Composable systems startup Liqid has had a massive $100 million funding round to take its datacentre do-more-with-less message mainstream.

The company sells composable systems software and hardware with which users separate or disaggregate server, networking and storage resources into pools, and construct dynamic server configurations with accurately sized components from the pools to run applications. They are torn down afterwards and the components returned to the resource pools for re-use. Liqid has found success in the high-performance market with several prominent customers.

Co-founder and CEO Sumit Puri provided a statement: “Liqid is excited to announce this funding to drive extended hypergrowth as software-defined infrastructure solutions like ours quickly become mainstream alongside the expansion of next-generation workloads like AI.”

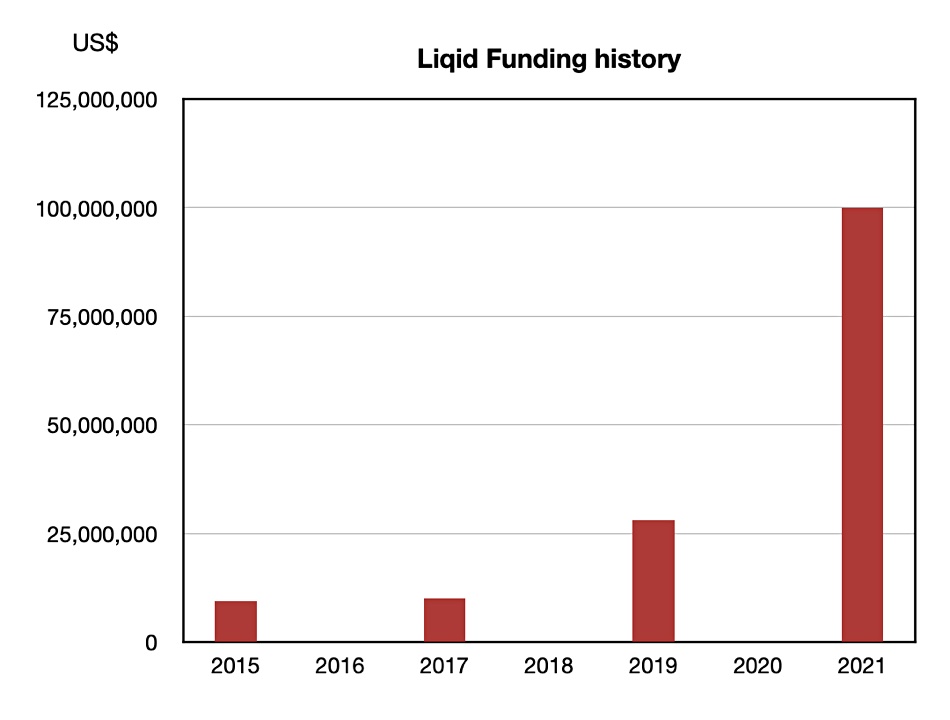

Liqid was started up in 2015 and has had four funding events (see chart), with the previous one being a $28 million B-round in 2019.

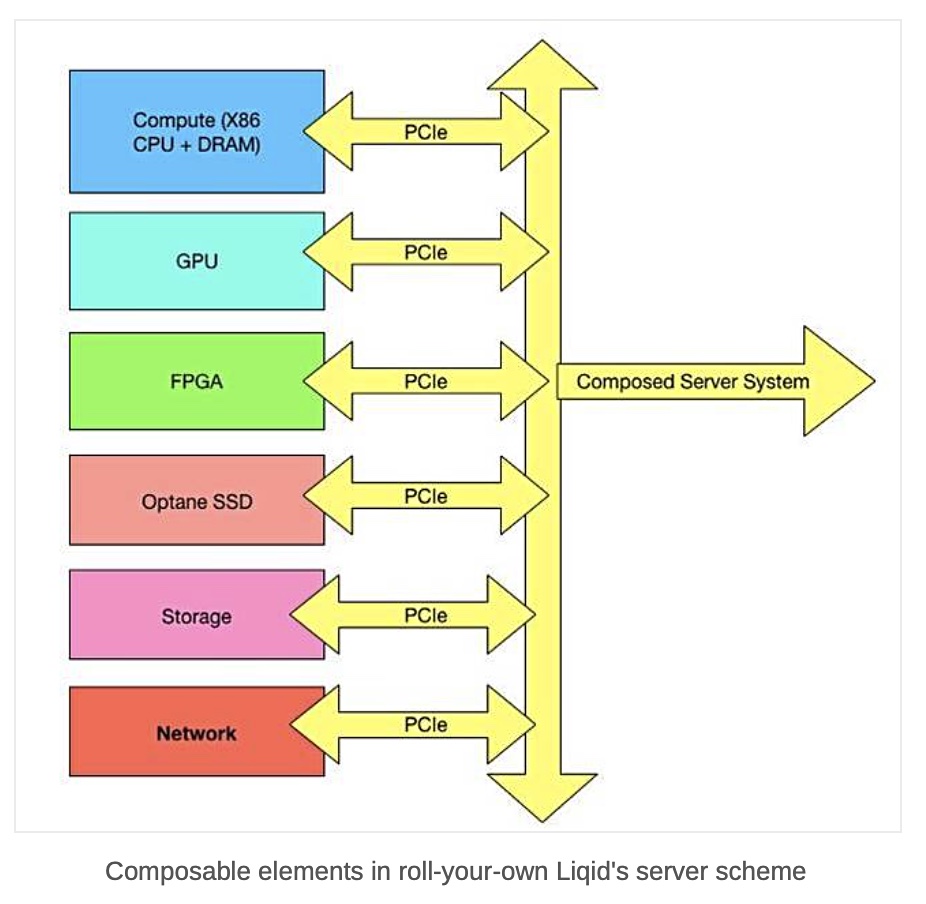

The founders were Puri, the original CEO Jay Breakstone who left in April 2018, COO Bryann Schramm, CTO J. Scott Cannata and Supply Chain VP Sandeep Rao. Its technology is based around its CDI (Composable Disaggregated Infrastructure) orchestration software which composes server CPUs+DRAM, GPUs, FPGAs, NVMe SSDs, networking, and storage-class memory using the PCIe bus (generations 3 and 4) as its connectivity, to create software-defined, bare metal servers on demand.

The CDI software includes the Matrix fabric and a Liqid Command Centre facility.

The justification for composing systems is that individual resource class utilisation — such as CPU, GPU, NVMe SSDs, etc. — will be higher in its composed systems than in a fixed configuration where resources are sized and costed for the largest-possible workload, meaning wasted resources when smaller workloads can’t run.

Customers include the US Army Corps of Engineers with a $20.6 million supercomputer deal, the Electronic Visualisation Lab at the University of Illinois, and two DoD contracts In August 2020, valued at about $32 million for the US High Performance Computing Modernisation Program.

Liqid has a partnership with Dell whereby Dell’s MX7000 composable system can have GPUs, FPGAs and NVMe storage added to it via the CDI software and a PCIe extension chassis. It has another partnership with Western Digital to include its openFlex drive systems in the CDI environment. It also works with VMware as vCentre users can compose server systems using Liqid’s Matrix fabric software via a plug-in.

In 2021 Liqid more than doubled its workforce, achieved a 100 customer count and recorded 1,034 per cent revenue growth from 2017 to 2020. Stats such as this would have emboldened the VCs to pump more money into the company to get it growing faster.

It is also firmly located in the reduce-climate-change-effects camp, saying its products provide 2–3x improvements in datacentre utilisation rates compared to legacy fixed config architectures. Its Matrix sotware can, it claims, significantly reducing energy consumption and save millions of litres of cooling water and tonnes of global CO2 emissions per year.

New funding

The new funding round was co-led by Lightrock and affiliates of DH Capital, with participation from current investors Panorama Point Partners and Iron Gate Capital. We asked Liqid if it is now valued at $1 billion or more — meaning it’s a unicorn — but a spokesperson said: “Unfortunately we do not discuss our valuation.”

We think that $100 million VC rounds come at a 10:1 or greater valuation and Liqid is a unicorn.

It will use the cash to:

- Expand internationally;

- Grow its salesforce;

- Enhance the support function;

- Increase awareness;

- Provide global marketing support for additional OEM and channel partners;

- Strengthen its operations team to scale across all business functions;

- Accelerate the software development roadmap.

Above all it wants to maintain its claimed market leadership position.

Liqid has already started building out its business infrastructure, hiring Tintri’s EMEA boss Paul Silver as its VP and GM for the EMEA region last month.

Comment

Liqid software runs in a server and composes PCIe-connected server component resources. Competitors include Fungible ($311 million funding), with its own data processing unit (DPU) chip and network fabric, and GigaIO ($19.25 million in funding), another PCIe-focussed supplier. Funding-wise GigaIO is a round behind Liqid and Fungible, who are both on C-rounds, and its investors surely need to pony up to prevent GigaIO being left behind.

Liqid’s PCIe focus positions it for using the CXL bus as that comes into play when the base PCIe 5 link is introduced. It can already compose so-called Liqid Memory (DRAM + Optane) so composing external CXL-linked DRAM pools should be no problem.

A looming challenge/opportunity is how to compose SmartNICs — plug-in server offload cards that run a mix of network, storage and security functions for servers. Fungible offers its own version of a SmartNIC with its Storage Initiator cards. It would seem logical for Liqid to support Nvidia’s BlueField 2 and 3 SmartNICs and rely on Nvidia market momentum to blunt Fungible’s charge into the enterprise datacentre.