8 million, up four per cent year over year, driven primarily by the increase in Metallic software as a service revenue. A four per cent rise might be thought disappointing, but Commvault added 400-plus Metallic customers in the quarter and now has around 1,500.

Operating cash flow totaled $26.8 million compared to $17.0 million in the year-ago quarter.

Total cash and short-term investments were $233.7 million at quarter end, compared to $397.2 million as of March 31, 2021.

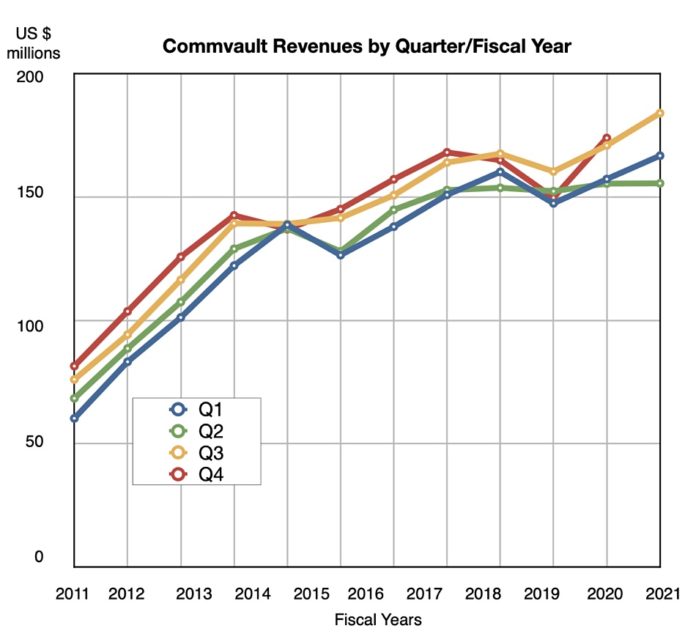

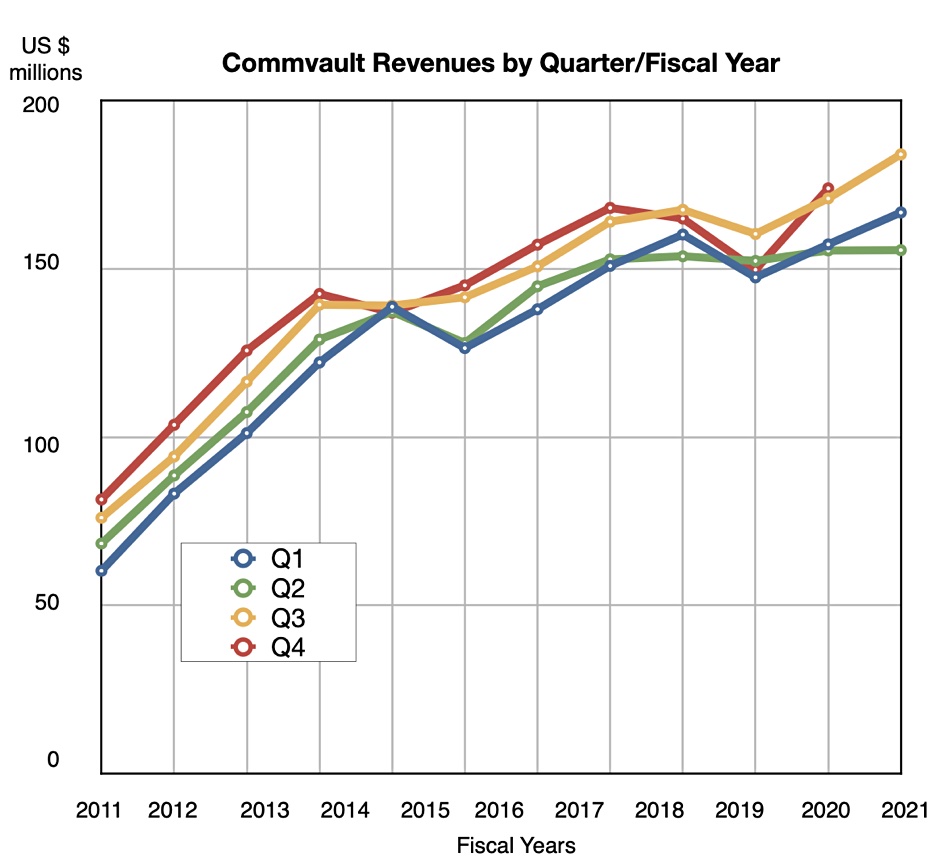

Commvault is guiding Q4 FY2022 revenue to be ~$202 million, which would be a 5.6 per cent increase on a year ago and indicates total FY2022 revenues around $759 million. This compares to the $723.5 million reported for FY2021, meaning an about five per cent increase.

Analyst views

What did analysts think? Aaron Rakers from Wells Fargo argued “With subdued investor expectations on CVLT following disappointing F2Q22 (Sept) results and F3Q22 (Dec) guide, CVLT delivered what we believe should be considered POSITIVE F3Q22 results and F4Q22 guide.”

He wrote: “Sixty per cent of the company’s new Metallic customers are net-new to Commvault and more than 50 per cent of the Metallic customers are using another Commvault product.”

Rakers thinks “that the company is now approximately two-thirds through its targeted transition of perpetual customers to subscription, a transition that we believe is driving a 30–40 per cent uplift in per customer revenue opportunities over a couple of years.”

Willam Blair’s Jason Ader told subscribers “Commvault reported a solid quarter, with top- and bottom-line beats ($7.3 million and $0.02, respectively) and a strong revenue guide for the fourth quarter ($5.3 million above consensus).

“Management attributed the improved results to the highest number of new customer additions in years (including several Fortune 500 wins), coupled with healthy expansion in the installed base (NDR of 110 per cent).

“Longer term, management expressed optimism around 1) Commvault’s ability to take share from both legacy and start-up data protection vendors based on its comprehensive data protection technology; 2) Metallic momentum; and 3) its ability to gain additional leverage from its MSP, VAR and SI partners.”

But Ader has two main concerns: “1) the competitive environment is intensifying with well-funded private vendors such as Cohesity, Rubrik, Veeam, Druva, OwnBackup, Acronis, and HYCU all growing rapidly and targeting Commvault’s customer base; and 2) Commvault’s financial model is in a tricky transition period where management is trying to balance Commvault’s slower-growth, high-margin core software business with the ramp-up in its high-growth, ratable, but lower-margin Metallic business.”